Shareholders Shouldn’t Be Too Comfortable With Xiamen Changelight's (SZSE:300102) Strong Earnings

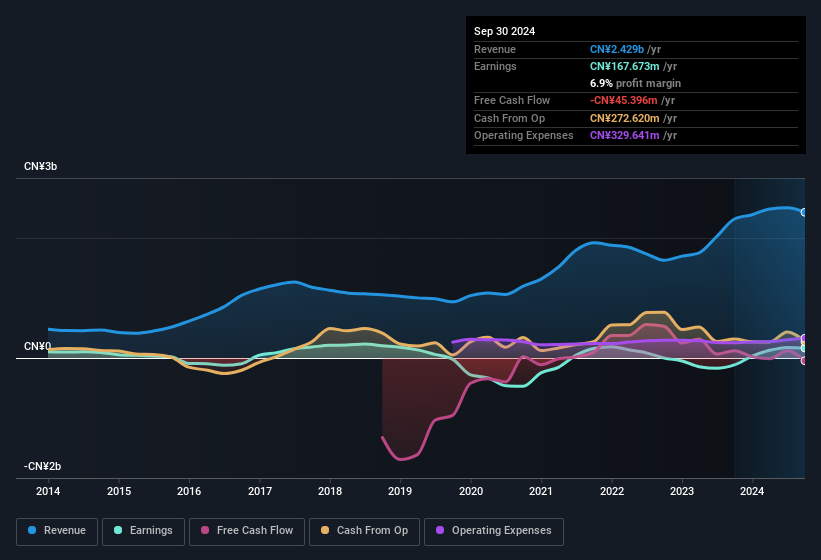

Xiamen Changelight Co., Ltd. (SZSE:300102) recently released a strong earnings report, and the market responded by raising the share price. While the headline numbers were strong, we found some underlying problems once we started looking at what drove earnings.

See our latest analysis for Xiamen Changelight

Operating Revenue Or Not?

Companies will classify their revenue streams as either operating revenue or other revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Xiamen Changelight saw a big increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from CN¥245.1m to CN¥640.4m. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Xiamen Changelight.

How Do Unusual Items Influence Profit?

As well as that spike in non-operating revenue, we should also consider the CN¥96m boost to profit coming from unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Xiamen Changelight had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

An Unusual Tax Situation

On top of the spike and non-operating revenue and the unusual item, we can also see that Xiamen Changelight received a tax benefit of CN¥53m. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Xiamen Changelight's Profit Performance

In its last report Xiamen Changelight benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may not be sustainable. And a tax benefit boosted its bottom line, too. The cherry on top was the unusual item. If these unreliable boosts don't persist, we'd expect profit to drop, all else being equal. On reflection, the above-mentioned factors give us the strong impression that Xiamen Changelight'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. If you want to do dive deeper into Xiamen Changelight, you'd also look into what risks it is currently facing. Our analysis shows 2 warning signs for Xiamen Changelight (1 shouldn't be ignored!) and we strongly recommend you look at these bad boys before investing.

Our examination of Xiamen Changelight has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal