High Growth Tech Stocks In Hong Kong For October 2024

As global markets experience varying trends, with U.S. indices reaching record highs and European hopes for economic stimulus rising, Hong Kong's tech sector faces its own unique challenges and opportunities amid a backdrop of cautious optimism. In this dynamic environment, identifying promising high-growth tech stocks involves evaluating factors such as innovation potential, market adaptability, and resilience to broader economic shifts.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.11% | 59.31% | ★★★★★☆ |

| Akeso | 33.46% | 53.03% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Q Technology (Group) (SEHK:1478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Q Technology (Group) Company Limited is an investment holding company that focuses on designing, researching and developing, manufacturing, and selling camera and fingerprint recognition modules across Mainland China, Hong Kong, India, and international markets with a market capitalization of approximately HK$5.45 billion.

Operations: The company generates revenue primarily from the sale of camera modules, which contribute significantly more than fingerprint recognition modules, with the former accounting for CN¥13.79 billion. The business operates across Mainland China, Hong Kong, India, and international markets.

Q Technology (Group) has demonstrated a robust growth trajectory, evidenced by its recent sales results which showed significant volumes in camera and fingerprint recognition modules. With a 583.8% increase in earnings over the past year, significantly outpacing the electronic industry's average of 11.7%, the company is making substantial strides. Additionally, its commitment to innovation is reflected in R&D expenses, crucial for sustaining its competitive edge in high-tech markets. Looking ahead, Q Technology's earnings are expected to grow by 36% annually, promising for future prospects despite a challenging market environment.

Weimob (SEHK:2013)

Simply Wall St Growth Rating: ★★★★☆☆

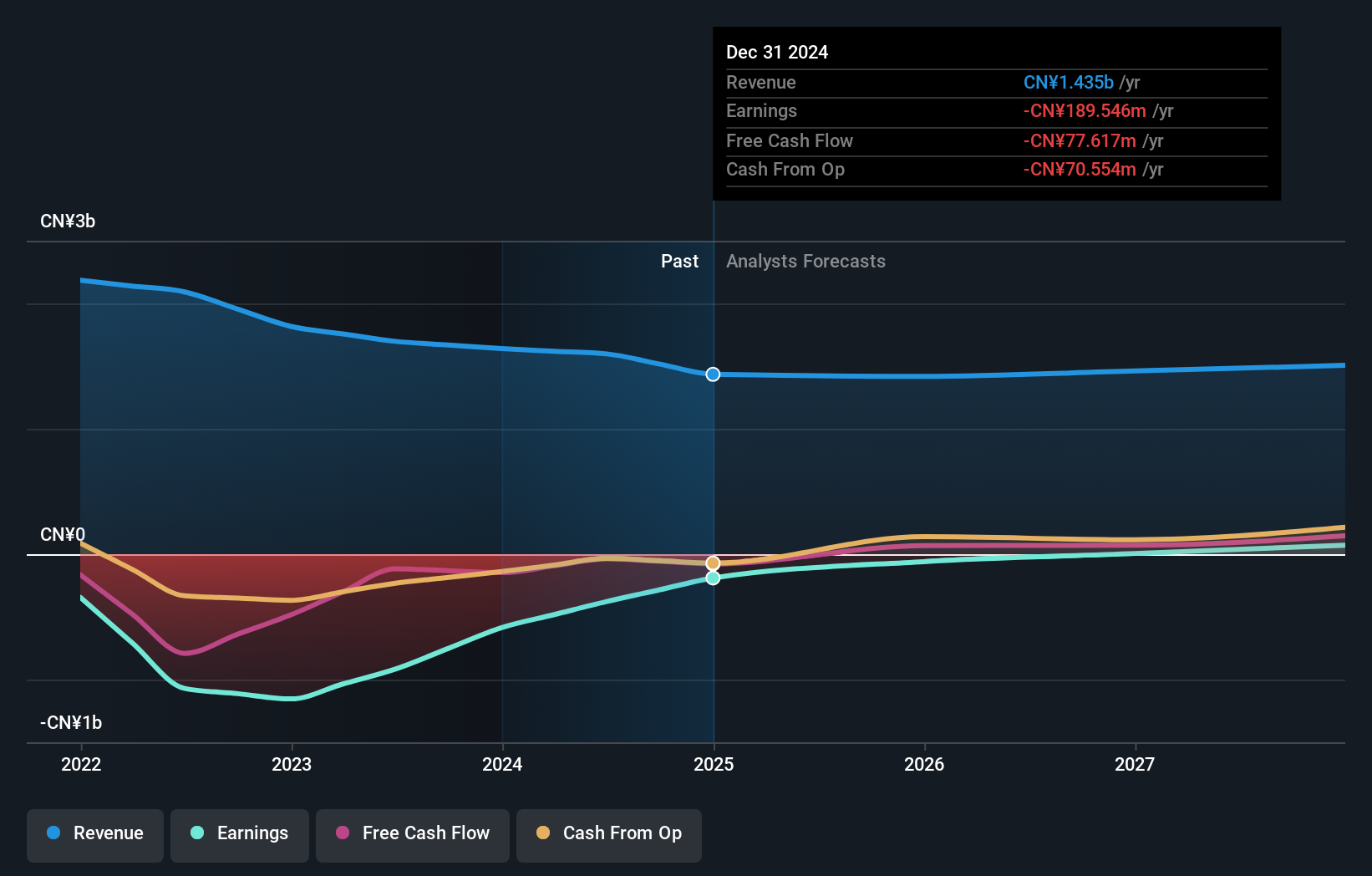

Overview: Weimob Inc. is an investment holding company that offers digital commerce and media services in the People’s Republic of China, with a market cap of HK$4.99 billion.

Operations: Weimob Inc. generates revenue primarily through its digital commerce solutions and media services in China. The company focuses on providing cloud-based marketing and sales solutions to small and medium-sized enterprises, enhancing their online presence and customer engagement capabilities.

Weimob's recent performance reflects a challenging phase, with a reported net loss widening to CNY 550.78 million from CNY 452.24 million year-over-year, alongside a decrease in sales to CNY 867.43 million from CNY 1,209.57 million. Despite these setbacks, the company is poised for recovery with anticipated revenue growth of 12.7% per year, outpacing the Hong Kong market's average of 7.3%. This growth is underpinned by Weimob's strategic focus on R&D which remains critical as it navigates through its financial recuperation phase; however, specific figures on recent R&D investments were not disclosed in the latest reports. The appointment of Mr. FEI Leiming as an executive Director could also signal a strategic realignment focusing more intensely on human resource optimization and operational efficiency moving forward.

- Click here to discover the nuances of Weimob with our detailed analytical health report.

Gain insights into Weimob's historical performance by reviewing our past performance report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market capitalization of HK$4.79 billion.

Operations: The company generates revenue primarily through its Cloud Services and On-premise Software and Services, with Cloud Services contributing significantly more at CN¥1.32 billion compared to CN¥281.71 million from On-premise Software and Services.

Ming Yuan Cloud Group Holdings is navigating through a transformative phase with a recent reduction in net loss to CNY 115.37 million from CNY 323.32 million year-over-year, reflecting improved operational efficiency. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape of Hong Kong. Despite a slight decrease in sales to CNY 720.11 million, Ming Yuan's strategic adjustments and leadership changes, including the appointment of Ms. WEN Hongmei as an independent non-executive director, signal a proactive approach towards governance and future growth prospects in the region’s tech sector.

- Get an in-depth perspective on Ming Yuan Cloud Group Holdings' performance by reading our health report here.

Understand Ming Yuan Cloud Group Holdings' track record by examining our Past report.

Where To Now?

- Dive into all 43 of the SEHK High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal