Optimistic Investors Push Shandong Hontron Aluminum Industry Holding Company Limited (SZSE:002379) Shares Up 36% But Growth Is Lacking

Shandong Hontron Aluminum Industry Holding Company Limited (SZSE:002379) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 47%.

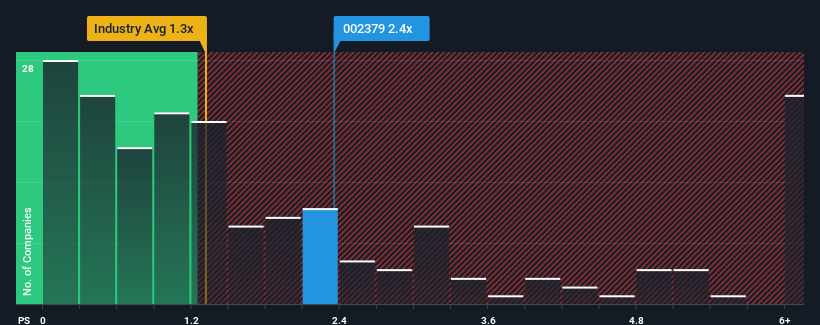

Following the firm bounce in price, you could be forgiven for thinking Shandong Hontron Aluminum Industry Holding is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Shandong Hontron Aluminum Industry Holding

What Does Shandong Hontron Aluminum Industry Holding's Recent Performance Look Like?

The recent revenue growth at Shandong Hontron Aluminum Industry Holding would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shandong Hontron Aluminum Industry Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Shandong Hontron Aluminum Industry Holding?

The only time you'd be truly comfortable seeing a P/S as high as Shandong Hontron Aluminum Industry Holding's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.3% last year. The latest three year period has also seen a 11% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Shandong Hontron Aluminum Industry Holding's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shandong Hontron Aluminum Industry Holding's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Shandong Hontron Aluminum Industry Holding currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Shandong Hontron Aluminum Industry Holding that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal