Internal and external clash! Will EUR/USD fall to parity again?

This week, the risk of the euro falling to parity against the US dollar is increasing as the ECB cuts interest rates again and the probability of Trump winning the US election soared, raising concerns about a global trade war.

Just a few days after Trump hinted that US tariffs might target Europe and other countries, ECB President Lagarde warned that any trade barriers would pose a “downside risk” to the EU's struggling economy. On Thursday, the ECB began continuous interest rate cuts, triggering the market to bet on more aggressive interest rate cuts in the future.

This combination caused the euro to plummet. EUR/USD fell for the third week in a row. EUR/GBP is likely to record the biggest weekly decline since this year.

Michael Hart (Michael Hart), a senior monetary strategist at Pictet Wealth Management (Pictet Wealth Management) in Switzerland, said: “If Trump wins and goes all out to levy tariffs, it is definitely possible for the euro to fall to parity against the US dollar.”

Patek and Deutsche Bank no longer believe that the parity between the euro and the US dollar is out of reach, while J.P. Morgan Private Bank (J.P. Morgan Private Bank) and ING Groep NV (ING Groep NV) believe that the euro may fall to parity levels against the US dollar before the end of the year.

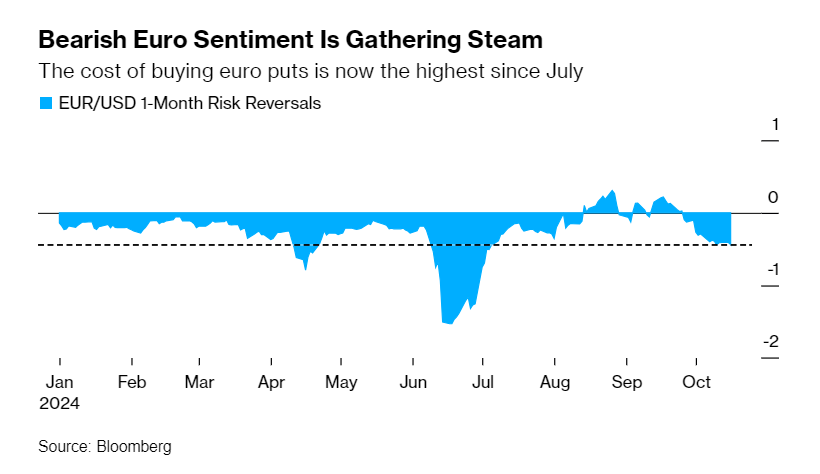

This nervousness is evident in the options market, where traders are increasing their bearish bets on the euro.

The indicator measuring the risk reversal of EURUSD over the next month now shows that investors are bearish on the euro to the highest level in 3 months.

According to data from deposit trusts and clearing companies, hedging against the weakening of EUR/USD in the short term is concentrated in the 1.08-1.07 area, and interest in downside protection of EUR/USD falling to 1.05 is also rising, while hedging against the currency falling to parity accounts for only a small portion of the total trading volume.

Wells Fargo strategist Aroop Chatterjee (Aroop Chatterjee) said, “Given Europe's sensitivity to changes in foreign policy and the prospect of widespread tariffs during Trump's administration, we tend to increase the dollar against the euro.”

In addition to the euro, the Mexican peso and yen are generally seen as the main victims of new US trade restrictions, but the European economic downturn has made the euro vulnerable. At a time when economic growth is slowing and central banks are cutting interest rates, US tariffs may curb global trade.

According to Bloomberg strategists, “Expectations of aggressive monetary policy easing by the ECB, along with other adverse factors, may drive statements about the return of the euro to parity against the US dollar in 2025 — the market seems to have largely underestimated this situation.”

The money market suggests that the possibility that the ECB will cut interest rates by 50 basis points at the last meeting of this year is 20%, and the possibility of cutting interest rates by 25 basis points at every meeting until April next year is almost fully priced. EUR/USD will continue to decline for three weeks, which will be the longest continuous decline since June.

Kaspar Hense (Kaspar Hense), senior portfolio manager at Royal Bank of Canada BlueBay Asset Management, said: “As the US election and tariff war looms, this may force the ECB to take further action to keep the euro weak and remain competitive.”

In an interview with Bloomberg earlier this week, Trump described tariffs as “the most beautiful word in the dictionary.” He specifically mentioned Europe and added, “Do you know who is ruthless? The European Union. They treated us so badly that we had a deficit.”

Although the election results are yet to be announced, George Saravelos (George Saravelos), the global head of foreign exchange research at Deutsche Bank, said that a potential global trade war would prompt the ECB to cut interest rates more aggressively than the market's current pricing.

“This will bring spreads to historic extremes, with EUR/USD falling to around 1,” he wrote earlier this month.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal