Uncovering Hong Kong's Undiscovered Gems In October 2024

As global markets experience mixed signals, with U.S. indices reaching new highs and China's equities facing declines, the Hong Kong market finds itself at a crossroads, presenting both challenges and opportunities for investors. In this dynamic environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth amid economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

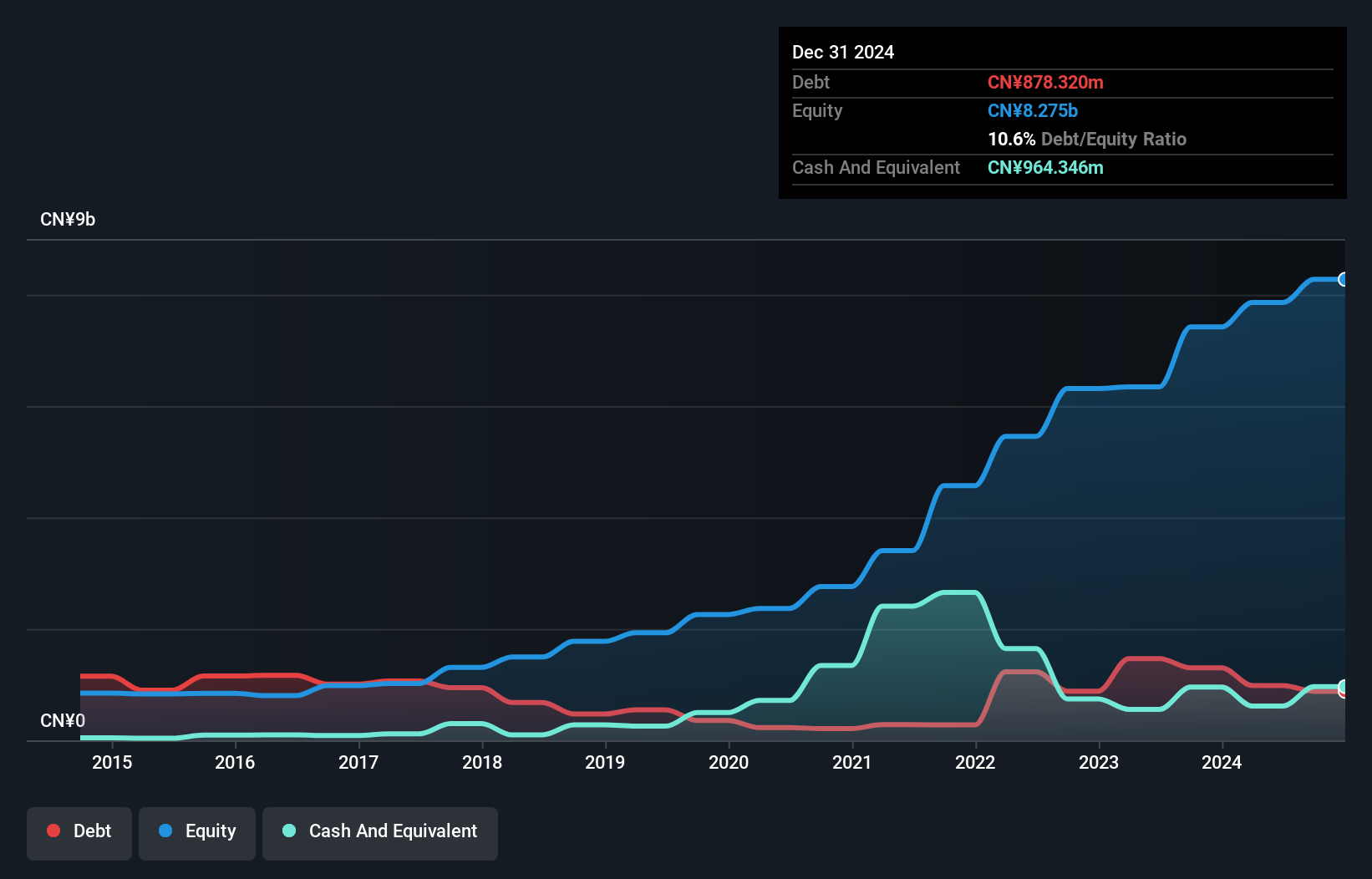

Overview: Kinetic Development Group Limited is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$14.25 billion.

Operations: Kinetic Development Group generates revenue through the extraction and sale of coal products in China. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin.

Kinetic Development Group, a promising player in Hong Kong's market, has shown impressive financial performance with earnings growth of 39.2% over the past year, surpassing the Oil and Gas industry's 4.6%. The company's net debt to equity ratio stands at a satisfactory 4.7%, indicating prudent financial management. Trading at roughly 55.7% below its estimated fair value, it presents an attractive opportunity for investors seeking undervalued stocks. Recent announcements include a significant increase in sales to CNY 2.53 billion from CNY 1.49 billion last year and net income rising to CNY 1.10 billion from CNY 570 million.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

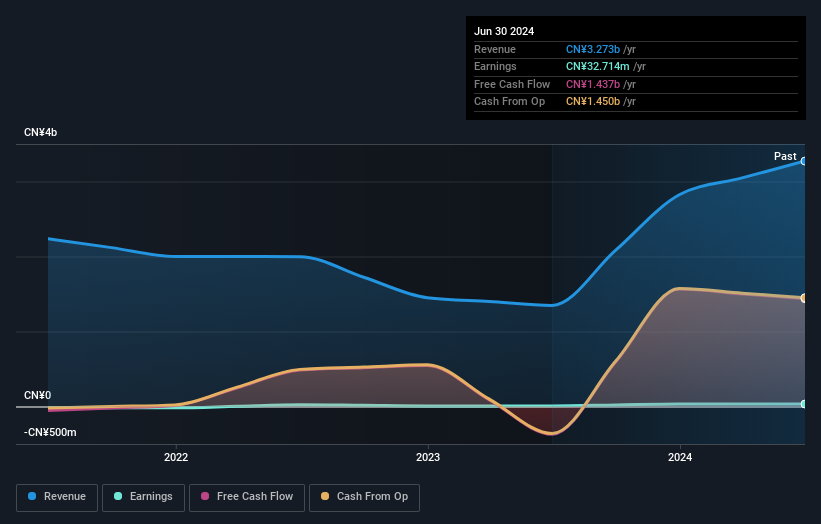

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market cap of HK$6.07 billion.

Operations: Sprocomm Intelligence generates its revenue primarily from the sale of wireless communications equipment, amounting to CN¥3.27 billion.

Sprocomm Intelligence, a tech player in Hong Kong, has been making waves with its earnings growth of 301% over the past year, significantly outpacing the industry average. Despite this impressive performance, a large one-off gain of CN¥18M influenced recent results. The company's net debt to equity ratio stands at 29%, which is satisfactory and indicates prudent financial management. However, insider selling in the last quarter raises some eyebrows about internal confidence. Trading at nearly 93% below estimated fair value suggests potential for investors seeking undervalued opportunities despite these mixed signals.

- Delve into the full analysis health report here for a deeper understanding of Sprocomm Intelligence.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

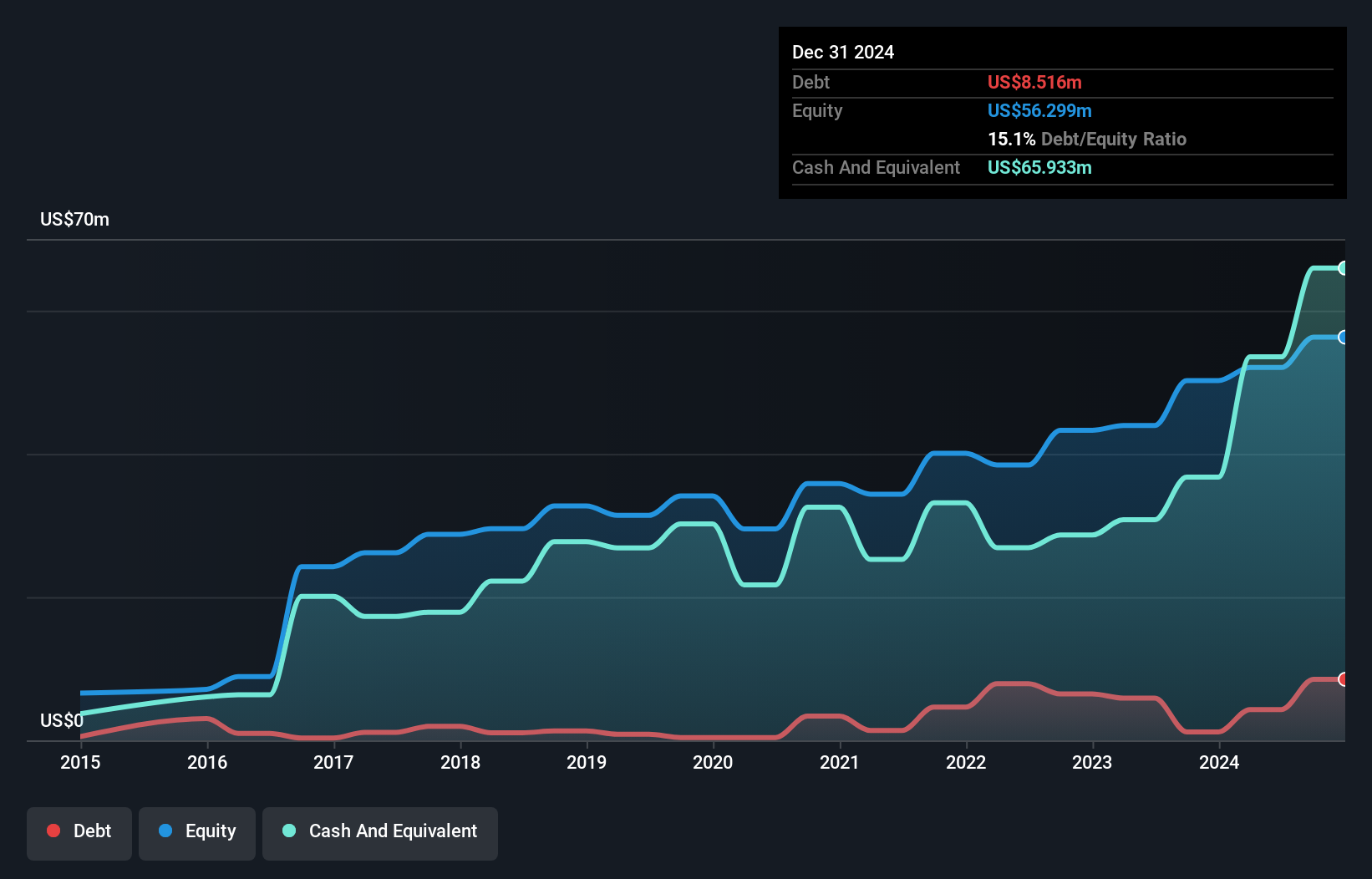

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.53 billion.

Operations: The company's revenue primarily comes from the sales of SD-WAN routers, with mobile-first connectivity generating $59.87 million and fixed-first connectivity contributing $15.19 million. Additionally, software licenses and warranty and support services add another $31.86 million to the revenue stream.

Plover Bay Technologies, a smaller player in the tech scene, is showing promising growth. Over the past year, earnings surged by 41.4%, outpacing the broader Communications industry. The company trades at 50.4% below its estimated fair value, presenting a potential opportunity for investors seeking undervalued assets. Plover Bay's debt to equity ratio has risen from 2.7% to 8.3% over five years, yet it holds more cash than total debt, ensuring financial stability. Recent leadership changes with Ms. Chiu's appointment as an executive director highlight a strategic focus on diversity and legal expertise within the boardroom dynamics.

Turning Ideas Into Actions

- Get an in-depth perspective on all 168 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal