Investor Optimism Abounds Nektar Therapeutics (NASDAQ:NKTR) But Growth Is Lacking

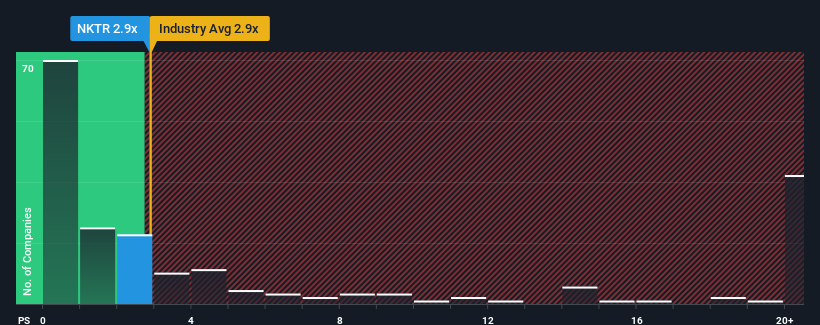

It's not a stretch to say that Nektar Therapeutics' (NASDAQ:NKTR) price-to-sales (or "P/S") ratio of 2.9x seems quite "middle-of-the-road" for Pharmaceuticals companies in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Nektar Therapeutics

What Does Nektar Therapeutics' P/S Mean For Shareholders?

Recent times haven't been great for Nektar Therapeutics as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nektar Therapeutics will help you uncover what's on the horizon.How Is Nektar Therapeutics' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nektar Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 0.3% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 18% per year.

In light of this, it's somewhat alarming that Nektar Therapeutics' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Nektar Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Nektar Therapeutics you should know about.

If you're unsure about the strength of Nektar Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal