October 2024's Undervalued Small Caps With Insider Buying In None Region

As global markets continue to navigate a complex landscape, U.S. stocks have reached new highs, buoyed by a strong start to earnings season despite some economic headwinds like higher-than-expected inflation and rising jobless claims. In this context, small-cap stocks present unique opportunities for investors looking to capitalize on potential growth at attractive valuations. Identifying promising small-cap companies often involves assessing factors such as insider buying trends and their ability to adapt in shifting economic conditions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 22.5x | 5.7x | 10.41% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 17.56% | ★★★★☆☆ |

| Studsvik | 21.0x | 1.3x | 41.74% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.48% | ★★★★☆☆ |

| HighPeak Energy | 12.0x | 1.5x | 35.57% | ★★★★☆☆ |

| German American Bancorp | 14.8x | 4.9x | 44.14% | ★★★☆☆☆ |

| Robert Walters | 41.5x | 0.2x | 41.89% | ★★★☆☆☆ |

| Citizens & Northern | 13.4x | 3.0x | 40.75% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -57.48% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider, primarily serving the global travel and tourism industry, with a market cap of $2.32 billion.

Operations: Sabre generates revenue primarily from its Travel Solutions and Hospitality Solutions segments, with the former contributing significantly more. The company has experienced fluctuations in its gross profit margin, which reached 59.47% as of June 30, 2024. Operating expenses include significant allocations to research and development, reflecting ongoing investment in technology and innovation.

PE: -3.1x

Sabre, a player in the travel technology sector, is gaining traction through strategic partnerships and innovative solutions like SabreMosaic. Recent collaborations with Riyadh Air and Arajet highlight its commitment to advancing airline retailing technology. Despite financial challenges, such as a net loss of US$69.76 million in Q2 2024, insider confidence remains strong with share purchases reported recently. The addition of Eric L. Kelly to the board brings valuable expertise in cybersecurity and strategic transformations, potentially aiding future growth amidst industry shifts.

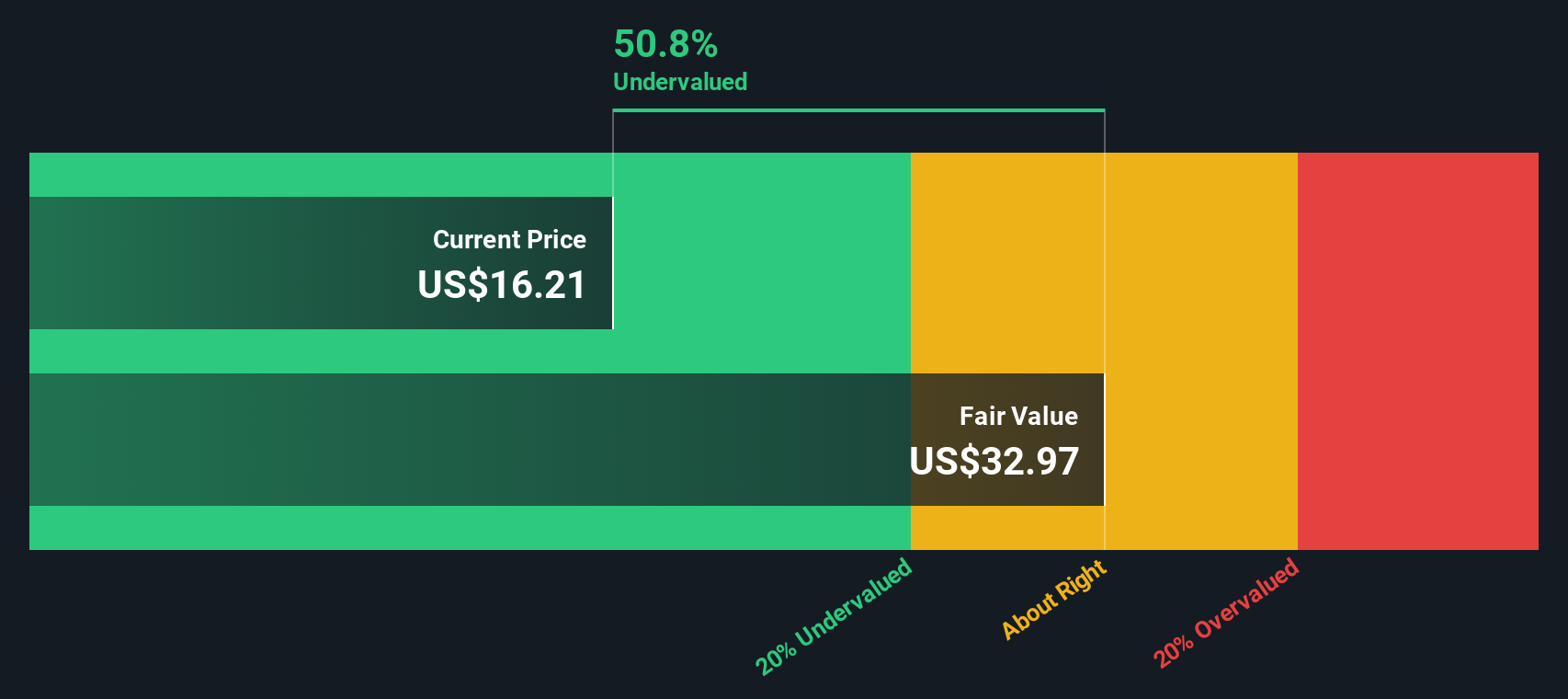

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Value Rating: ★★★★★☆

Overview: First Commonwealth Financial is a financial services company primarily engaged in banking operations, with a market cap of approximately $1.24 billion.

Operations: The primary revenue stream is derived from banking operations, with a recent revenue of $462.65 million. Operating expenses have consistently been a significant portion of the cost structure, with general and administrative expenses reaching $202.82 million in the latest period. The net income margin has shown variability over time, most recently recorded at 34.30%.

PE: 11.4x

First Commonwealth Financial, a smaller player in the financial sector, has shown resilience despite recent executive changes and earnings pressures. Insider confidence is evident with share repurchases totaling 2.57% since October 2021. The company reported net income of US$37 million for Q2 2024, down from US$42.78 million a year ago, yet maintained a dividend increase of 4%. While earnings are projected to decline slightly over the next three years, strategic leadership appointments and community involvement highlight its commitment to growth and stability.

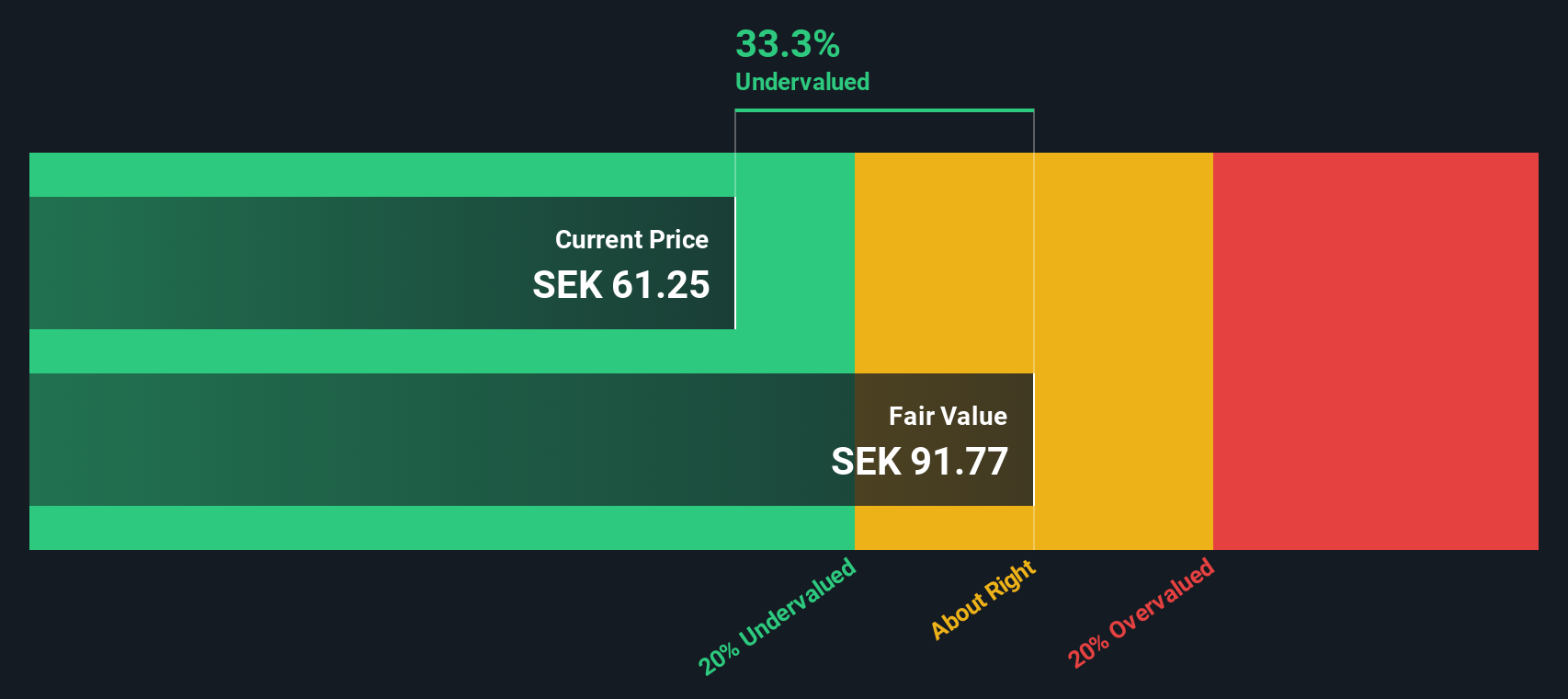

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company that specializes in caller identification and spam blocking services, with a market capitalization of approximately SEK 17.18 billion.

Operations: Truecaller generates revenue primarily from its communications software, with recent figures showing SEK 1.72 billion. The company's gross profit margin has shown an upward trend, reaching 77.75% by June 2022 before slightly adjusting to around 75.64% by October 2024. Operating expenses are a significant cost factor, including general and administrative expenses which were SEK 646.91 million in October 2024.

PE: 32.4x

Truecaller, a prominent player in the communication verification industry, is capturing attention as an undervalued stock. The company recently appointed Seema Jindal to strengthen its regulatory framework in India. This strategic move aligns with its partnership with Halan, enhancing call verification services. Despite a dip in earnings for Q2 2024 to SEK 457.87 million from last year's SEK 519.07 million, insider confidence remains high with share repurchases initiated on July 19, 2024, highlighting potential growth prospects amidst current challenges.

- Take a closer look at Truecaller's potential here in our valuation report.

Evaluate Truecaller's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 191 more companies for you to explore.Click here to unveil our expertly curated list of 194 Undervalued Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal