As Hanmi Science (KRX:008930) jumps 10% this past week, investors may now be noticing the company's three-year earnings growth

Hanmi Science Co., Ltd. (KRX:008930) shareholders should be happy to see the share price up 11% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 36% in the last three years, significantly under-performing the market.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Hanmi Science

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Hanmi Science actually saw its earnings per share (EPS) improve by 58% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

With a rather small yield of just 0.6% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 13% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Hanmi Science more closely, as sometimes stocks fall unfairly. This could present an opportunity.

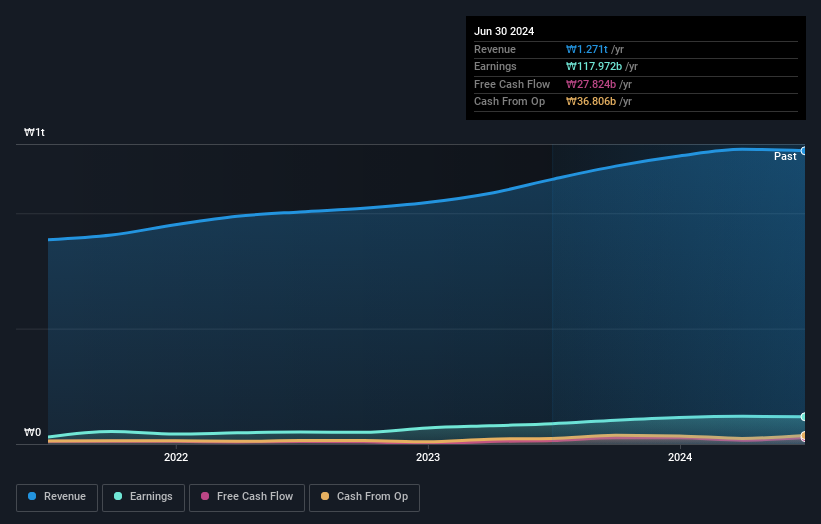

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Hanmi Science's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Hanmi Science has rewarded shareholders with a total shareholder return of 21% in the last twelve months. And that does include the dividend. That certainly beats the loss of about 1.9% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Before forming an opinion on Hanmi Science you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal