Weekly Hot Picks: “Trump Deal” Relaunch! The US index has broken the negative correlation with gold!

Market review

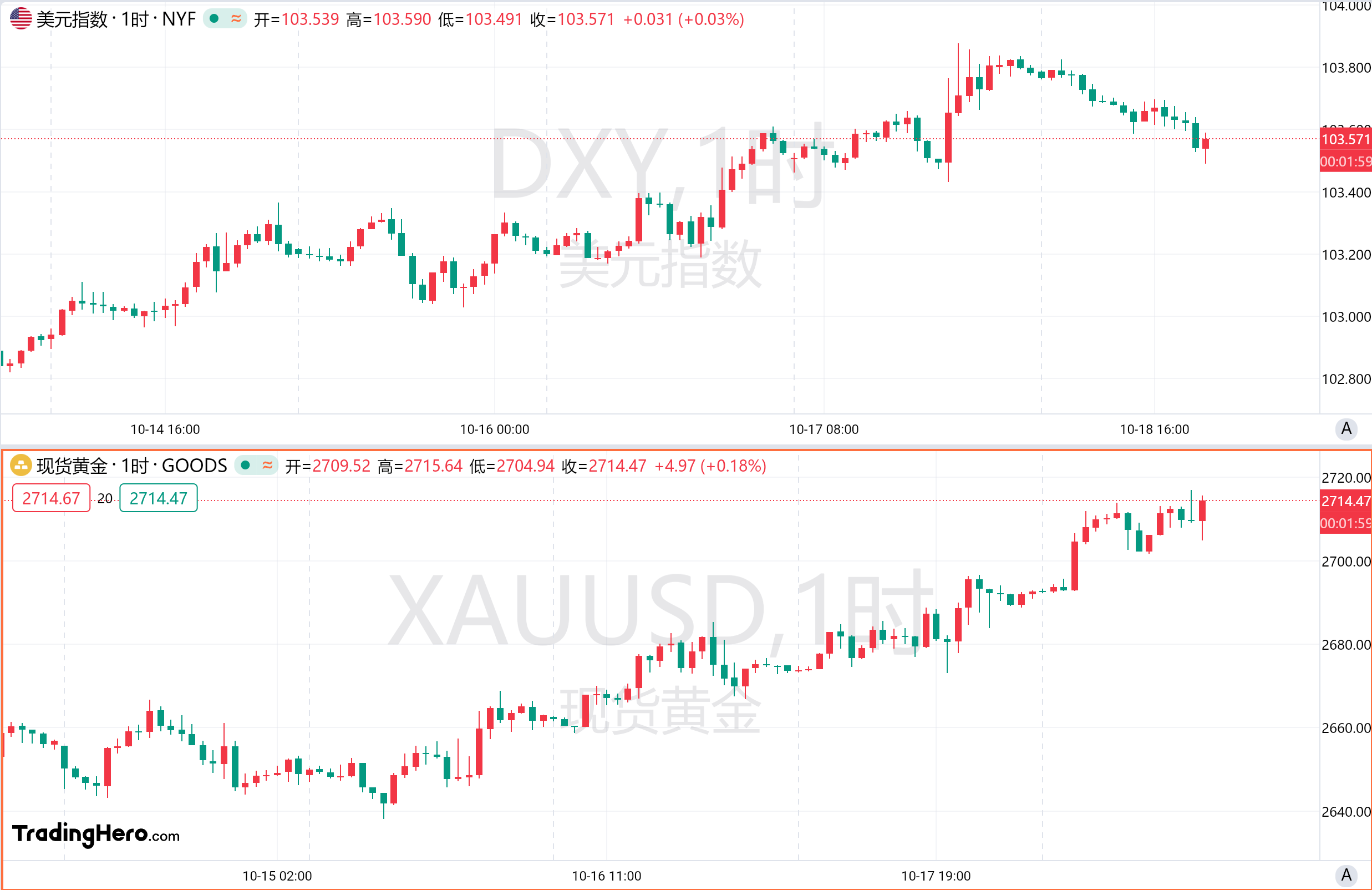

The US dollar index continued to rise this week, continuing three weeks of gains. Various data show that the US economy is performing well. The market expects the Federal Reserve to cut interest rates at a small pace within the next year and a half, and believes that Trump will win the general election, which is expected to boost the dollar, and the US index hit an 11-week high.

Spot gold was not impacted by the higher dollar. Since October, the US gold index has risen at the same time. The uncertainty surrounding the US election and the Middle East conflict prompted investors to seek safe haven assets, and the price of gold hit the 2,700 US dollars/ounce mark, once again reaching a record high. According to Dow Jones market data, so far this year, gold, the most active contract, has reached a record high in 34 days, the highest since reaching 38 record highs in 2011. As of press time, spot gold is hovering at an all-time high near $2,715 per ounce.

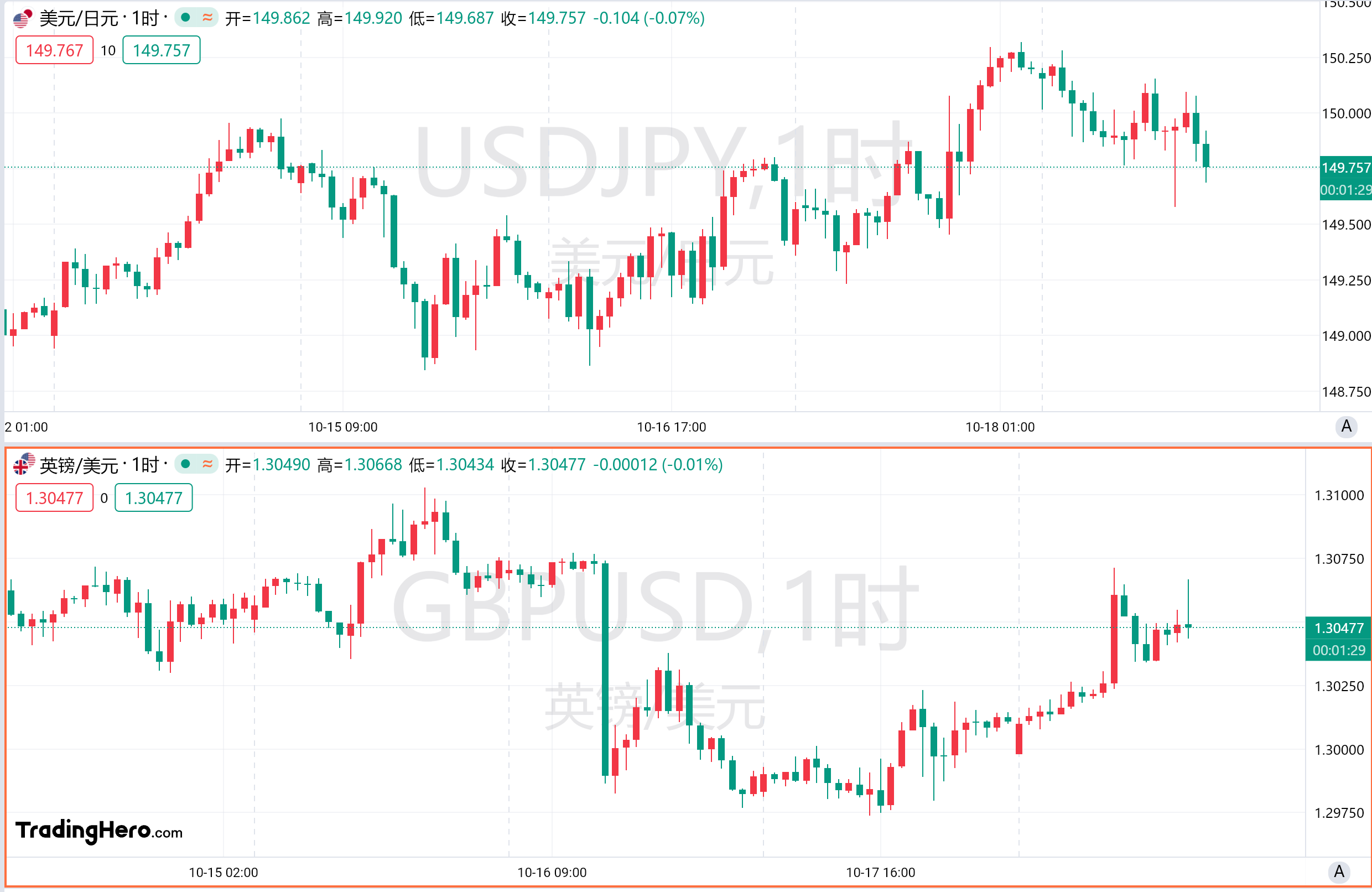

In terms of non-US currencies, the US dollar once returned to 150 against the yen. The market was concerned about the risk of intervention by the Japanese authorities. Japan's top currency official Jun Mimura warned that he was watching the market. Affected by expectations of interest rate cuts, the pound once fell below 1.30 against the US dollar, the first time since August 20. This week it will record its third consecutive week of decline. In an environment of trade uncertainty caused by Trump's tariffs, the euro has also been falling for four consecutive weeks against the US dollar, and the market is beginning to worry that it will fall to parity.

The better-than-expected UK retail sales data suggests that the country's economy is likely to perform well, while signs of the Eurozone economy faltering are increasingly evident, and the euro fell to its highest level against the pound in two and a half years.

International oil prices continued to fall this week. Israel says it will attack Iran's military targets, not nuclear facilities or oil targets. Market concerns about disruptions in Iran's supply have been mitigated. Furthermore, due to predictions that oil demand growth will slow, oil prices remain near a two-week low. Among them, WTI crude oil plummeted 4.5% on Monday, and Brent crude oil plummeted 4.2%. Both oils are expected to fall by more than 7% this week.

On the stock market side, the S&P 500 index hit another record high this week. Goldman Sachs tactical expert Scott Rubner is expected to rise to 6270 points before the end of the year; capital rotation helps the small-cap stock index approach a three-year high; AI demand prospects drive Nvidia to a new record intraday high; and Apple hit a record intraday high, with a total market value of 3.61 trillion US dollars at one point.

The A-share Hong Kong stock market was adjusted, but it rose sharply on Friday, catalyzed by intensive policies. Market and capital optimism continues unabated. According to a global survey conducted by Bank of America in October, “going long on Chinese stocks” ranked in the top three most popular transactions this month. Bank of America strategists who accurately predicted the rise in the Chinese stock market last month believe there is still room for further growth. China's well-known macro-hedge fund Banxia Investment advises retail investors to buy stocks now, believing that relatively low valuations and government support policies are favorable factors.

Weekly calendar

1. Incremental funding is here! SFISF launches repurchase refinancing to increase holdings

The People's Bank of China officially announced on the 18th that it has issued a notice in conjunction with the Securities Regulatory Commission to launch the Securities, Fund, and Insurance Company Exchange Facilitation (SFISF) operation from now on. Currently, 20 securities and fund companies have been approved to participate in the operation of the tool, and the total application amount has exceeded 200 billion yuan.

Specifically, the swap period is 1 year, and you can apply for an extension as needed; the initial operation amount is 500 billion yuan, and the rate for each operation is determined using tenders; the scope of pledges includes bonds, stock ETFs, Shanghai and Shenzhen 300 constituent stocks, public REITs, etc., and the conversion rate is graded according to the risk characteristics of the pledge, and is more favorable than the market level.

On the other hand, the central bank announced the official launch of stock repurchases and reloans. From now on, 21 national financial institutions can issue relevant loans to eligible listed companies and major shareholders. If the requirements are met, the People's Bank of China will provide reloan support according to 100% of the loan principal amount, with an initial amount of 300 billion yuan, an interest rate of 1.75%, and a period of 1 year. The cumulative period is estimated to reach 3 years. Pan Gongsheng said that the central bank's provision of stock repurchases and reloans to increase holdings is specific, and the bottom line is that credit funds cannot enter the stock market in violation of regulations.

Pan Gongsheng also said that it is expected that before the end of the year, depending on market liquidity, the deposit reserve ratio will be further lowered by 0.25-0.5 percentage points, and the loan market quoted interest rate (LPR) announced on the 21st is also expected to drop by 0.2-0.25 percentage points.

2. A combo punch pushed real estate to stop falling and stabilize, and the five central government departments made a big statement!

One million new urban villages and dilapidated housing were renovated: ① focus on supporting cities above prefectural level; ② development and policy financial institutions grant special loans; ③ allow local authorities to issue special bonds; ④ grant tax concessions; ⑤ commercial banks issue loans based on assessments.

Increase the credit scale of “white list” projects to 4 trillion yuan by the end of the year: ① include all commercial housing project loans in the “white list”; ② optimize the disbursement method of loan funds to achieve “as soon as possible”.

Special debt purchases of existing commercial housing: ① Local decisions are made independently and implemented voluntarily; ② support local authorities to increase the covered housing area. By the end of the year, 4.5 million people will live in affordable housing.

Special debt to collect and store land: ① We will work with relevant departments to study and set up special loans to acquire existing land; ② research and allow policy banks and commercial banks to issue loans to enterprises that are in a position to do so, and the central bank will provide necessary reloan support; ③ cities with too long removal cycles will guide local authorities to suspend the supply of commercial residential land and implement how much to revitalize and supply cities with long removal cycles; ④ will reasonably determine the purchase price with stock land owners.

Stock mortgage interest rates: It is expected that interest rates on stock mortgages will drop by an average of about 0.5 percentage points. Interest rates on most stock mortgages will be cut in batches on October 25.

Real estate value-added tax: We are urgently studying and clearly abolishing tax policies linking general housing with non-general housing, mainly including policies related to value-added tax and land value-added tax.

3. China's major economic data was released this week!

According to preliminary accounting by the National Bureau of Statistics, the gross domestic product for the first three quarters was 949,74.6 billion yuan, an increase of 4.8% over the previous year at constant prices. By industry, the primary sector added value of 5773.3 billion yuan, an increase of 3.4% over the previous year; the secondary sector added value of 36136.2 billion yuan, an increase of 5.4%; and the tertiary sector added value of 530.61 billion yuan, an increase of 4.7%. On a quarterly basis, GDP grew 5.3% year-on-year in the first quarter, 4.7% in the second quarter, and 4.6% in the third quarter. On a month-on-month basis, the gross domestic product increased by 0.9% in the third quarter.

According to data from the People's Bank of China, in the first three quarters, China's imports and exports reached 32.33 trillion yuan, an increase of 5.3% over the same period in history. Imports and exports of 10.15 trillion yuan, 11 trillion yuan, and 11.17 trillion yuan respectively in each quarter exceeded 10 trillion yuan. This is also the first time in the same period in history.

According to data from the General Administration of Customs, in the first three quarters of this year, RMB loans increased by 16.02 trillion yuan; the RMB loan balance increased by 8.1% year on year at the end of September; the scale of social financing increased by 25.66 trillion yuan, which is 3.68 trillion yuan less than the same period last year; and social finance stocks increased 8% year on year at the end of September. At the end of September, the balance of broad currency (M2) increased 6.8% year on year, 0.5 percentage points higher than at the end of the previous month; narrow currency (M1) balance fell 7.4% year on year. Overall, the total financial volume index remained stable in September, and the credit structure continued to be optimized.

4. The bet that the Federal Reserve will cut interest rates by only 25 bp next month has increased

After better-than-expected “horror data” retail sales and initial demand data were released, traders expected the Fed to cut interest rates less during the year.

The increase in retail sales in the US in September was slightly higher than expected, supporting the view that the economy maintained strong growth in the third quarter; the number of jobless claims in the US unexpectedly fell by 19,000 at the beginning of last week, the biggest drop in three months. Signs of economic recovery are difficult to stop the Federal Reserve from cutting interest rates again next month, but they will reinforce expectations of cutting interest rates by only 25 basis points.

This week, Federal Reserve Governor Waller believes that the Federal Reserve should be more cautious in cutting interest rates than during the September meeting. If inflation falls below 2%, but this is an unlikely situation, or if the labor market deteriorates, the Federal Reserve can cut interest rates ahead of time, but if inflation unexpectedly rises, the Federal Reserve may suspend interest rate cuts. Minneapolis Federal Reserve Chairman Kashkari said that further “moderate” interest rate cuts seem appropriate. San Francisco Federal Reserve Chairman Daly said that as inflation and the labor market cools down, the Federal Reserve must remain alert to maintain economic growth.

5. Multiple banks lowered deposit interest rates by 200,000 yuan, and interest on three-year savings was reduced by 1,500 yuan

On October 18, ICBC, CCB, Bank of Communications, Agricultural Bank and Bank of China all updated their deposit listing interest rates. Interest rates on three-month, half-year, one-year, two-year, three-year, and five-year time deposits were all reduced by 25 basis points, with one-year interest rates falling to 1.1%. Interest rates on 7-day notice deposits also fell by 25BP to 0.45% at the same time. This is another time after July that major banks lowered deposit interest rates after a lapse of less than 3 months. It will also be the sixth time since September 2022 that major banks have taken the initiative to lower deposit interest rates.

Interest rates on three-year deposits were cut by 0.25 percentage points. If 200,000 yuan were saved for three years, the interest rate for three years would be reduced by 1,500 yuan after the interest rate cut. Following the path of cutting interest rates on deposits in the past, major state-owned banks took the lead in cutting interest rates, then small and medium banks followed suit. Joint stock banks are expected to start cutting interest rates on deposits soon.

6. Hamas leader Sinwar is dead; Israel may retaliate against Iran before the US election

According to the Washington Post, Israel agreed to limit its retaliation against Iran to military targets and avoid attacking Iran's energy and nuclear facilities. In terms of timing, CNN reports that US officials expect Israel to retaliate against Iran's attacks this month before the November 5 election.

Iran, on the other hand, conveyed news to Israel through secret channels that if Israel's response to Iran's attack was limited, Iran would consider this round of confrontation between the two countries to be over.

Israel confirmed this week that Hamas leader Sinwar, who led the attack on southern Israel in October last year, was killed by the Israeli army. US Vice President Harris said that Sinwar's death provided an opportunity to end the war in Gaza, but Netanyahu said Israel will continue fighting until all hostages are released.

7. The win rate has soared! The “Trump deal” is making a comeback

There are only about three weeks left until voting day in the US election. Trump's advantage in swing states has prompted the market to once again expect his chances of winning to increase, and the “Trump deal” heats up.

Trump is working to close the fundraising gap with Harris, and Musk became one of its biggest supporters, donating about $75 million between July and September to the American Political Action Committee (America PAC), a political group supporting Trump.

In an exclusive interview this week, Trump emphasized that his tariff-focused economic policy would stimulate growth in an attempt to allay concerns that his economic plans would drive up inflation. Trump's transition team co-chairman Lutnick said that if Trump wins the election, companies such as Apple and Tesla will pay higher US taxes.

Billionaire investor Druckenmiller said that judging from the performance of assets such as bank stocks and cryptocurrencies, the recent market is digesting Trump's victory. Bitcoin is approaching an all-time high of $70,000, and analysts say the market will usher in a perfect storm.

Democratic presidential candidate Harris is reportedly stepping up efforts to win over Republican voters who are dissatisfied with Trump. Meanwhile, the growing conflict in the Middle East has become a key issue in the US election, and US President Joe Biden and Vice President Harris are facing pressure from the left to deal with this situation. Trump and other Republicans accuse the administration of failing to handle the crisis, leaving the world in chaos.

8. Major Wall Street banks have released beautiful financial reports one after another

Thanks to the increase in stock trading revenue, Goldman Sachs's profit soared 45% in the third quarter; Citibank's marketing department achieved the best performance in at least ten years; Bank of America's investment banking and trading business performance and net interest income all exceeded analysts' expectations; and Morgan Stanley announced a sharp increase in trading business revenue in the third quarter, driving up 32% in profit for the quarter, and spurring the biggest increase in stock prices in nearly four years.

As major Wall Street banks release beautiful financial reports one after another, bankers are looking forward to “rising” bonuses. The trend shows that this year is expected to be the highest paid year since Wall Street bank revenue hit record in 2021.

9. The ECB starts a model of continuous interest rate cuts

The ECB cut interest rates for the third time in the year, and the most critical deposit mechanism interest rate was cut from 3.5% to 3.25%. Governor Lagarde reiterated that without prior commitment to a specific interest rate path, it will remain restrictive as needed; it will continue to rely on data to make decisions meeting by meeting; the risk of economic growth is declining and the risk of inflation is on the rise; and officials have not discussed the option of cutting interest rates by 50 basis points this week.

Sources said that ECB officials expect inflation to reach 2% in the first or second quarter of next year, and think it is very likely that interest rates will be cut in December. Traders raised their bets on the ECB's interest rate cut at the end of the year. It is not ruled out that interest rates will be cut by 50 basis points, and they have almost completely absorbed the situation where interest rates were cut by 25 basis points at every meeting until April. Well-known economist El-Erian predicts that the ECB may cut interest rates more than the Federal Reserve.

10. Inflation fell below 2%, and the Bank of England is expected to restart interest rate cuts

According to UK data this week, CPI increased 1.7% year on year in September, falling short of the central bank's target to hit its lowest level in three and a half years. Traders then increased their bets on the Bank of England's interest rate cut. It is expected to cut interest rates by 24 basis points in November, with a cumulative total of 42 basis points cut by the end of the year. The Bank of England began cutting interest rates for the first time in August, by 25 basis points. Interest rate cuts were suspended in September with an 8:1 vote, while reaffirming that “monetary policy needs to remain restrictive for a long enough period of time.”

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal