Improved Revenues Required Before Realcan Pharmaceutical Group Co., Ltd. (SZSE:002589) Stock's 36% Jump Looks Justified

Despite an already strong run, Realcan Pharmaceutical Group Co., Ltd. (SZSE:002589) shares have been powering on, with a gain of 36% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.9% over the last year.

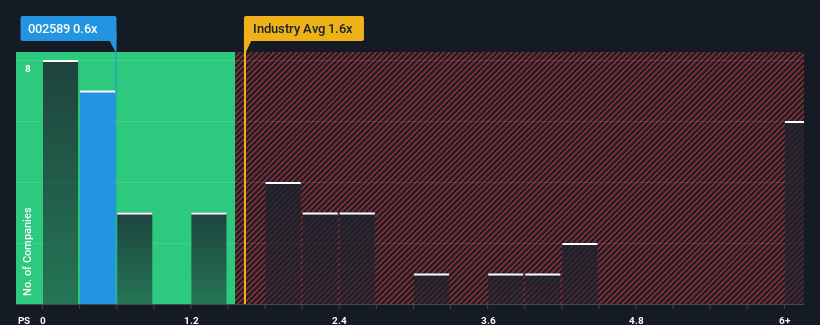

In spite of the firm bounce in price, when close to half the companies operating in China's Healthcare industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Realcan Pharmaceutical Group as an enticing stock to check out with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Realcan Pharmaceutical Group

How Has Realcan Pharmaceutical Group Performed Recently?

For instance, Realcan Pharmaceutical Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Realcan Pharmaceutical Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Realcan Pharmaceutical Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Realcan Pharmaceutical Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 71% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 13% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Realcan Pharmaceutical Group is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Realcan Pharmaceutical Group's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Realcan Pharmaceutical Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Realcan Pharmaceutical Group has 2 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal