Top TSX Growth Companies With Insider Ownership In October 2024

The Canadian market has shown robust performance, rising by 1.6% over the past week and 25% over the last year, with earnings projected to grow annually by 16%. In this thriving environment, identifying growth companies with substantial insider ownership can provide insights into stocks where those closest to the business have confidence in its future potential.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| Aritzia (TSX:ATZ) | 18.9% | 59.7% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 18.3% | 73% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 69.5% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's explore several standout options from the results in the screener.

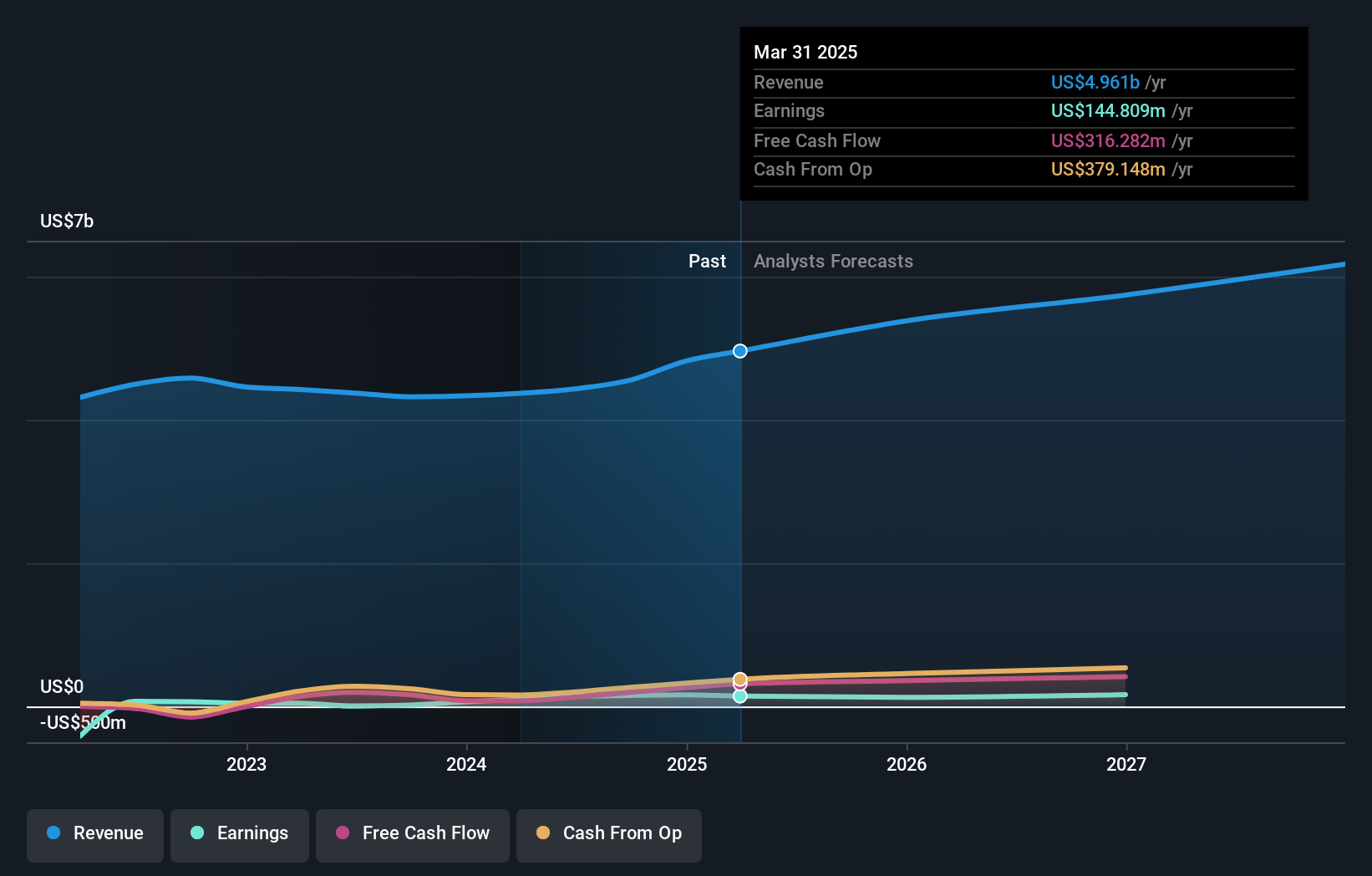

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately CA$10.38 billion.

Operations: The company generates revenue from several segments, including the Americas ($2.59 billion), Asia Pacific ($614.55 million), Investment Management ($496.42 million), and Europe, Middle East & Africa (EMEA) ($734.93 million).

Insider Ownership: 14.1%

Revenue Growth Forecast: 11% p.a.

Colliers International Group's earnings are forecast to grow significantly at 20.8% annually, outpacing the Canadian market average of 14.7%. Revenue is also expected to increase by 11% per year, surpassing the national market rate of 7.1%. Despite recent shareholder dilution and significant insider selling over the past quarter, insiders have bought more shares than sold in the last three months. Recent earnings show a substantial turnaround from losses to profits year-over-year.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Colliers International Group's share price might be too optimistic.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$3.18 billion.

Operations: The company's revenue segments include CA$154.10 million from Easyhome and CA$1.24 billion from Easyfinancial.

Insider Ownership: 21.2%

Revenue Growth Forecast: 31.6% p.a.

goeasy's revenue is forecast to grow significantly at 31.6% annually, well above the Canadian market average of 7.1%. Earnings are expected to increase by 17.1% per year, surpassing the national rate of 15.6%. The company trades at a good value compared to peers, though its debt coverage by operating cash flow is weak. Recent board appointment of Radhika Kakkar may enhance strategic operations, but insider activity shows significant selling over the past quarter despite some buying in recent months.

- Navigate through the intricacies of goeasy with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, goeasy's share price might be too pessimistic.

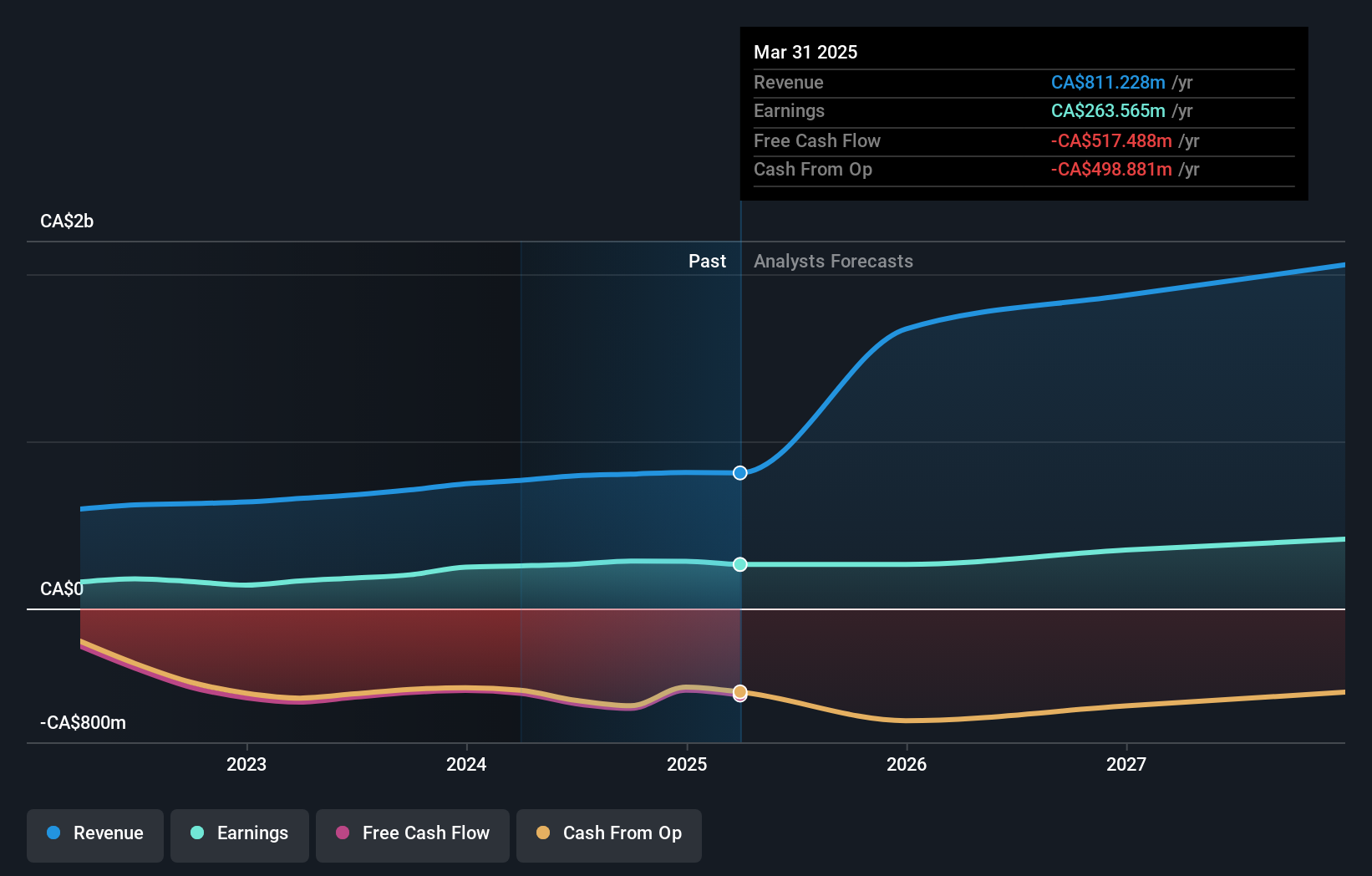

Artemis Gold (TSXV:ARTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company that specializes in identifying, acquiring, and developing gold properties, with a market cap of CA$3.14 billion.

Operations: Artemis Gold Inc. does not currently report revenue segments, as it is focused on the development of gold properties.

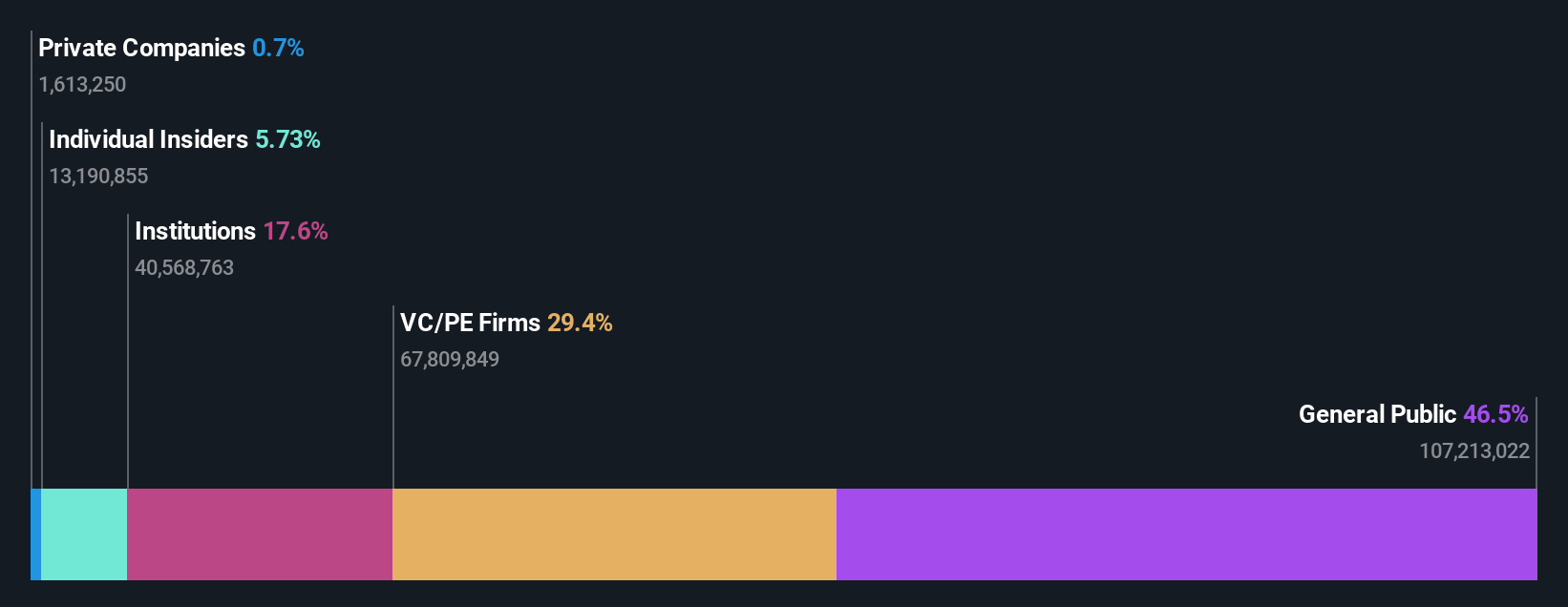

Insider Ownership: 29.9%

Revenue Growth Forecast: 45.9% p.a.

Artemis Gold's insider ownership aligns with its growth prospects, as the company is trading significantly below estimated fair value. The Blackwater Mine project is over 95% complete and fully funded, with first gold pour targeted for late Q4 2024. Despite past wildfire disruptions, construction progresses well. Revenue is expected to grow rapidly at 45.9% annually, outpacing the Canadian market average of 7.1%. However, recent shareholder dilution may concern potential investors.

- Get an in-depth perspective on Artemis Gold's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Artemis Gold is trading behind its estimated value.

Make It Happen

- Gain an insight into the universe of 35 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal