Optimistic Investors Push Beijing Aosaikang Pharmaceutical Co., Ltd. (SZSE:002755) Shares Up 35% But Growth Is Lacking

Beijing Aosaikang Pharmaceutical Co., Ltd. (SZSE:002755) shares have continued their recent momentum with a 35% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 68%.

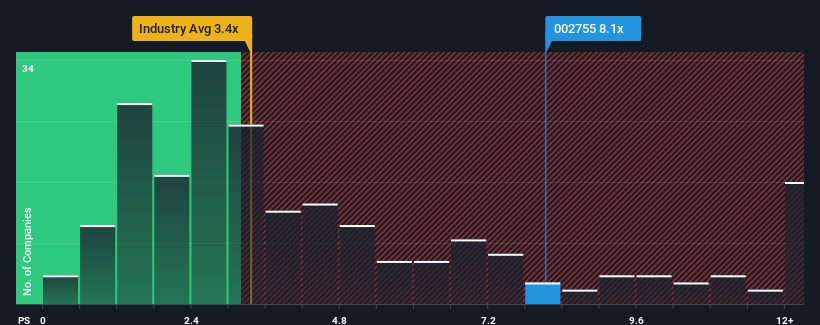

Following the firm bounce in price, given around half the companies in China's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider Beijing Aosaikang Pharmaceutical as a stock to avoid entirely with its 8.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Beijing Aosaikang Pharmaceutical

What Does Beijing Aosaikang Pharmaceutical's P/S Mean For Shareholders?

Recent times haven't been great for Beijing Aosaikang Pharmaceutical as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Aosaikang Pharmaceutical.Is There Enough Revenue Growth Forecasted For Beijing Aosaikang Pharmaceutical?

Beijing Aosaikang Pharmaceutical's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 5.1% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 58% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 14% over the next year. Meanwhile, the rest of the industry is forecast to expand by 140%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Beijing Aosaikang Pharmaceutical's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Beijing Aosaikang Pharmaceutical's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Beijing Aosaikang Pharmaceutical trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about this 1 warning sign we've spotted with Beijing Aosaikang Pharmaceutical.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal