There's Reason For Concern Over SHIMAMURA Co., Ltd.'s (TSE:8227) Price

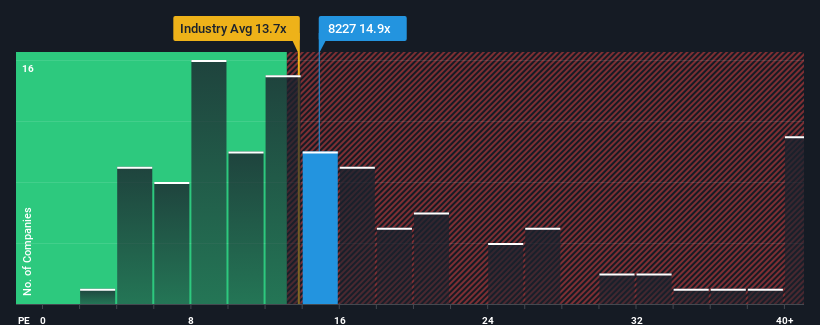

It's not a stretch to say that SHIMAMURA Co., Ltd.'s (TSE:8227) price-to-earnings (or "P/E") ratio of 14.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's inferior to most other companies of late, SHIMAMURA has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for SHIMAMURA

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, SHIMAMURA would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.5% last year. The latest three year period has also seen a 25% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 3.8% per annum as estimated by the eleven analysts watching the company. That's shaping up to be materially lower than the 9.6% per annum growth forecast for the broader market.

In light of this, it's curious that SHIMAMURA's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of SHIMAMURA's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for SHIMAMURA that you should be aware of.

You might be able to find a better investment than SHIMAMURA. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal