3 Growth Companies With Strong Insider Confidence

As global markets navigate a complex landscape marked by interest rate cuts from the European Central Bank and the Bank of England, alongside a rally in AI-related stocks on the Nasdaq, investors are increasingly focused on identifying growth opportunities. In this context, companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests, making them compelling considerations for those looking to capitalize on current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

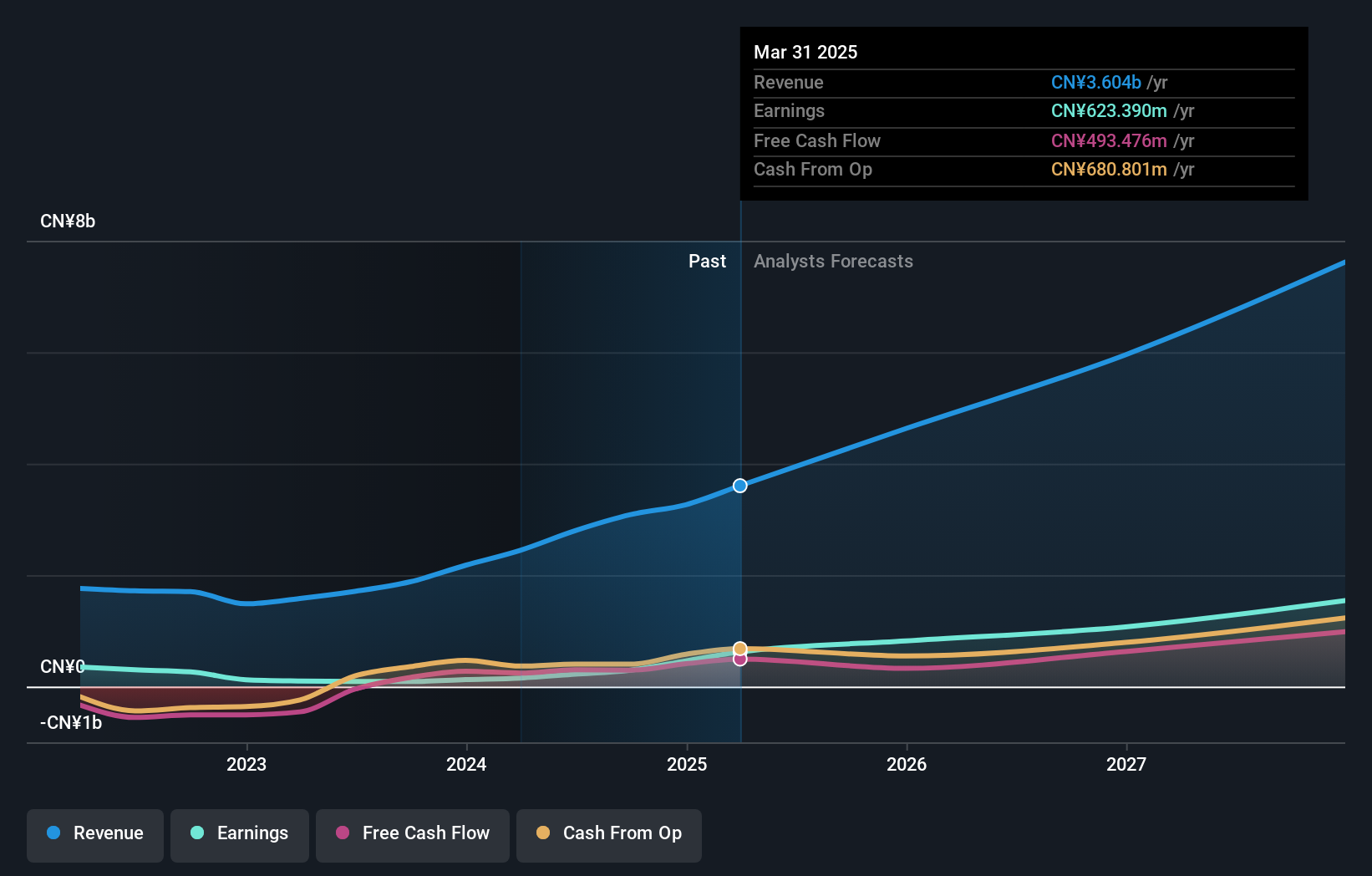

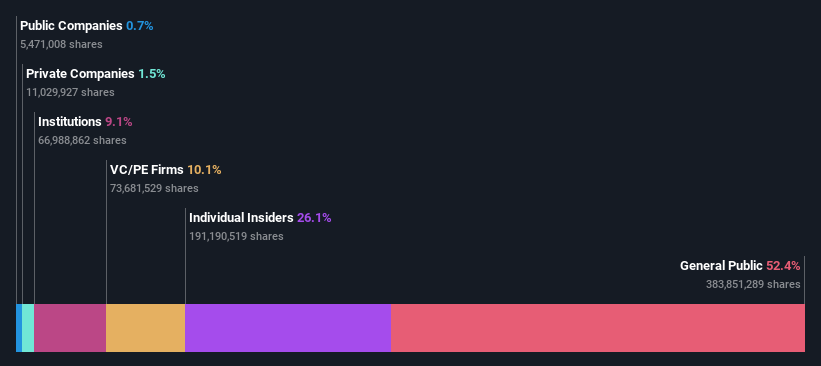

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China with a market cap of CN¥7.70 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 15.4%

Suzhou TZTEK Technology is positioned for substantial growth, with revenue projected to increase by 32.4% annually, outpacing the broader Chinese market. Despite a recent net loss of CNY 26.25 million for H1 2024, its earnings are forecasted to grow significantly at 39.2% per year. The company's buyback program has seen modest activity, completing a repurchase of shares worth CNY 30.03 million since February 2024.

- Take a closer look at Suzhou TZTEK Technology's potential here in our earnings growth report.

- According our valuation report, there's an indication that Suzhou TZTEK Technology's share price might be on the expensive side.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips with a market cap of CN¥32.02 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, amounting to CN¥2.80 billion.

Insider Ownership: 25.7%

Bestechnic (Shanghai) is poised for strong growth, with earnings expected to rise by 42.35% annually, surpassing the broader Chinese market's growth rate. The company reported a substantial increase in net income to CNY 147.64 million for H1 2024, up from CNY 49.25 million the previous year. Despite high share price volatility and low forecasted return on equity of 8.8%, revenue is anticipated to grow at an impressive rate of 24% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Bestechnic (Shanghai).

- Upon reviewing our latest valuation report, Bestechnic (Shanghai)'s share price might be too optimistic.

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. develops and sells micro-electromechanical systems (MEMS) products in China, with a market capitalization of CN¥14.53 billion.

Operations: Sai MicroElectronics Inc. focuses on the development and sale of micro-electromechanical systems (MEMS) products in China.

Insider Ownership: 26%

Sai MicroElectronics is projected to experience significant earnings growth of 53.4% annually over the next three years, outpacing the Chinese market's rate. Revenue is also expected to rise by 23.5% per year, surpassing market averages. Despite becoming profitable this year, recent results show a net loss of CNY 42.67 million for H1 2024 amid high share price volatility and low forecasted return on equity of 7%.

- Dive into the specifics of Sai MicroElectronics here with our thorough growth forecast report.

- Our expertly prepared valuation report Sai MicroElectronics implies its share price may be too high.

Where To Now?

- Reveal the 1485 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal