3 TSX Stocks Estimated To Be Undervalued In October 2024

The Canadian market has shown impressive growth, with a 1.6% increase over the past week and a remarkable 25% rise over the last year, while earnings are anticipated to grow by 16% annually in the coming years. In such a thriving environment, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$189.76 | CA$359.17 | 47.2% |

| Computer Modelling Group (TSX:CMG) | CA$12.07 | CA$21.90 | 44.9% |

| Tourmaline Oil (TSX:TOU) | CA$62.49 | CA$120.11 | 48% |

| VersaBank (TSX:VBNK) | CA$21.12 | CA$41.35 | 48.9% |

| Trisura Group (TSX:TSU) | CA$45.21 | CA$87.82 | 48.5% |

| Kinaxis (TSX:KXS) | CA$156.82 | CA$284.63 | 44.9% |

| Endeavour Mining (TSX:EDV) | CA$32.84 | CA$55.71 | 41.1% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.11 | CA$13.90 | 41.7% |

| Blackline Safety (TSX:BLN) | CA$6.18 | CA$10.98 | 43.7% |

Let's dive into some prime choices out of the screener.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.45 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $9.27 billion.

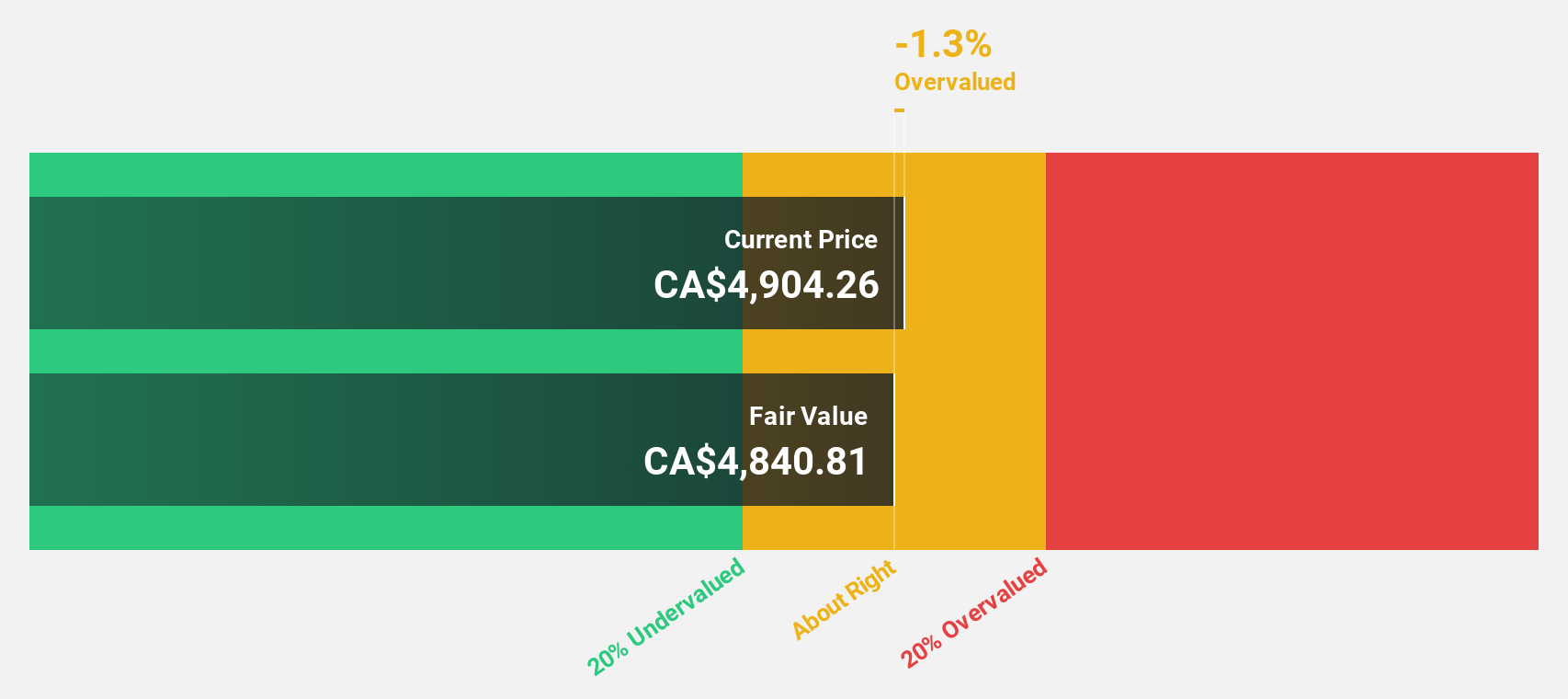

Estimated Discount To Fair Value: 20.7%

Constellation Software, trading at CA$4,431.07, is undervalued by over 20% based on discounted cash flow analysis with a fair value estimate of CA$5,588.15. Despite significant insider selling recently and high debt levels, its earnings grew 33.5% last year and are expected to continue growing significantly at 23.6% annually over the next three years, outpacing the Canadian market's growth rate of 14.7%.

- In light of our recent growth report, it seems possible that Constellation Software's financial performance will exceed current levels.

- Get an in-depth perspective on Constellation Software's balance sheet by reading our health report here.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$26.14 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through its mining, development, and exploration activities focused on minerals and precious metals in Africa.

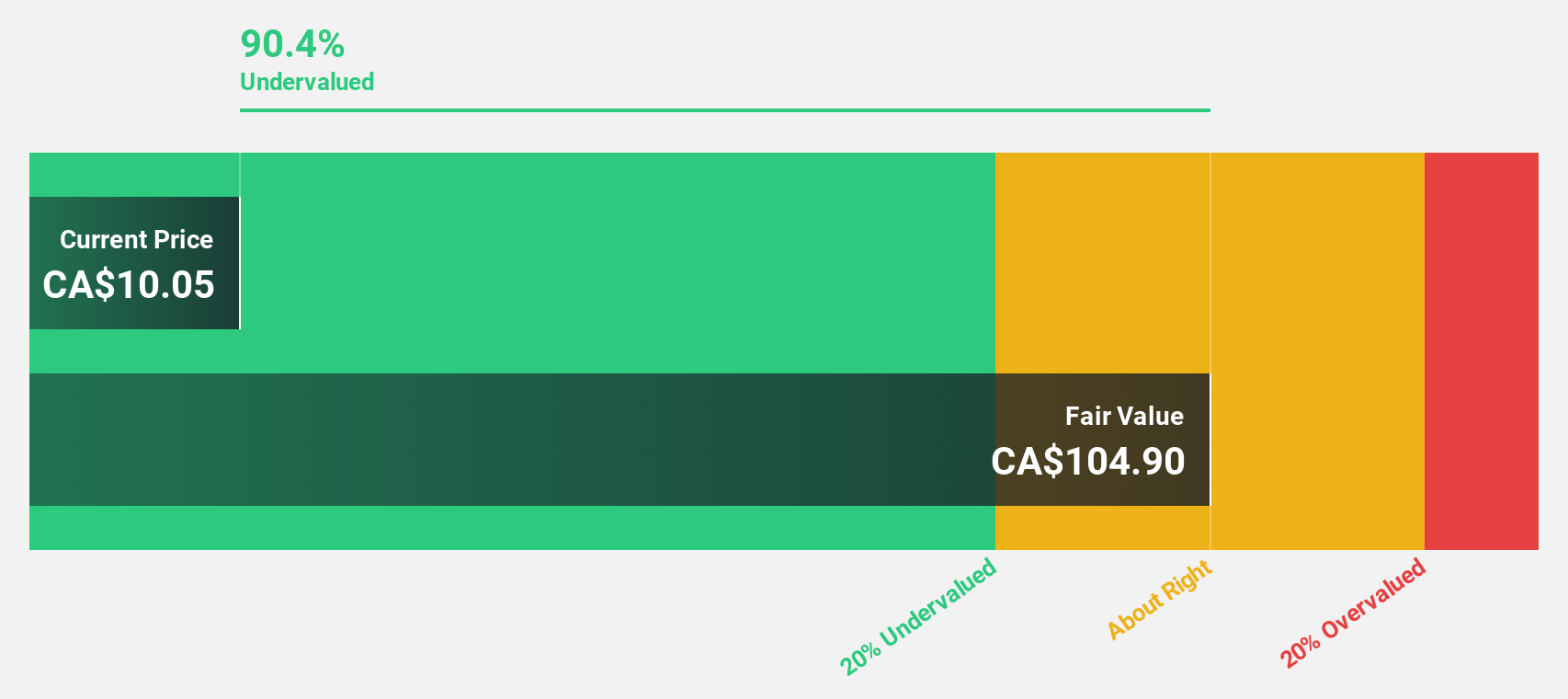

Estimated Discount To Fair Value: 20.2%

Ivanhoe Mines, trading at CA$19.22, is significantly undervalued by over 20% based on discounted cash flow analysis with a fair value estimate of CA$24.08. Despite recent production guidance revisions for its Kamoa-Kakula and Kipushi projects, the company's revenue is forecast to grow at an impressive 86.7% annually, far exceeding the Canadian market's growth rate of 7.1%. Earnings are also expected to expand substantially by 69.5% per year over the next three years.

- The analysis detailed in our Ivanhoe Mines growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Ivanhoe Mines.

Lundin Gold (TSX:LUG)

Overview: Lundin Gold Inc. is a Canadian mining company with a market capitalization of CA$7.88 billion, focusing on the exploration and development of gold properties.

Operations: The company's revenue is primarily derived from its Fruta Del Norte segment, which generated $930.03 million.

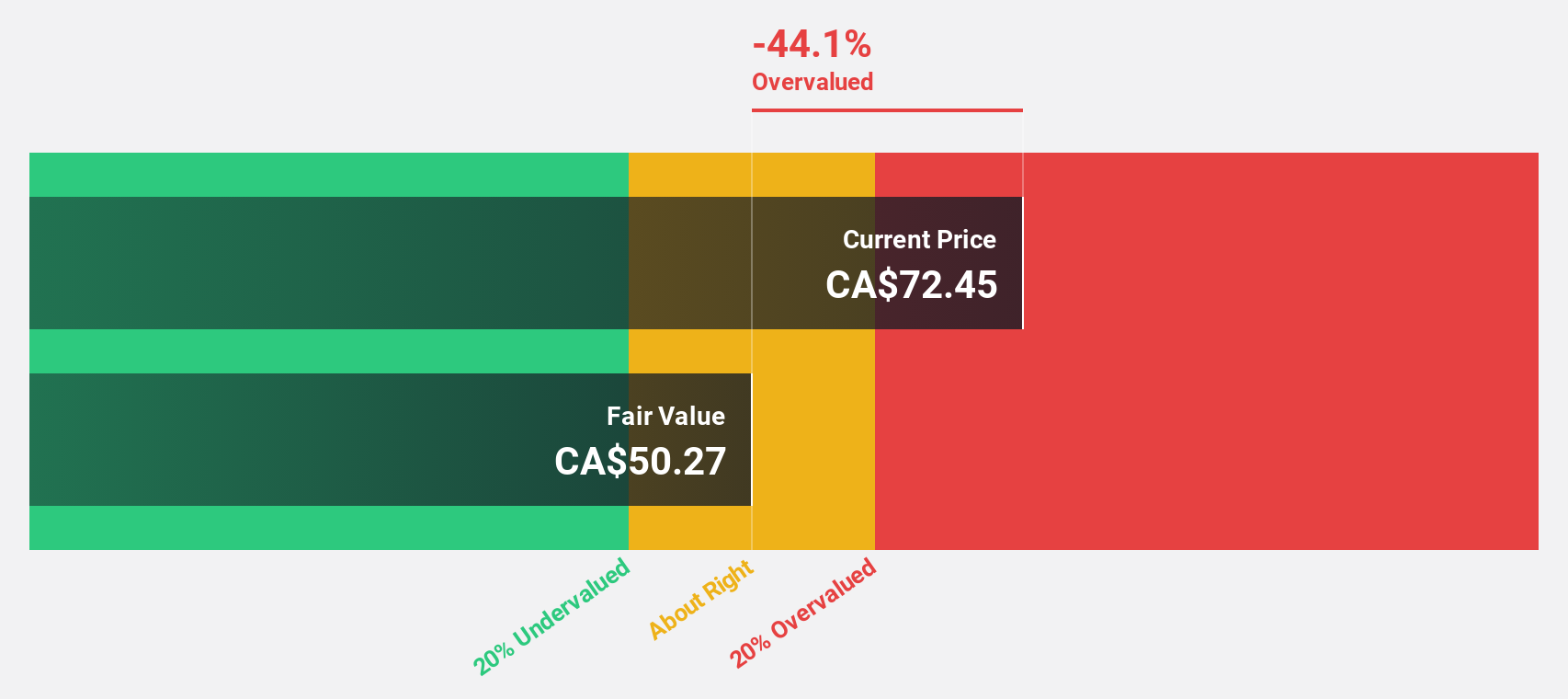

Estimated Discount To Fair Value: 16.6%

Lundin Gold, trading at CA$33.16, is undervalued by 16.6% based on discounted cash flow analysis with a fair value estimate of CA$39.74. The company reported strong Q2 earnings with net income of US$119.29 million, up from US$63.15 million a year ago, and increased its dividend to US$0.20 per share. Earnings are forecast to grow significantly at 24% annually over the next three years, outpacing the Canadian market's growth rate of 14.7%.

- Insights from our recent growth report point to a promising forecast for Lundin Gold's business outlook.

- Take a closer look at Lundin Gold's balance sheet health here in our report.

Seize The Opportunity

- Gain an insight into the universe of 28 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal