Exploring 3 Undervalued Small Caps In United States With Insider Buying

Over the last 7 days, the United States market has risen by 1.1%, contributing to a substantial 36% climb over the past year, with earnings anticipated to grow by 15% annually. In this context of robust market performance, identifying stocks that are potentially undervalued and exhibit insider buying can be an intriguing strategy for investors seeking opportunities in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.5x | 2.2x | 48.50% | ★★★★★☆ |

| Franklin Financial Services | 9.7x | 1.9x | 37.58% | ★★★★☆☆ |

| HighPeak Energy | 12.0x | 1.5x | 35.57% | ★★★★☆☆ |

| German American Bancorp | 14.8x | 4.9x | 44.14% | ★★★☆☆☆ |

| Citizens & Northern | 13.4x | 3.0x | 40.75% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -107.12% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -44.70% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -57.48% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.6x | -210.10% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

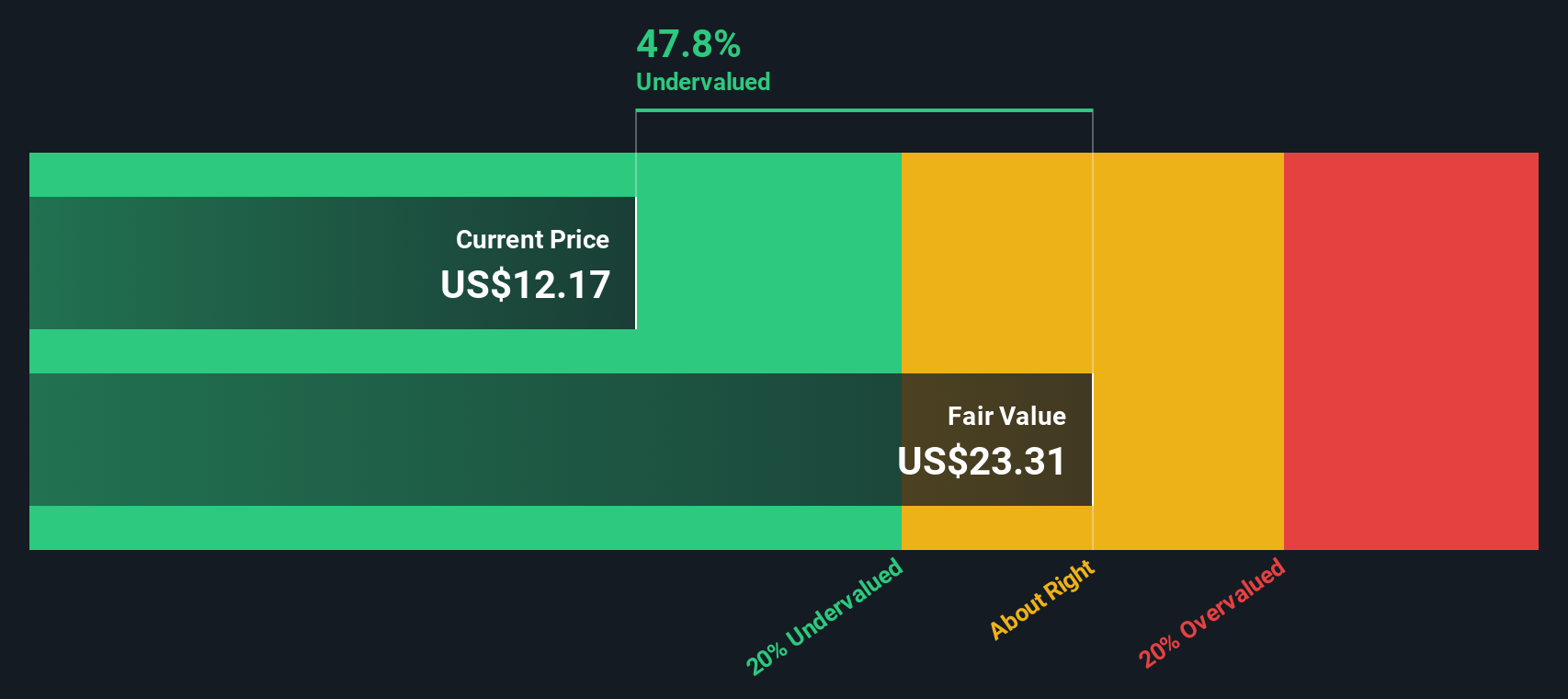

Northwest Bancshares (NasdaqGS:NWBI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Northwest Bancshares operates primarily in community banking, with a market cap of approximately $1.24 billion.

Operations: The company generates revenue primarily from community banking, with recent figures at $491.91 million. Operating expenses are significant, totaling $341.42 million for the latest period, with general and administrative expenses being a major component at $325.59 million. The net income margin has shown variability over time, recorded at 20.72% in the most recent quarter analyzed.

PE: 17.3x

Northwest Bancshares, a smaller U.S. company, is gaining attention for its potential growth, with earnings projected to rise 16.82% annually. Despite a challenging second quarter where net income dropped to US$4.75 million from US$33.04 million the previous year, insider confidence remains strong due to consistent dividend payments of US$0.20 per share in August 2024. While no shares were repurchased recently, the company's strategic focus suggests promising future prospects within its industry context.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology solutions provider that primarily serves the global travel and tourism industry, with a market cap of approximately $2.90 billion.

Operations: Sabre's revenue primarily stems from its Travel Solutions and Hospitality Solutions segments, with recent figures indicating $2.70 billion and $315.74 million, respectively. The company's gross profit margin has shown variability over time, reaching 59.47% in the most recent period. Operating expenses have been a significant component of its cost structure, consistently impacting net income margins negatively in recent periods.

PE: -3.1x

Sabre, a tech-driven company in the travel industry, has captured attention with its strategic partnerships and innovative solutions. Recently, Riyadh Air's adoption of SabreMosaic™ technology highlights Sabre's cutting-edge AI capabilities. The firm also secured key distribution agreements with Arajet and Play airlines, enhancing its global reach. Despite facing financial challenges with a net loss of US$69.76 million in Q2 2024, insider confidence is evident through recent share purchases by executives earlier this year. This mix of strategic moves and insider activity suggests potential for future growth amidst current undervaluation concerns.

- Take a closer look at Sabre's potential here in our valuation report.

Review our historical performance report to gain insights into Sabre's's past performance.

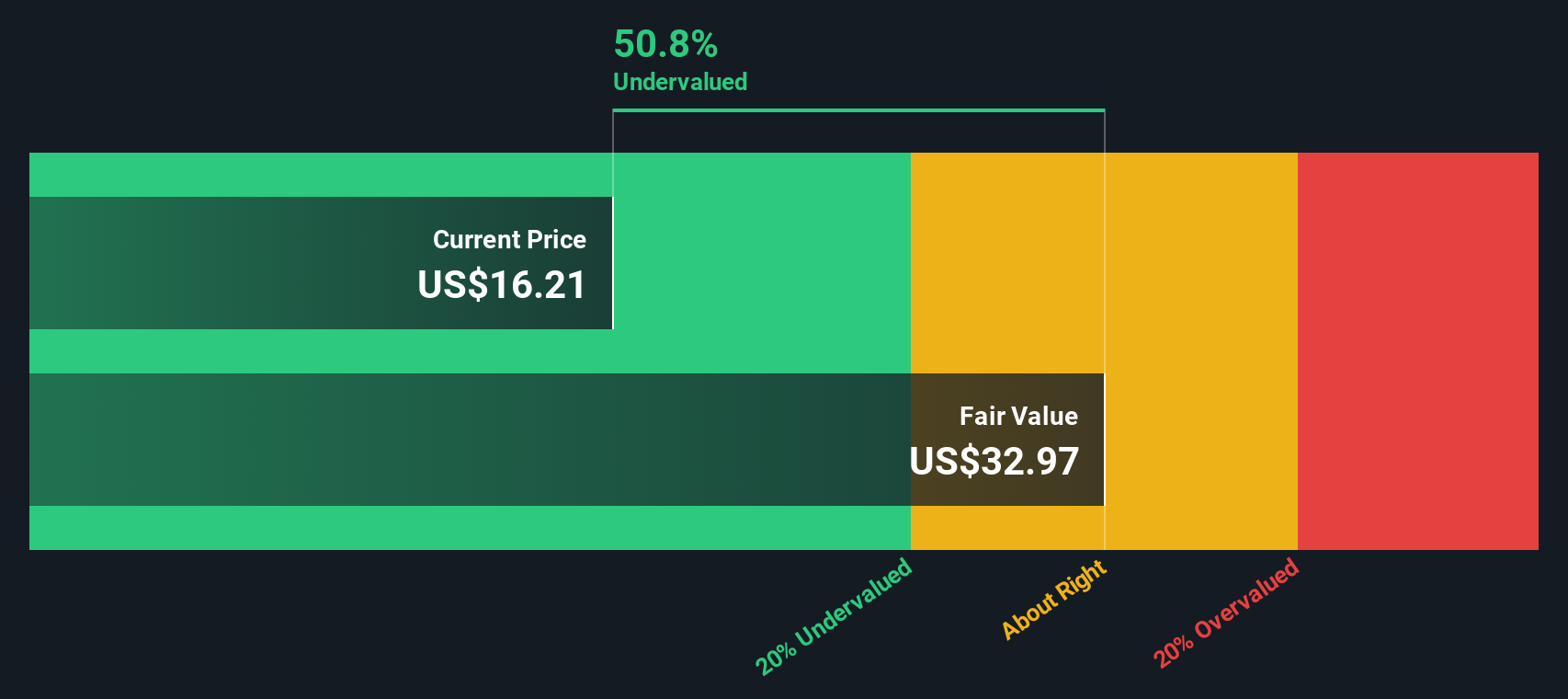

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Value Rating: ★★★★★☆

Overview: First Commonwealth Financial operates as a financial services company primarily engaged in providing banking services, with a market capitalization of $1.44 billion.

Operations: The primary revenue stream is from banking, generating $462.65 million. Operating expenses are significant, with general and administrative expenses consistently forming a substantial part of these costs. The gross profit margin remains at 100%, indicating no cost of goods sold reported over the periods analyzed. Net income margin shows variability but reaches 34.30% in recent quarters, reflecting profitability after accounting for operating expenses.

PE: 11.4x

First Commonwealth Financial, a financial services firm, has seen insider confidence with share purchases in recent months. Despite earnings forecasted to decline by 0.1% annually over the next three years, the company remains attractive due to strategic leadership changes and consistent dividend growth—recently increased by 4% from last year. The firm reported net income of US$37 million for Q2 2024 amidst a challenging environment but completed significant share repurchases worth US$32.89 million since October 2021, reflecting management's commitment to shareholder value.

Summing It All Up

- Investigate our full lineup of 52 Undervalued US Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal