High Growth Tech Stocks in France This October 2024

As of October 2024, the French market is experiencing a cautious optimism, with the CAC 40 Index showing a modest increase amid broader European hopes for quicker interest rate cuts by the ECB and potential economic stimulus from China. In this environment, identifying high-growth tech stocks in France involves looking for companies that demonstrate strong innovation capabilities and adaptability to changing economic conditions while maintaining robust financial health.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 22.84% | 18.29% | ★★★★★☆ |

| Valbiotis | 43.33% | 42.78% | ★★★★★☆ |

| beaconsmind | 25.00% | 78.71% | ★★★★★★ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

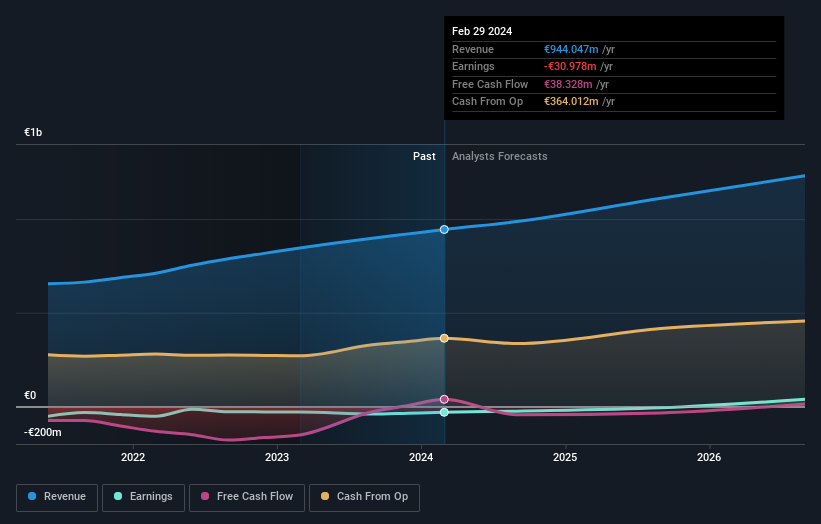

Overview: OVH Groupe S.A. offers a range of public and private cloud services, shared hosting, and dedicated server solutions globally, with a market capitalization of approximately €1.36 billion.

Operations: OVH generates revenue primarily from its Private Cloud and Public Cloud segments, with Private Cloud contributing approximately €589.61 million and Public Cloud around €169.01 million.

Amidst a challenging landscape, OVH Groupe stands out with its strategic focus on innovation and market adaptation. With revenue projected to increase by 9.7% annually, the company is positioning itself well within France's competitive tech sector. Notably, OVH's commitment to research and development is robust, as evidenced by their presentations at the recent OCP Global Summit; such dedication is crucial for staying ahead in technology advancements. Despite current unprofitability and a highly volatile share price, forecasts suggest a promising turnaround with earnings expected to surge by 101.4% per year, signaling potential for substantial growth ahead. This growth trajectory, coupled with an anticipated profitability shift within three years, underscores OVH's resilience and adaptability in navigating market dynamics.

- Dive into the specifics of OVH Groupe here with our thorough health report.

Examine OVH Groupe's past performance report to understand how it has performed in the past.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

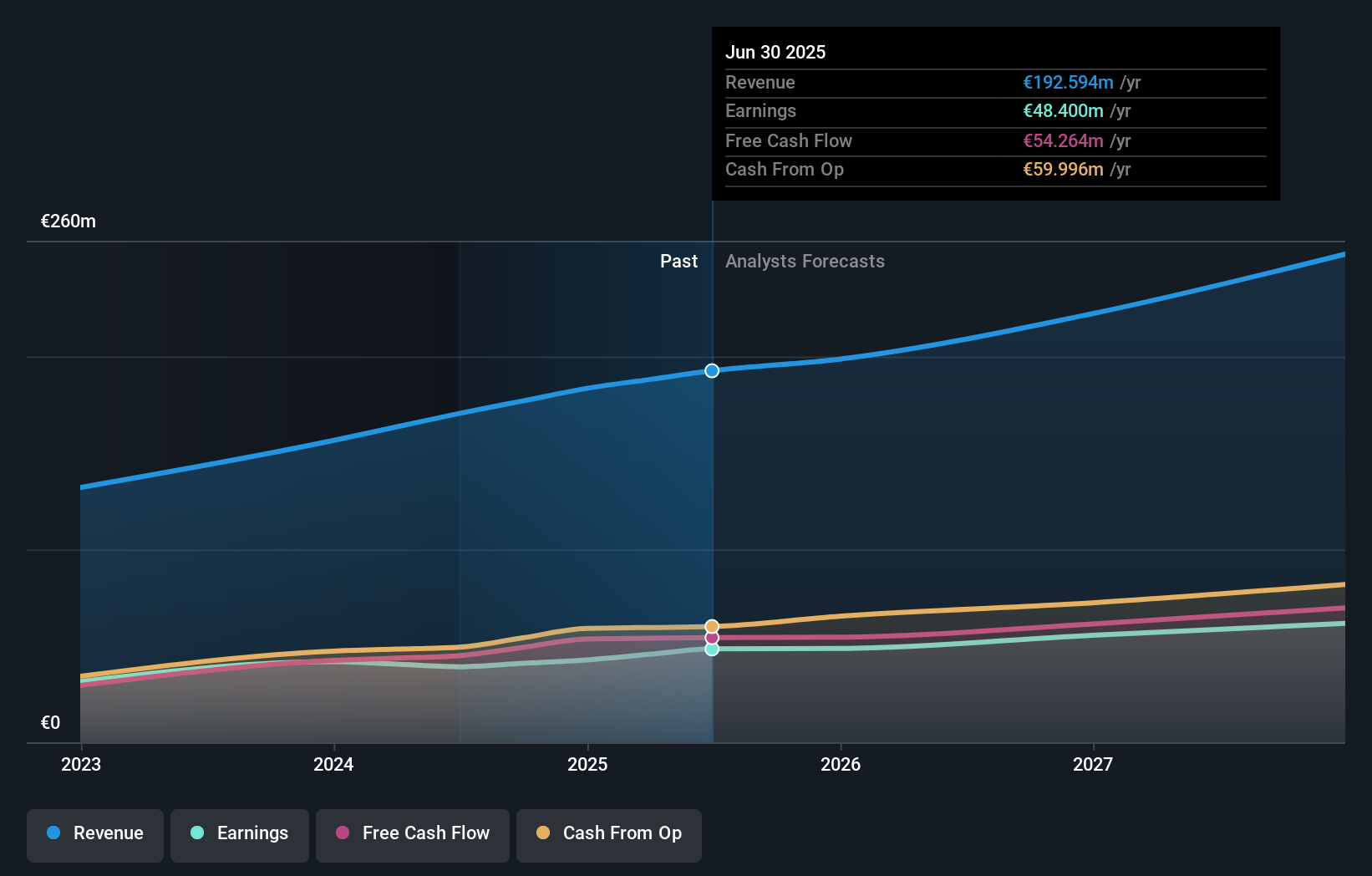

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations in Europe, the Americas, the Asia-Pacific, and internationally, and has a market capitalization of €1.89 billion.

Operations: Planisware SAS generates revenue primarily from its Software & Programming segment, which amounts to €170.48 million. The company operates as a business-to-business software-as-a-service provider across multiple regions globally.

Planisware SAS, a player in France's tech scene, is demonstrating robust growth with revenue expected to climb by 16.5% annually, outpacing the French market average of 5.6%. This growth is supported by a significant commitment to innovation, as reflected in R&D expenses which have been strategically increased to foster advancements in their software solutions. Despite earnings growing at a slower pace than the industry average last year (6.8% versus 11.2%), Planisware's projected annual earnings growth of 19.7% exceeds the broader market forecast of 12.1%. Recent financials reveal a dip in net income from EUR 18.66 million to EUR 15.98 million year-over-year; however, this is set against a backdrop of increasing sales and investment in future capabilities, indicating potential for sustained upward trajectories in both market presence and technological leadership.

- Delve into the full analysis health report here for a deeper understanding of Planisware SAS.

Review our historical performance report to gain insights into Planisware SAS''s past performance.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

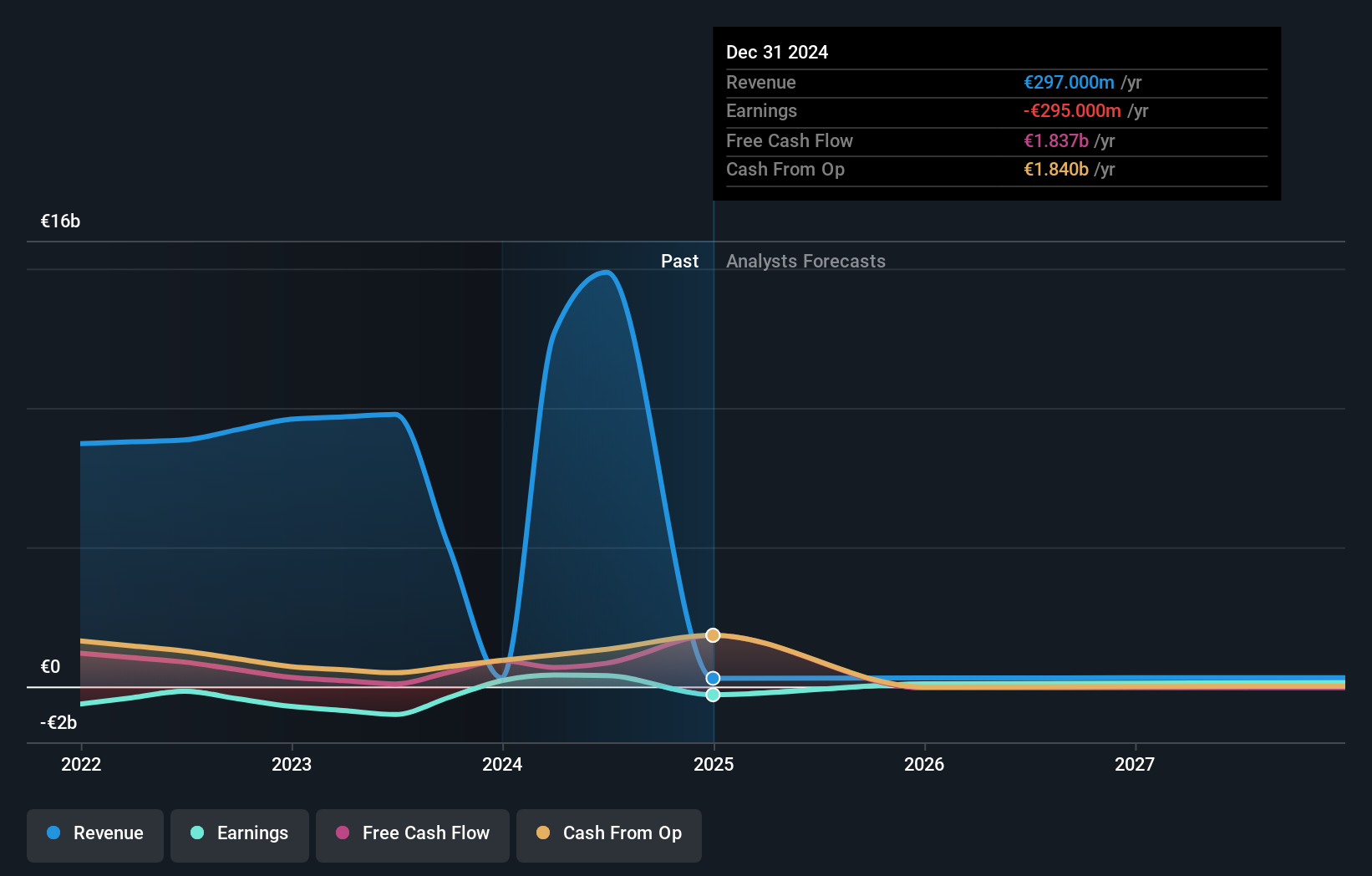

Overview: Vivendi SE is an entertainment, media, and communication company with a market cap of approximately €10.67 billion, operating across France, the rest of Europe, the Americas, Asia/Oceania, and Africa.

Operations: Vivendi SE generates revenue primarily from its Canal+ Group (€6.20 billion) and Havas Group (€2.92 billion) segments, with additional contributions from Gameloft (€304 million), Prisma Media (€303 million), Vivendi Village (€151 million), and New Initiatives (€176 million). The company's business model is driven by diverse media and communication services across multiple regions.

Vivendi SE, amidst a dynamic tech landscape in France, has shown promising growth with its recent earnings report highlighting a significant surge in sales to EUR 9.05 billion from EUR 4.7 billion year-over-year. This uptick is underpinned by an aggressive R&D strategy, where the firm channels substantial resources to foster innovation—evident from their latest R&D expense figures. Despite a slight dip in net income to EUR 159 million from EUR 174 million, the company's strategic share repurchases—totaling over 18 million shares for €184 million—reflect a proactive approach to capital management and shareholder value enhancement. With earnings expected to burgeon by an impressive 30.6% annually, Vivendi is strategically poised within the high-growth tech sector, although it trails behind with a forecasted revenue growth of just 9.4% per year compared to more aggressive market averages.

- Click to explore a detailed breakdown of our findings in Vivendi's health report.

Assess Vivendi's past performance with our detailed historical performance reports.

Make It Happen

- Click here to access our complete index of 39 Euronext Paris High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal