Benzinga's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet

Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week of Oct. 18:

MGE Energy Inc (NASDAQ:MGEE) is new to the Stock Whisper Index. The electric and natural gas company, which covers the Wisconsin area, saw increased interest from readers. Shares are trading near a 52-week high, with third-quarter financial results expected in late October. Morgan Stanley maintained an Underweight rating on the stock in September and raised the price target from $71 to $74. Shares of MGE Energy were up over 3% over the last five days as shown on the Benzinga Pro chart below and are up 27% year-to-date in 2024.

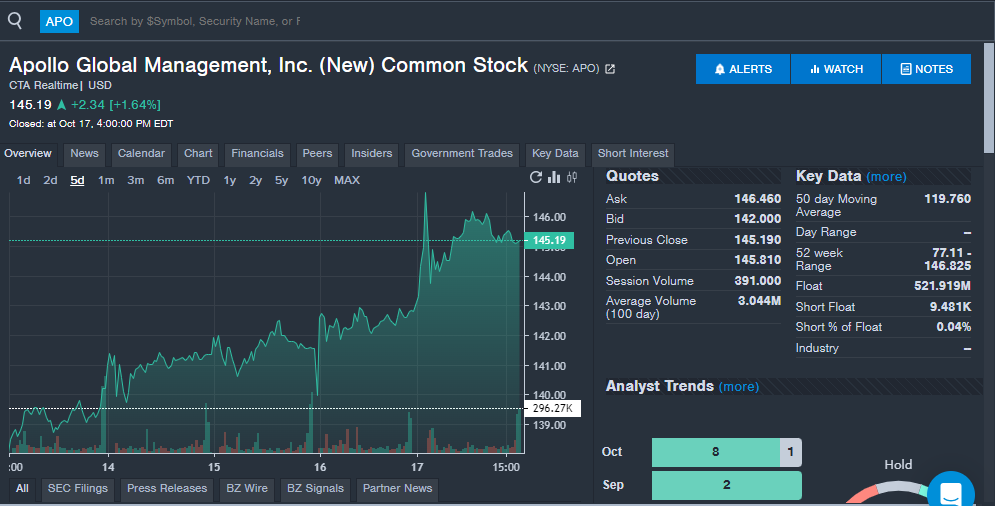

Apollo Global (NYSE:APO) saw increased interest from Benzinga readers during the week. The stock also trades near a 52-week high. This comes as bank stocks and financial service companies have reported quarterly financial results that beat estimates and showed strength in the sector. Several Apollo peers showed strength that could have investors anticipating a strong third-quarter report from the company on Nov. 5. Analysts expect the company to report earnings per share of $1.72 and revenue of $4.14 billion. The alternative investment management company has missed analyst estimates for earnings per share in three of the last five quarters. But revenue has been a much different story. Apollo enjoyed three straight beats and totals higher than analyst estimates in eight of the last 10 quarters. Apollo shares are up over 5% in the last five days and up over 59% year-to-date in 2024.

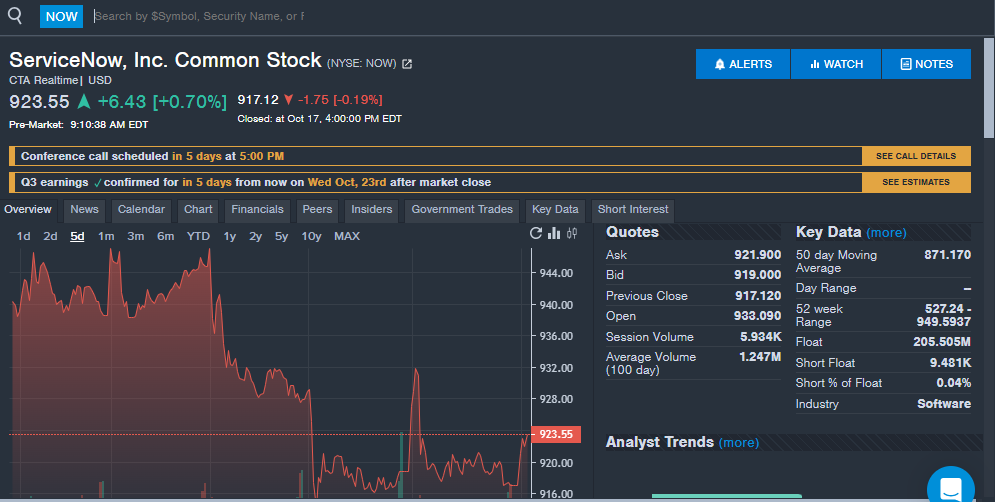

ServiceNow Inc (NYSE:NOW) saw increased interest from readers on the heels of announcing a $1.5 billion investment in the U.K. to grow its innovation and artificial intelligence work. The software company will report third-quarter financial results on Oct. 23. Analysts expect the company to report earnings per share of $3.46 and revenue of $2.74 billion. The company has beaten analyst estimates on earnings per share in more than 10 straight quarters and beaten revenue estimates in six straight quarters. In second-quarter results, ServiceNow CEO Bill McDermott said the company's "relevance as the AI Platform for business transformation remains stronger than ever," which could be a good sign for future quarterly results. McDermott said ServiceNow plans to reinvent workflow in every industry it can, powered by generative AI.

Analysts have been raising their price targets on ServiceNow ahead of the quarterly earnings. ServiceNow shares were down on the week, but remain up over 30% year-to-date.

Vistra Corp (NYSE:VST) rejoins the Stock Whisper Index with strong interest from Benzinga readers due to the energy sector and particularly companies exposed to the nuclear energy sector seeing rising interest thanks to growing demand for data centers and AI infrastructure. The energy company will report third-quarter financial results on Oct. 7 with earnings per share of $1.09 and revenue of $5.01 billion expected by analysts.

Vistra has missed earnings per share estimates in three of the last four quarters and revenue estimates in four of the last five quarters. The third quarter results could show if the company can beat estimates and show its strength in the sector. Analysts have been increasing their price targets on Vistra ahead of the earnings report and JPMorgan recently initiated coverage with an Overweight rating and $178 price target. The stock was up over 8% during the last five trading days as nuclear energy remains a hot investor topic. With a gain of over 230% year-to-date, Vistra stock is one of the best-performing S&P 500 stocks.

Uber Technologies (NYSE:UBER) saw increased interest from readers as the ride-share company considers a bid for Expedia Group Inc (NASDAQ:EXPE) according to reports. Uber’s current CEO, Dara Khosrowshahi, previously led Expedia as CEO for 12 years. The report comes as Uber has considered acquisitions for growth and to diversify its business into a travel superapp. Khosrowshahi also showed minimal concern over competition from Tesla Inc‘s (NASDAQ:TSLA) robotaxi.

"I don't think this is going to be a winner-take-all marketplace. We believe in the spirit of partnership. We'll see what Tesla does, and either we'll compete with them, or we'll work with them, or a combination therof," Khosrowshahi said.

Uber will report quarterly results on Oct. 31, which could provide more commentary on the competition from Tesla and acquisition plans. The stock was down 2% on the week and is up over 35% year-to-date in 2024.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal