Commercial Metals Earnings Miss Estimates in Q4, Sales Dip Y/Y

Commercial Metals Company CMC reported adjusted earnings per share (EPS) of 90 cents for fourth-quarter fiscal 2024 (ended Aug. 31, 2024), missing the Zacks Consensus Estimate of 91 cents. The bottom line fell from the prior-year quarter’s $1.58.

During the fourth quarter of fiscal 2023 , CMC had previously made an adjustment of $16 million for mill operational commissioning costs related to its third micro mill, which was placed into service in the quarter. During its fourth quarter 2024 earnings release, the company stated that periods commencing after Feb. 29, 2024, will no longer include any adjustment for mill operational commissioning costs. Accordingly, Commercial Metals recast adjusted earnings for the prior-year quarter to $1.58. Including the adjustment, it previously stood at $1.69.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Net sales in the reported quarter were around $2 billion compared with the year-ago quarter’s $2.21 billion. The reported figure missed the Zacks Consensus Estimate of $2.07 billion.

The cost of goods sold in the quarter was down 6.2% from the year-ago quarter to $1.67 billion. The gross profit was down 24% from the year-ago quarter to $323 million during this period. The core EBITDA was $227 million in the fiscal fourth quarter, down 30.8% from the year-ago quarter.

Commercial Metals’ Q4 Segmental Performance

The North America Steel Group segment generated net sales of $1.56 billion in the fiscal fourth quarter compared with $1.72 billion in the year-ago quarter. We expected net sales of $1.66 billion for the quarter. The segment registered an adjusted EBITDA of $210.9 million compared with the year-ago quarter’s $336.8 million. Our model predicted an adjusted EBITDA of $194 million.

The Europe Steel Group segment’s revenues were $222 million, down 18.9% from the year-ago quarter. Our model predicted net sales of $229 million. The adjusted EBITDA was a negative $3.6 million in the fiscal fourth quarter compared with the year-ago quarter’s negative $30 million. We expected an adjusted EBITDA of a negative $0.6 million for the quarter.

The Emerging Businesses Group segment generated net sales of $196 million in the fiscal fourth quarter compared with $209 million in the year-ago quarter. We expected net sales of $172 million for the quarter. The segment registered an adjusted EBITDA of $42.5 million, down 0.2% year over year. Our model predicted an adjusted EBITDA of $26.5 million.

CMC’s FY24 Top Line Dips Y/Y

Commercial Metals reported adjusted earnings per share of $4.14 for fiscal 2024, marking a 42% decline from $7.16 in fiscal 2023. The bottom line missed the Zacks Consensus Estimate of $4.37. Revenues dropped 9.9% year over year to $7.93 billion in fiscal 2024, missing the Zacks Consensus Estimate of $7.99 billion.

The company had made an adjustment of $35.8 million for mill operational commissioning costs in fiscal 2023. Including this, CMC had reported adjusted earnings per share of $7.40 for fiscal 2023. However, this figure has now been recast to $7.16 as the company will no longer make adjustments for mill operational commissioning costs, as stated above.

Commercial Metals’ Q4 Cash Flow & Balance Sheet Updates

CMC reported cash and cash equivalents of $858 million at the end of fiscal 2024 compared with $592 million at the end of fiscal 2023. The company’s long-term debt was $1.15 billion at the end of fiscal 2024 compared with $1.11 billion at the fiscal 2023 end. Cash generated from operating activities was $0.9 billion in fiscal 2024 compared with $1.34 billion in the last fiscal year.

CMC’s FY25 Outlook

The company anticipates weaker results in the first quarter of fiscal 2025 than in the fourth quarter of 2024. This is due to ongoing macroeconomic uncertainty and dampened sentiment within certain areas of the construction industry.

Finished steel shipments within the North America Steel Group are projected to follow regular seasonal trends. Commercial Metals expects the adjusted EBITDA margin to decline due to a lower steel product margin over scrap costs.

CMC anticipates a sequential improvement in Europe Steel Group's adjusted EBITDA in the first quarter of 2025. The Europe Steel Group's underlying financial performance is expected to be comparable to the fourth-quarter 2024 reported level . Earnings for the Emerging Businesses Group are expected to fall due to typical seasonality and the effects of economic uncertainties in the United States and Europe.

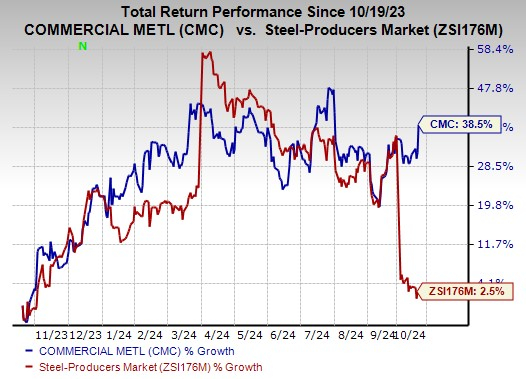

Commercial Metals’ Share Price Outperforms Industry

Shares of the company have gained 38.5% in the past year compared with the industry’s growth of 2.5%.

Image Source: Zacks Investment Research

CMC’s Zacks Rank

Commercial Metals currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Steel - Producers Stocks Awaiting Results

L.B. Foster Company FSTR is expected to release its third-quarter 2024 results soon.

The Zacks Consensus Estimate for FSTR’s earnings per share is pegged at 49 cents for the third quarter, suggesting growth from the 5 cents reported in the year-ago quarter. The Zacks Consensus Estimate for total revenues is pinned at $144.5 million, indicating a year-over-year decrease of 0.6%.

Gerdau S.A. GGB is expected to release third-quarter 2024 results soon.

The Zacks Consensus Estimate for GGB’s earnings per share is pegged at 16 cents for the third quarter , suggesting growth of 6.7% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $2.9 billion, indicating a year-over-year decrease of 14.8%.

Ternium S.A. TX is expected to release third-quarter 2024 results soon.

The Zacks Consensus Estimate for TX’s earnings per share is pegged at $1.01 for the fiscal third quarter, suggesting a decline of 26.8% from the year-ago reported figure. The Zacks Consensus Estimate for the total revenues is pinned at $4.5 billion, indicating a year-over-year decrease of 13.8%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gerdau S.A. (GGB): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

Commercial Metals Company (CMC): Free Stock Analysis Report

L.B. Foster Company (FSTR): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal