Noumi Limited (ASX:NOU) Surges 59% Yet Its Low P/S Is No Reason For Excitement

Noumi Limited (ASX:NOU) shares have continued their recent momentum with a 59% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

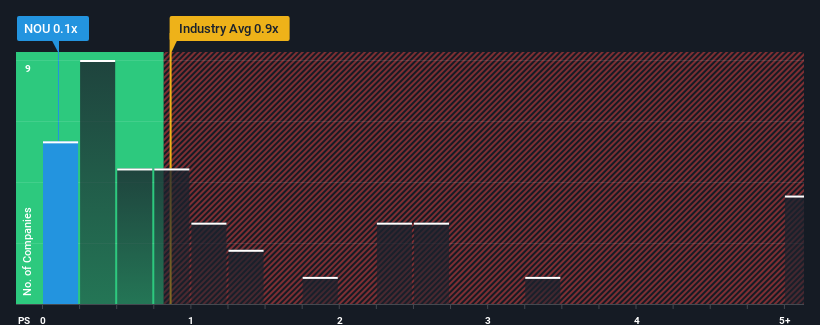

Even after such a large jump in price, Noumi may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Food industry in Australia have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Noumi

What Does Noumi's P/S Mean For Shareholders?

Recent times haven't been great for Noumi as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Noumi will help you uncover what's on the horizon.How Is Noumi's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Noumi's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 6.9% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 7.8% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.4% over the next year. Meanwhile, the rest of the industry is forecast to expand by 8.5%, which is noticeably more attractive.

In light of this, it's understandable that Noumi's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Noumi's P/S

The latest share price surge wasn't enough to lift Noumi's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Noumi maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Noumi you should be aware of, and 1 of them is a bit concerning.

If you're unsure about the strength of Noumi's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal