The Federal Reserve's new indicators are green: QT can still advance!

A new indicator released by the New York Federal Reserve on Thursday shows that the Federal Reserve is not facing imminent market liquidity challenges and is therefore unable to stop the continued contraction of its balance sheet.

This new indicator is called “Reserve Demand Elasticity” (Reserve Demand Elasticity, RDE for short) by the New York Federal Reserve and aims to measure how liquid bank reserves are. The Federal Reserve said it would help Fed officials better manage the uncertain process of reducing bond holdings, called quantitative austerity (QT).

The purpose of creating the new indicator is to make it an early warning indicator of a shortage of bank reserves. The New York Federal Reserve said in a blog post that the indicator will help find a transition point from an adequate level of liquidity to an “adequate” level. The level of “adequate” reserves that policymakers refer to is often difficult to determine.

With data available as of October 11, the indicator indicates “reserves are still sufficient. The latest RDE estimate is close to zero, which means the federal funds rate will not respond significantly to changes in reserve supply. For reference, negative RDE readings will indicate tightening liquidity.

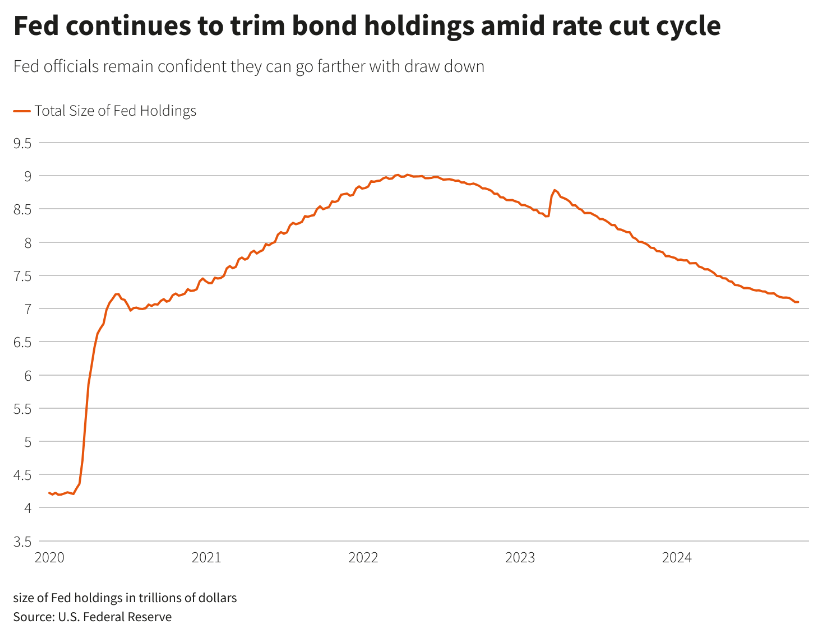

The Federal Reserve's QT process has continued for more than two years, shrinking its total balance sheet from a peak of $9 trillion to the current level of $7.1 trillion. Following the COVID-19 pandemic, the Federal Reserve is seeking to withdraw unnecessary liquidity as part of the normalization of monetary policy.

The Federal Reserve wants to ensure sufficient liquidity in the financial system so that it can firmly control the federal funds rate. The latter is the Federal Reserve's main monetary policy tool to influence the economy. The challenge facing officials, however, is that it is currently unclear when liquidity will become too scarce, causing turbulence in interest rates in the money market.

Earlier this year, the Federal Reserve slowed the pace of QT to make it easier to identify any impending liquidity challenges before they become apparent. This is because officials were afraid of the turmoil caused by the last QT, when there was an unexpected shortage of liquidity in September 2019, which forced the Federal Reserve to intervene to increase liquidity in the market.

Federal Reserve officials said they expect the QT program to continue for some time. Prior to the Federal Reserve's September policy meeting, market participants expected this process to stop in the spring.

At the end of September, before entering the fourth quarter, the currency market was volatile enough to make some market participants speculate that the Federal Reserve might need to end QT early. However, St. Louis Federal Reserve Chairman Mussalem pointed out in his comments on October 7 that the federal funds rate “has been well controlled” for some time, implying that recent fluctuations will not affect QT prospects.

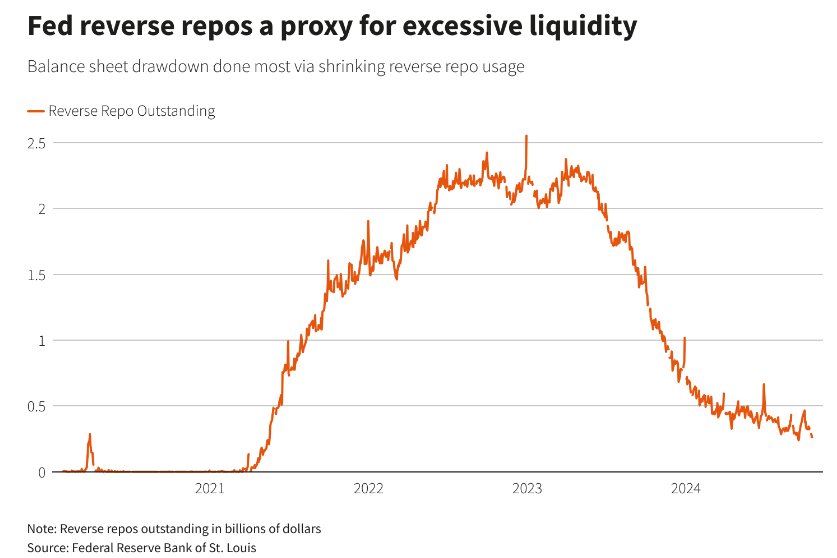

Until now, the Federal Reserve's QT process has mainly been to remove cash from reverse repurchase instruments. Since this year, the use of the Federal Reserve's reverse repurchase tool has declined drastically.

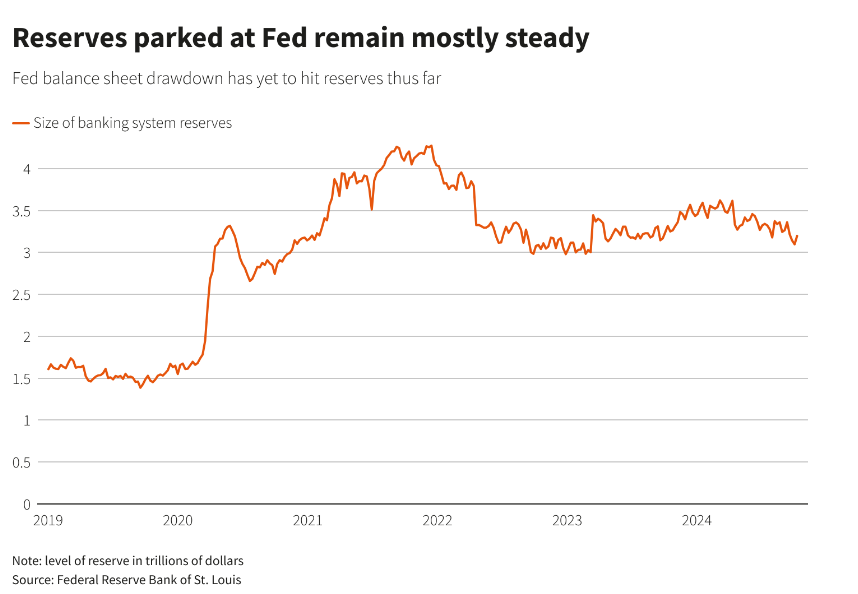

Meanwhile, the level of banks' collective reserves remained almost unchanged over a long period of time. Most observers believe the Federal Reserve will be able to continue implementing QT until they begin to decline.

In a blog post, the New York Federal Reserve pointed out that RDE was negative long before the September 2019 trouble, which indicates that the new indicator can help officials understand well in advance when there may be a shortage of reserves, thereby challenging their control over federal funds interest rates.

Prior to the publication of the above article by the New York Federal Reserve, analysts at investment bank Barclays said, “We expect bank reserves to remain slightly above the 'sufficient' threshold at the end of the year.” They continue to expect the Federal Reserve's QT to end this year, ahead of many other traders' and investors' expectations.

The New York Federal Reserve said it will update RDE readings on the 3rd Thursday of each month at 10 a.m. EST, with the exception of the date of the Federal Open Market Committee (FOMC) meeting.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal