Undiscovered Gems in the UK to Explore This October 2024

Over the last 7 days, the United Kingdom market has risen by 1.6% and is up 11% over the past year, with earnings forecasted to grow by 14% annually. In this promising environment, identifying stocks that are not only aligned with these growth trends but also possess unique attributes can uncover potential opportunities for investors seeking to expand their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★★★☆

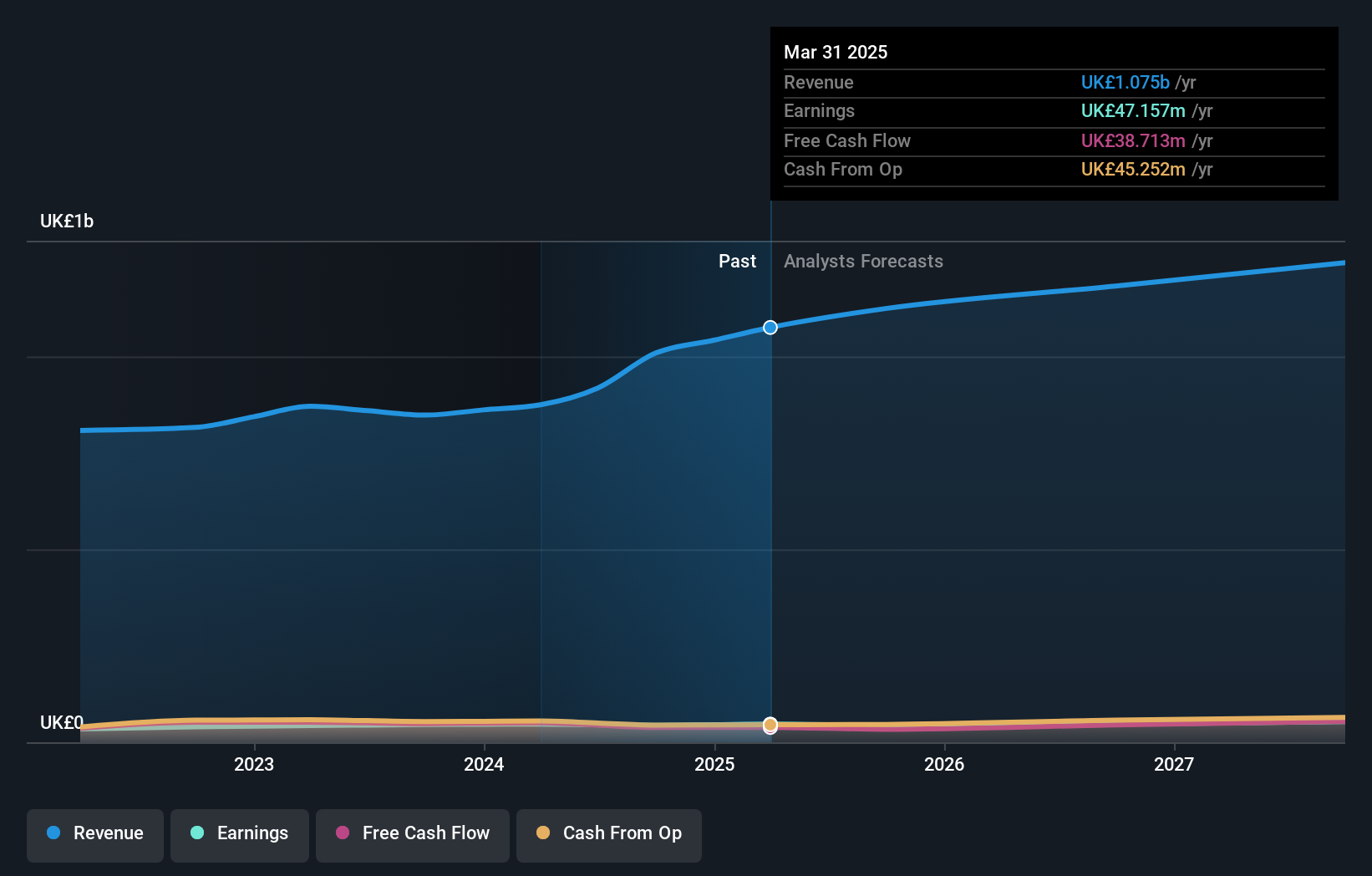

Overview: Renew Holdings plc operates as a contractor specializing in engineering services and specialist building in the United Kingdom, with a market capitalization of approximately £911.67 million.

Operations: Renew Holdings generates revenue primarily from its Engineering Services segment, contributing £910.83 million, while the Specialist Building segment adds £84.80 million.

Renew Holdings, a nimble player in the UK market, stands out with its debt-free status and high-quality earnings. Over the past five years, it has achieved an impressive 18.1% annual growth in earnings, although last year's 13.2% growth lagged behind the construction industry's 18.7%. The company's shares trade at a value perceived to be 15.3% below their fair estimate, suggesting potential for upside. Forecasts indicate a steady growth rate of 3.59% annually moving forward, while recent administrative updates include relocating their registered office to Leeds as of October 2024.

- Take a closer look at Renew Holdings' potential here in our health report.

Gain insights into Renew Holdings' historical performance by reviewing our past performance report.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

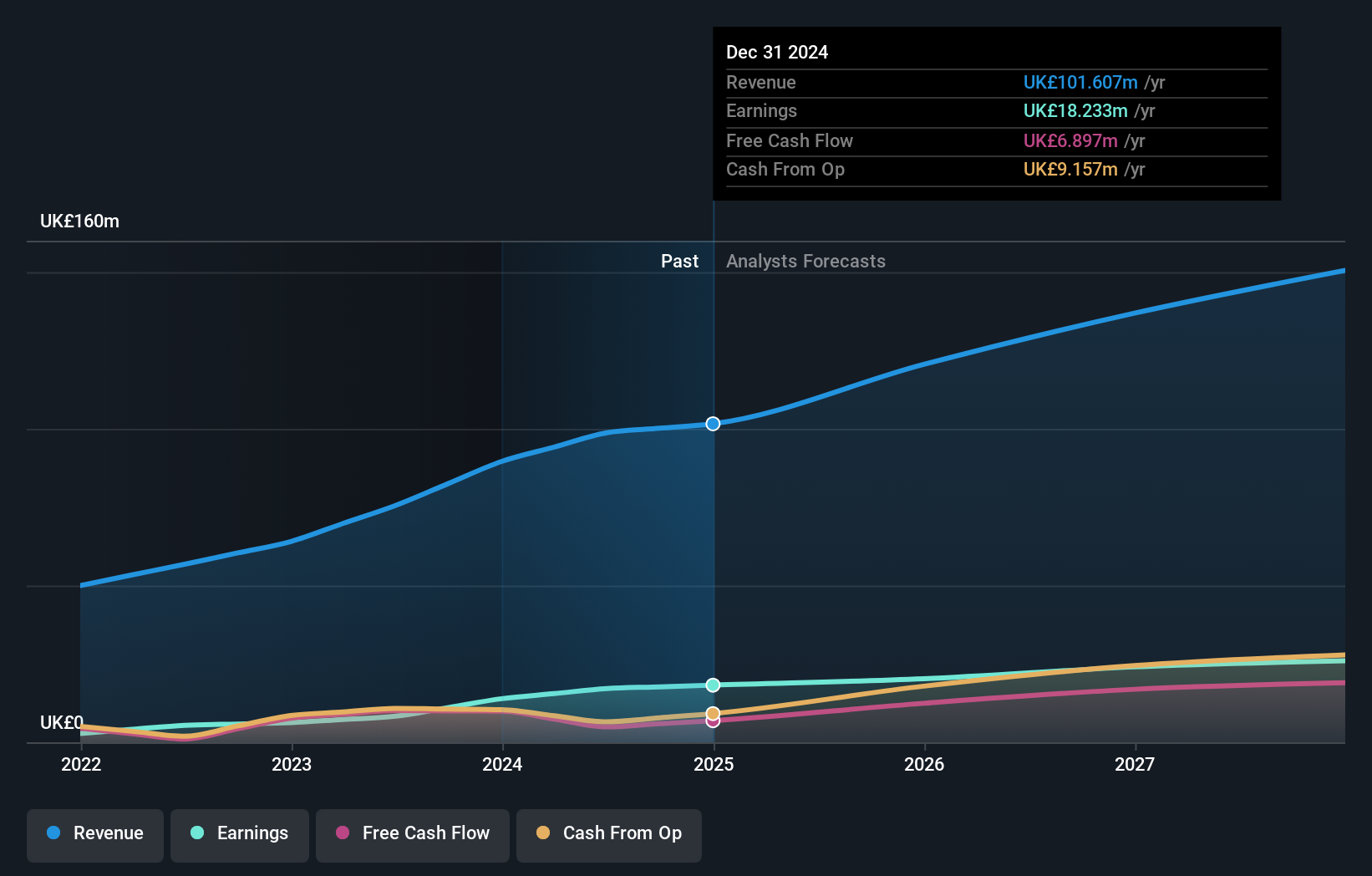

Overview: Warpaint London PLC, along with its subsidiaries, is engaged in the production and sale of cosmetics, with a market cap of £436.14 million.

Operations: Warpaint London generates revenue primarily from its Own Brand segment, which accounts for £96.72 million, while the Close-Out segment contributes £2.12 million.

Warpaint London, a nimble player in the beauty sector, has shown impressive financial strides with earnings surging by 106% over the past year, outpacing the industry's 7% growth. This debt-free company reported half-year sales of £45.85 million and net income of £8.02 million, reflecting a strong operational performance compared to last year's figures. Despite its highly volatile share price recently, Warpaint's profitability is underscored by positive free cash flow and a forecasted annual earnings growth of 11%. The recent dividend increase to 3.5 pence per share further highlights its commitment to shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of Warpaint London.

Assess Warpaint London's past performance with our detailed historical performance reports.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

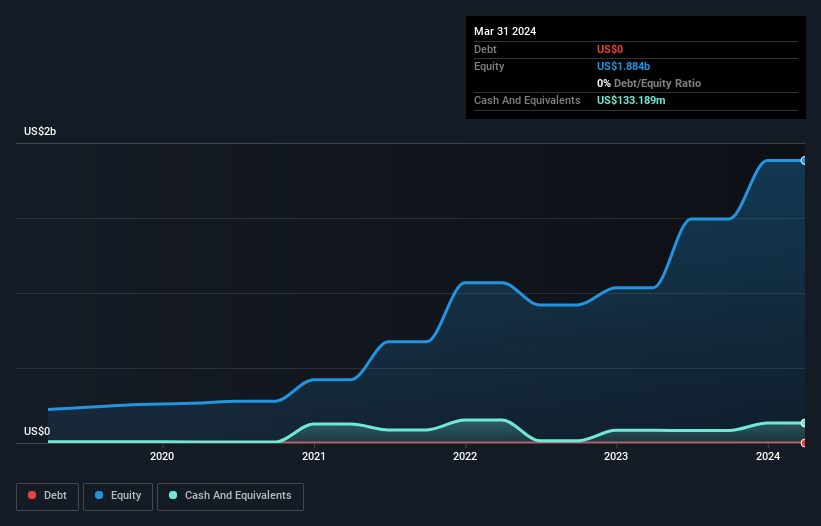

Overview: Yellow Cake plc operates in the uranium sector with a market capitalization of £1.28 billion.

Operations: Yellow Cake generates revenue primarily from its holdings of U3O8 for long-term capital appreciation, valued at $735.02 million.

Yellow Cake, a nimble player in the uranium market, has shown remarkable financial turnaround. The company reported a net income of US$727 million for the year ending March 2024, bouncing back from a net loss of US$103 million the previous year. With no debt on its books for five years and trading at a low price-to-earnings ratio of 2.3x compared to the UK market's 16.7x, it stands out as an attractive value proposition. Despite high non-cash earnings quality, future earnings are projected to decline by an average of 78% annually over three years, raising concerns about sustained profitability.

Make It Happen

- Dive into all 81 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal