Despite the downward trend in earnings at Elbit Systems (TLV:ESLT) the stock climbs 3.7%, bringing three-year gains to 76%

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, the Elbit Systems Ltd. (TLV:ESLT) share price is up 71% in the last three years, clearly besting the market decline of around 5.4% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 3.3%, including dividends.

Since the stock has added ₪1.3b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Elbit Systems

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, Elbit Systems failed to grow earnings per share, which fell 2.3% (annualized).

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

Languishing at just 0.9%, we doubt the dividend is doing much to prop up the share price. It could be that the revenue growth of 6.8% per year is viewed as evidence that Elbit Systems is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

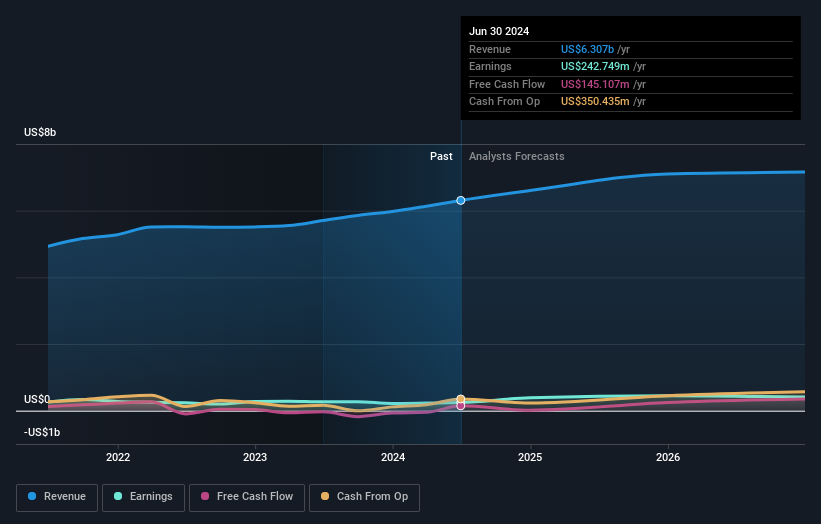

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Elbit Systems' TSR for the last 3 years was 76%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Elbit Systems provided a TSR of 3.3% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 8% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before forming an opinion on Elbit Systems you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal