Discover October 2024's Stocks Estimated To Be Trading Below Fair Value

As global markets navigate a complex landscape marked by record highs in U.S. indices and mixed economic signals from Europe and China, investors are keenly observing the implications of modestly higher inflation and shifting interest rate expectations. Amidst this dynamic environment, identifying stocks that may be trading below their fair value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.657 | £1.31 | 49.8% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK87.50 | SEK174.61 | 49.9% |

| On the Beach Group (LSE:OTB) | £1.536 | £3.06 | 49.8% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7470.00 | ₩14880.44 | 49.8% |

| Icon Offshore Berhad (KLSE:ICON) | MYR1.11 | MYR2.21 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$60.74 | US$120.88 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | US$88.00 | US$175.93 | 50% |

| Loungers (AIM:LGRS) | £2.67 | £5.34 | 50% |

| Xplora Technologies (OB:XPLRA) | NOK25.10 | NOK50.13 | 49.9% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 50% |

Let's review some notable picks from our screened stocks.

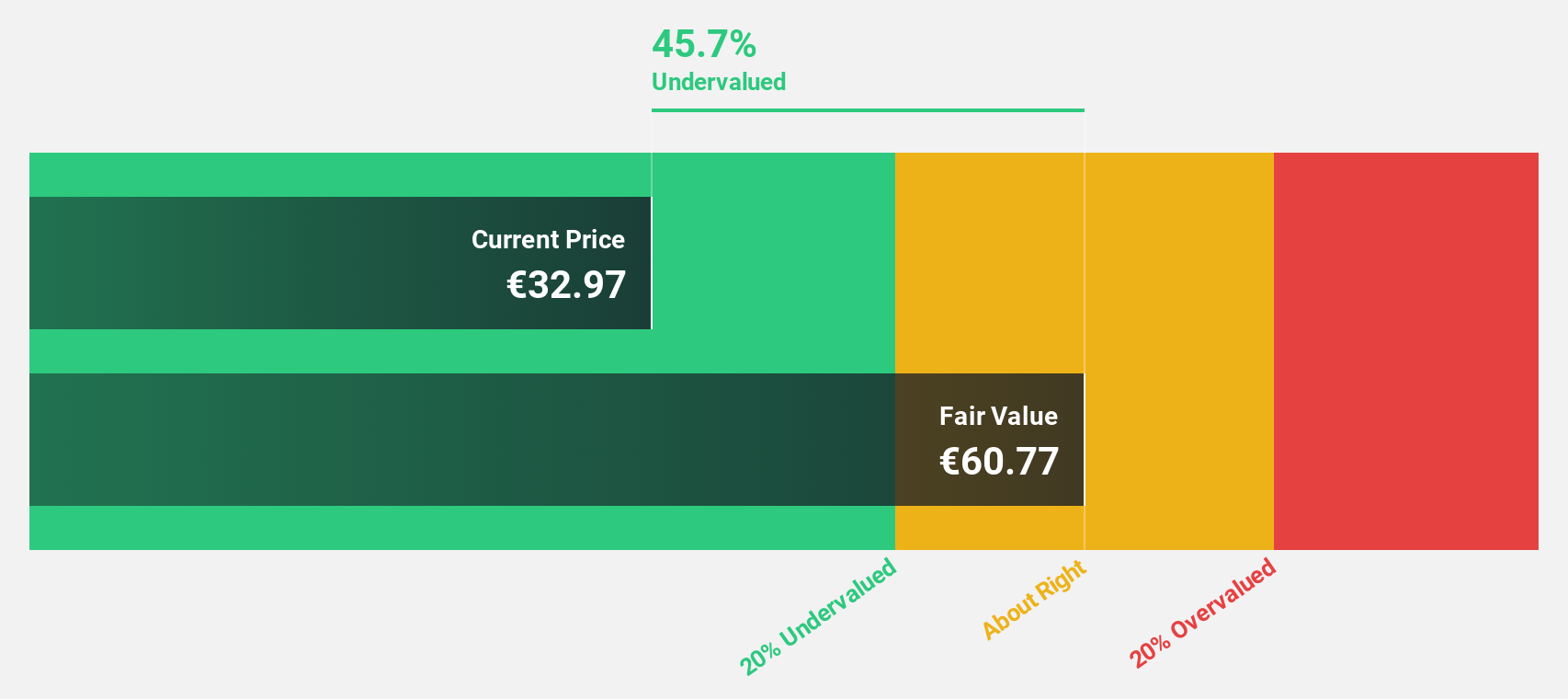

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates wireless telecommunication infrastructure across several European countries, including Austria, Spain, and the United Kingdom, with a market cap of €25.63 billion.

Operations: Cellnex Telecom generates its revenue from operating wireless telecommunication infrastructure across multiple European nations, including Austria, Denmark, and Spain.

Estimated Discount To Fair Value: 45.1%

Cellnex Telecom is trading significantly below its estimated fair value of €66.19, with a current price of €36.33. Despite reporting a net loss of €418.09 million for the first half of 2024, Cellnex is expected to achieve profitability within three years, with earnings forecasted to grow substantially at 83.8% annually. However, the company's return on equity is projected to remain low at 0.9%. Recent M&A discussions have stalled, impacting strategic cost management efforts.

- Our earnings growth report unveils the potential for significant increases in Cellnex Telecom's future results.

- Click here to discover the nuances of Cellnex Telecom with our detailed financial health report.

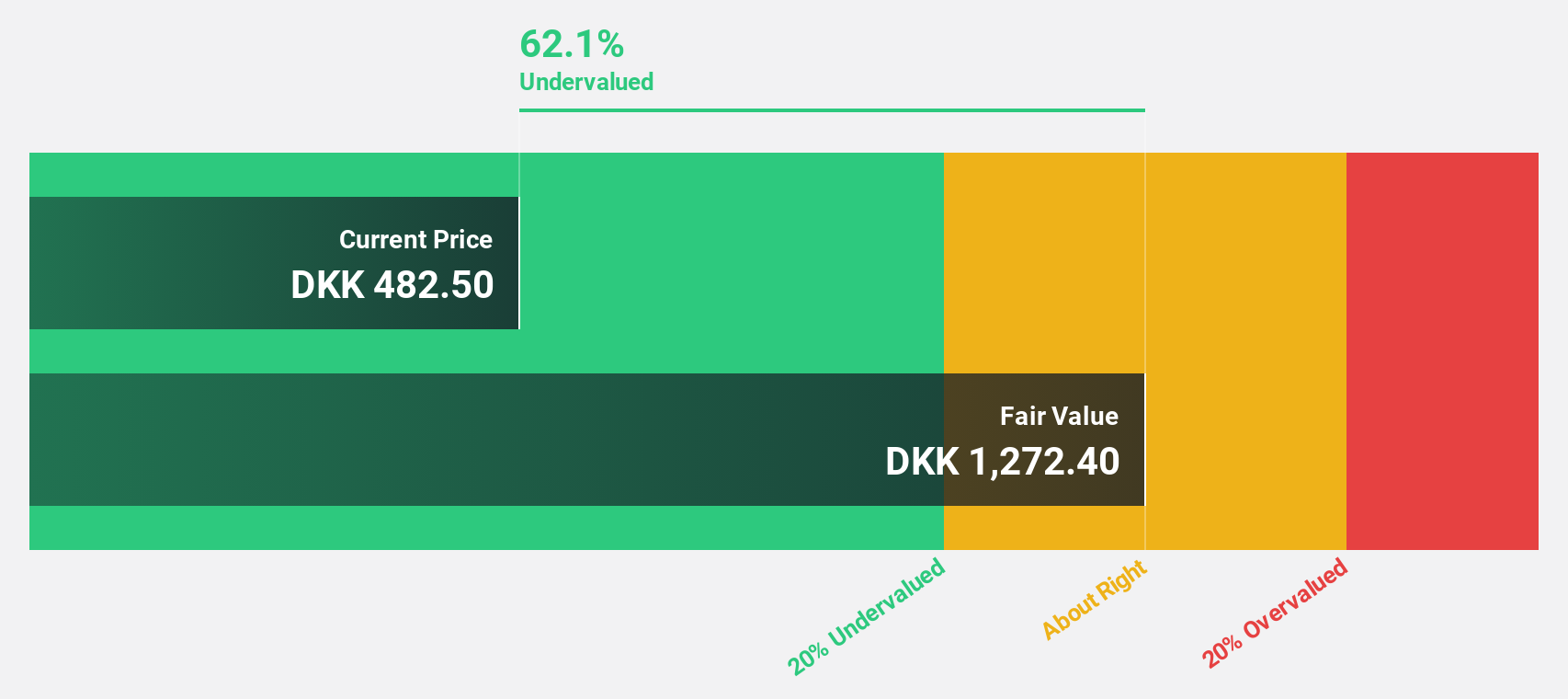

Novo Nordisk (CPSE:NOVO B)

Overview: Novo Nordisk A/S is a global pharmaceutical company involved in the research, development, manufacture, and distribution of pharmaceutical products across Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally with a market cap of DKK3.62 trillion.

Operations: The company's revenue is primarily derived from its Diabetes and Obesity Care segment, which accounts for DKK241.17 billion, followed by the Rare Disease segment with DKK16.83 billion.

Estimated Discount To Fair Value: 26.9%

Novo Nordisk is currently trading at DKK816.6, significantly below its estimated fair value of DKK1116.85, representing a 26.9% discount. Despite recent significant insider selling, the company demonstrates high-quality earnings and robust cash flow generation, with earnings having grown by 33.7% over the past year. Although forecasted annual profit growth of 14.4% isn't substantial, it surpasses Danish market expectations and aligns with Novo Nordisk's strategic focus on innovative therapies and partnerships in genetic medicine development.

- Our growth report here indicates Novo Nordisk may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Novo Nordisk stock in this financial health report.

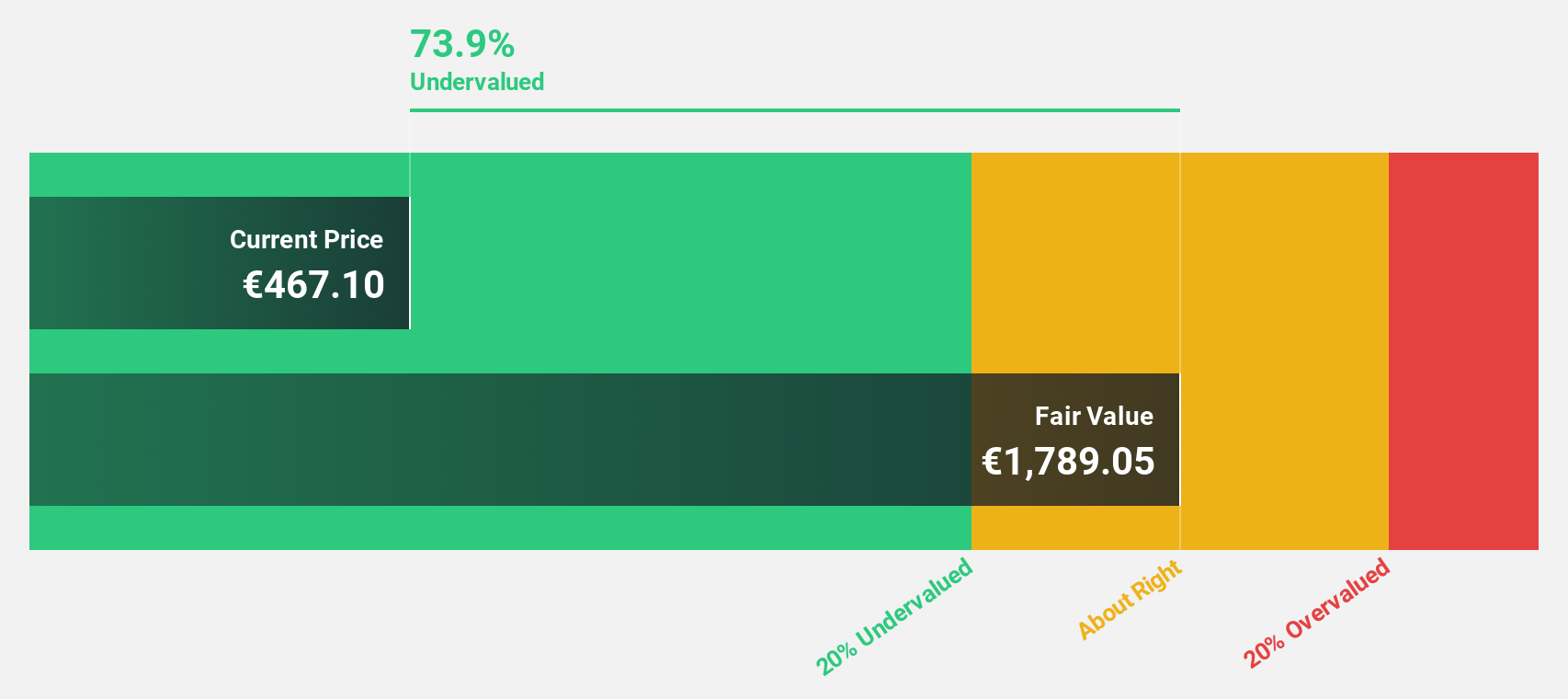

argenx (ENXTBR:ARGX)

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China with a market cap of €30.07 billion.

Operations: Revenue for argenx SE primarily comes from its biotechnology segment, totaling $1.66 billion.

Estimated Discount To Fair Value: 42.5%

Argenx is trading at €502.8, well below its estimated fair value of €875.05, indicating a significant undervaluation based on cash flows. Despite recent insider selling and shareholder dilution, the company shows potential with a forecasted annual earnings growth of 59.24%. Argenx's revenue growth rate of 25.9% annually surpasses the Belgian market average, supported by strong clinical trial results for VYVGART Hytrulo and recent FDA approval for treating CIDP and gMG in adults.

- Our expertly prepared growth report on argenx implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of argenx.

Turning Ideas Into Actions

- Reveal the 964 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal