Discovering Transcorp Power And 2 Hidden Small Caps With Promising Potential

As global markets continue to reach new highs, buoyed by a robust earnings season in the U.S. and tempered expectations for interest rate cuts, investors are increasingly turning their attention to small-cap stocks that may have been overlooked. In this environment of cautious optimism, identifying stocks with strong fundamentals and growth potential becomes essential for those looking to uncover hidden gems like Transcorp Power and two other promising small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 17.77% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Transcorp Power (NGSE:TRANSPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Transcorp Power Plc is involved in the generation and sale of electric power both within Nigeria and internationally, with a market capitalization of NGN2.48 trillion.

Operations: Transcorp Power generates revenue primarily from its non-regulated utility segment, amounting to NGN277.24 billion.

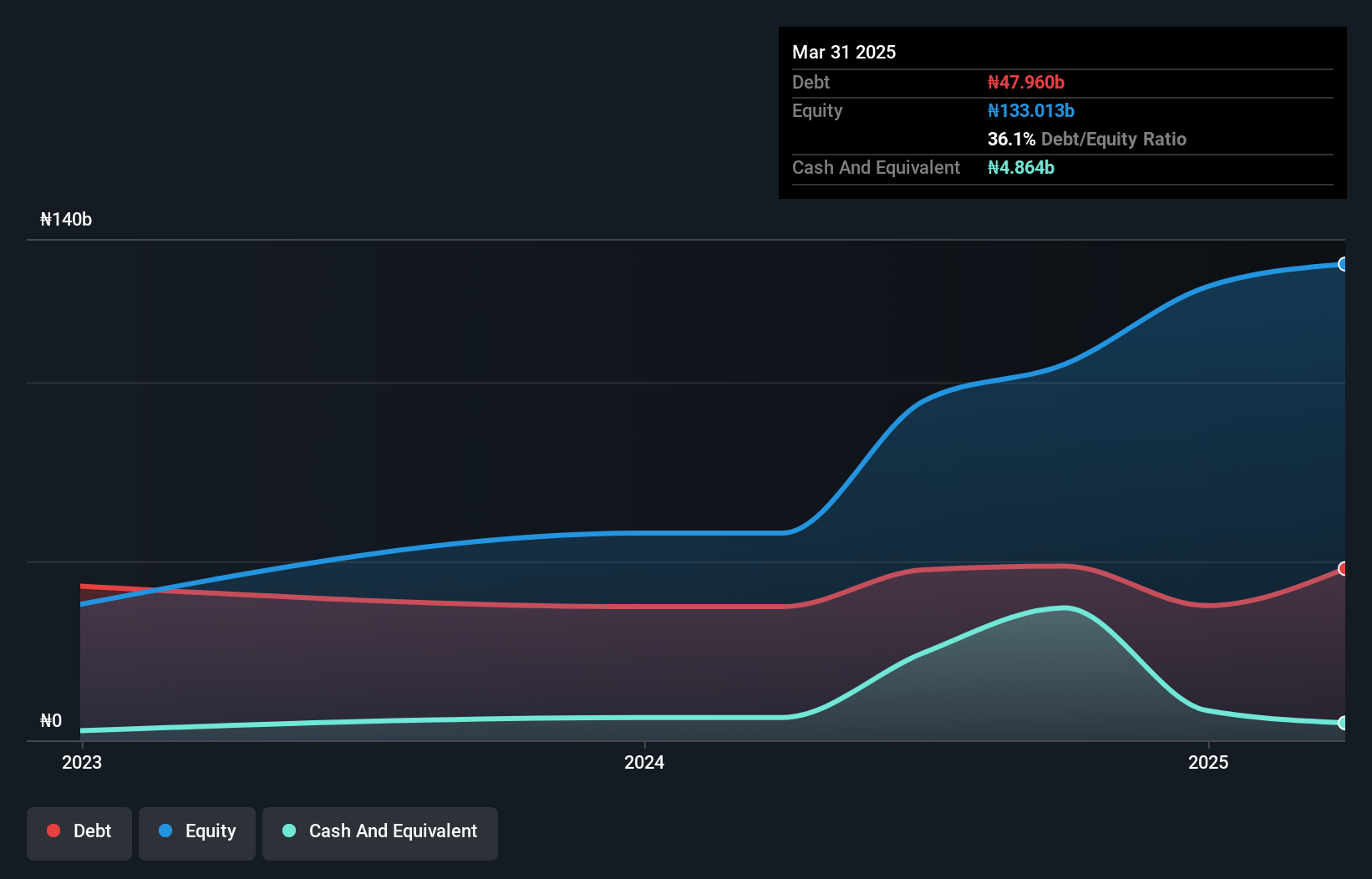

Transcorp Power, a smaller player in the electric utilities sector, has shown impressive growth with earnings surging 152.9% over the past year, outpacing the industry average of 11.9%. Its interest payments are comfortably covered by EBIT at 22.9 times, indicating strong financial health despite having less than three years of financial data available. The net debt to equity ratio stands at a satisfactory 11.1%, reflecting prudent debt management. Recent results highlight robust performance with quarterly sales reaching NGN 88 billion and net income hitting NGN 20 billion, showcasing significant year-over-year improvements in both metrics.

- Click to explore a detailed breakdown of our findings in Transcorp Power's health report.

Review our historical performance report to gain insights into Transcorp Power's's past performance.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector and has a market cap of CN¥11.13 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. generates revenue through its agricultural technology offerings, with a market capitalization of CN¥11.13 billion.

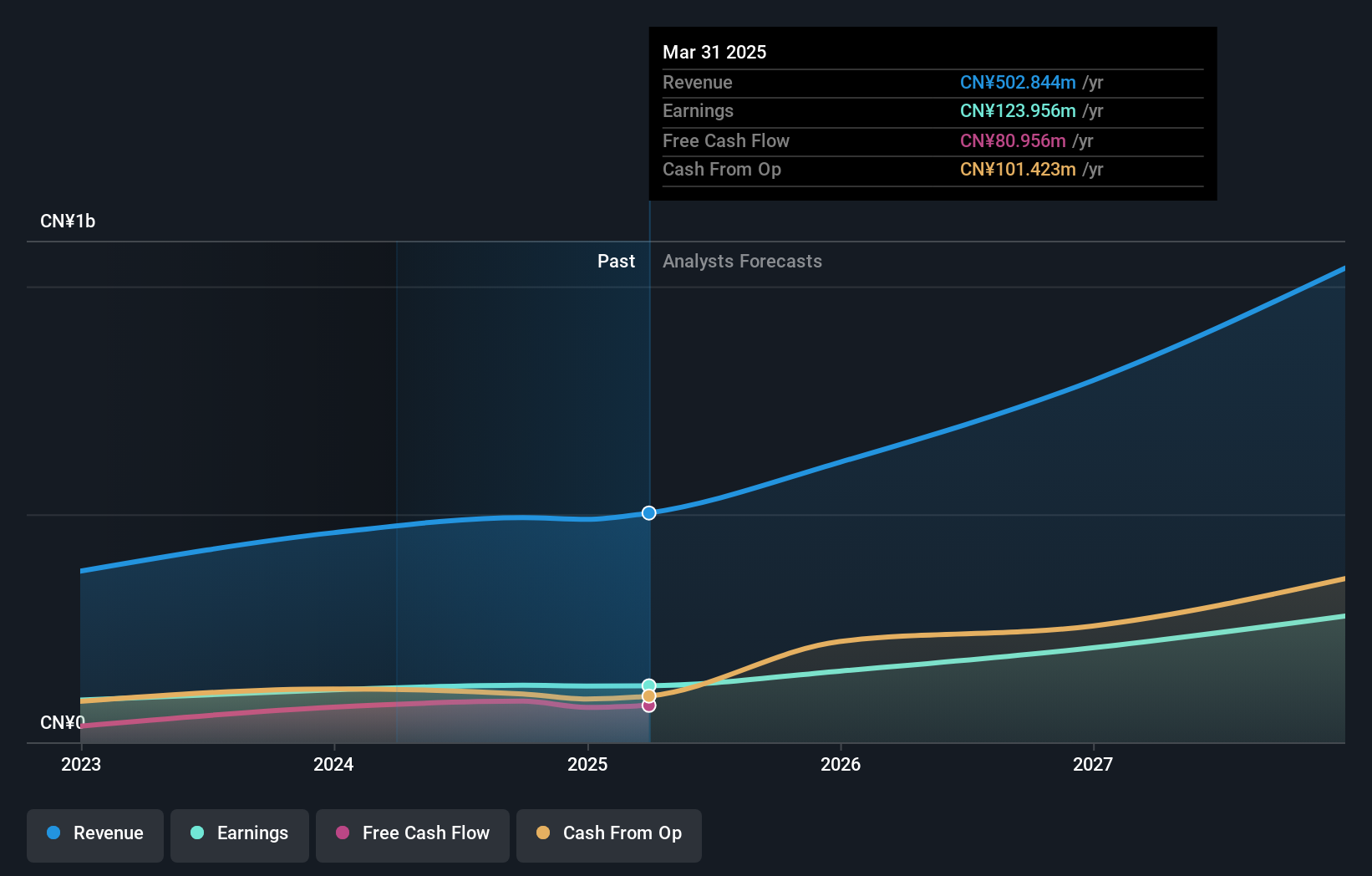

Zhejiang Top Cloud-agri Technology, a relatively small player, has shown robust financial health with earnings growth of 24.1% over the past year, surpassing the electronic industry average of -3.7%. The company's debt to equity ratio improved significantly from 7.1 to 1.7 over five years, indicating better financial management. Recently added to the Shenzhen Stock Exchange Composite and A Share Indexes, it completed an IPO raising CNY 309 million at CNY 14.5 per share. Last year's revenue climbed to CNY 459 million from CNY 375 million, while net income increased to CNY 115 million from CNY 93 million previously.

Taiwan Takisawa Technology (TPEX:6609)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Takisawa Technology Co., Ltd. is engaged in the manufacturing and sale of precision machine tools and printed circuit board drillers both domestically in Taiwan and internationally, with a market capitalization of NT$8.04 billion.

Operations: Taiwan Takisawa Technology generates revenue primarily from Taiwan, contributing NT$1.93 billion, followed by Mainland China at NT$372.27 million and the U.S. at NT$42.99 million.

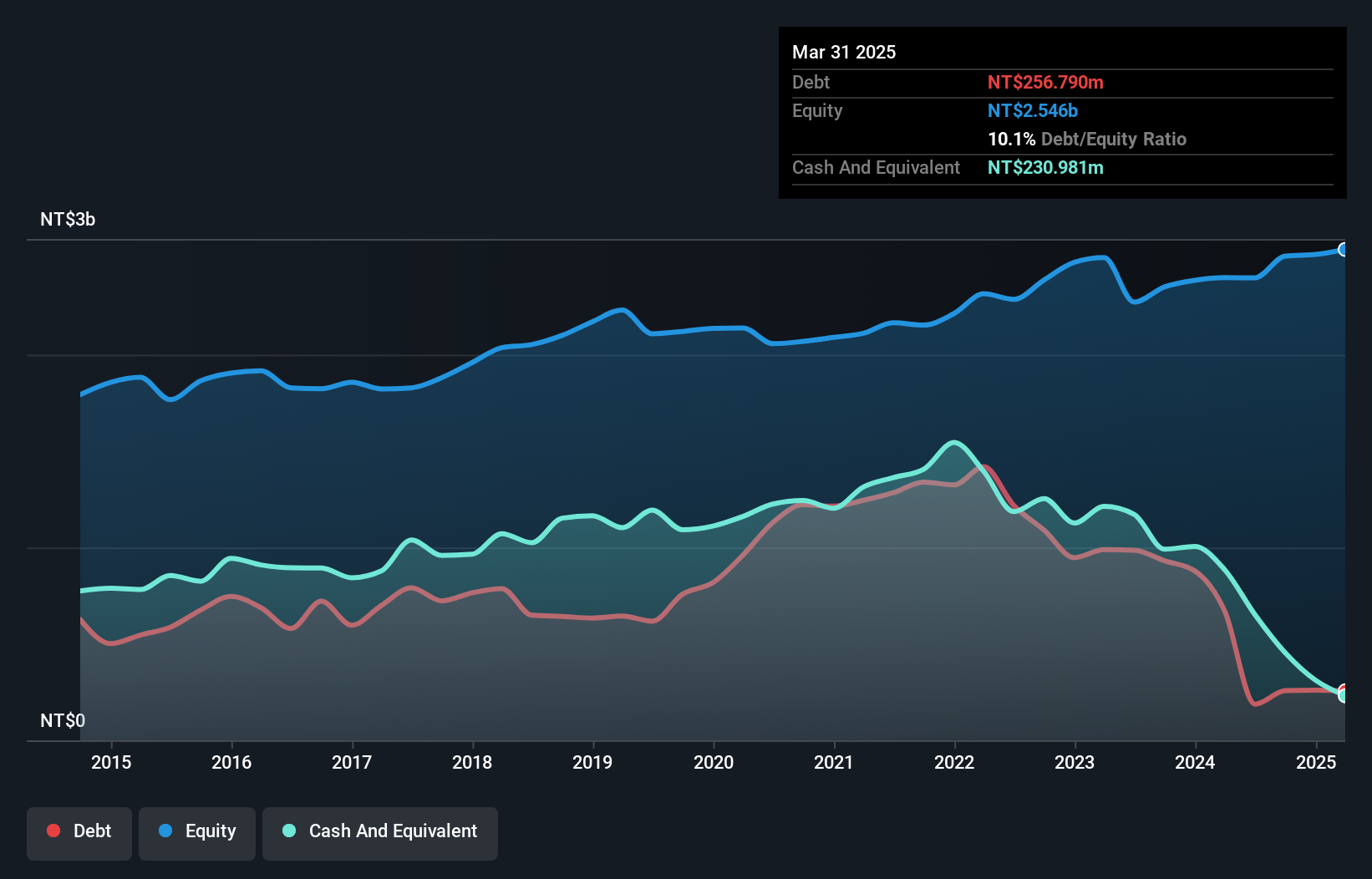

Taiwan Takisawa Technology, a smaller player in the machinery sector, has shown mixed results recently. Despite a 17.5% earnings drop over the past year, its debt situation looks favorable with a reduction from 29.3% to 7.8% in five years and more cash than total debt. The company reported second-quarter sales of TWD 722 million and net income of TWD 61 million, rebounding from last year's slight loss. Changes in leadership have occurred with Lin Zhenzhang's resignation as director due to share transfer rules and adjustments in financial officer roles, potentially impacting future strategic direction.

- Click here to discover the nuances of Taiwan Takisawa Technology with our detailed analytical health report.

Learn about Taiwan Takisawa Technology's historical performance.

Key Takeaways

- Access the full spectrum of 4781 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal