3 UK Growth Stocks With Insider Ownership And 29% Earnings Growth

Over the last 7 days, the United Kingdom market has risen by 1.6%, contributing to an impressive 11% increase over the past year, with earnings forecasted to grow by 14% annually. In this favorable environment, identifying growth companies with significant insider ownership can be a promising strategy as it often indicates confidence in the company's future prospects and aligns management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 82.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 120.4% |

Let's dive into some prime choices out of the screener.

Equals Group (AIM:EQLS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Equals Group plc develops and sells payment platforms, including prepaid currency cards, international money transfers, and current accounts in the UK, with a market cap of £212.50 million.

Operations: The company's revenue segments include Banking (£8.26 million), Solutions (£42.15 million), Travel Cash (£0.02 million), Currency Cards (£15.46 million), and International Payments (Excl. Solutions) (£40.71 million).

Insider Ownership: 22.5%

Earnings Growth Forecast: 31.9% p.a.

Equals Group is experiencing significant growth, with forecasted annual earnings expansion of 31.9%, outpacing the UK market's 14.1%. Recent insider activity shows more shares bought than sold in the past three months, indicating confidence among insiders despite substantial selling. Revenue is expected to grow at 18.8% annually, faster than the UK's average but below a high-growth threshold. M&A discussions are ongoing with a consortium considering an all-cash offer for Equals' share capital at 135 pence per share.

- Take a closer look at Equals Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Equals Group shares in the market.

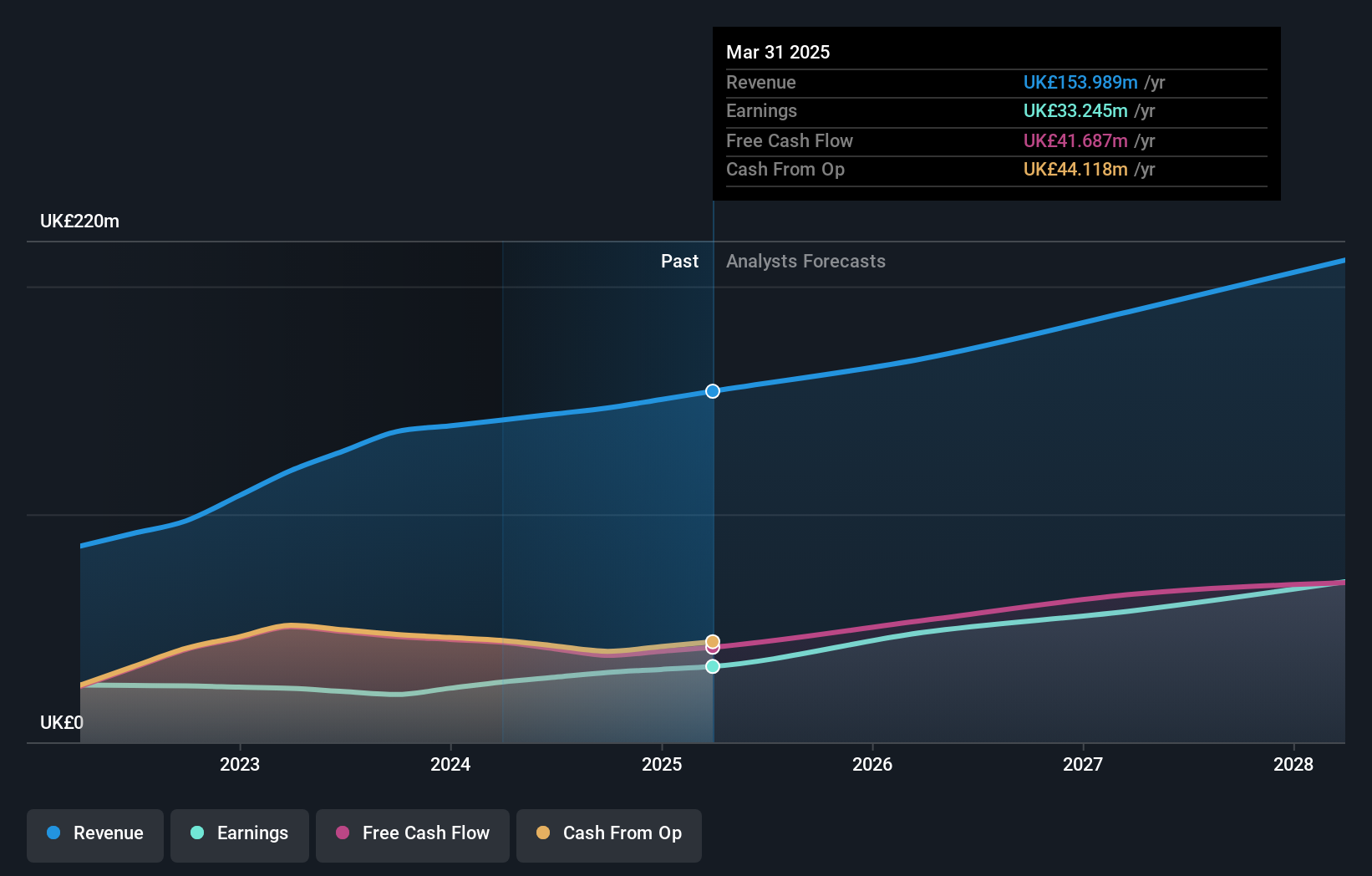

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £571.69 million.

Operations: The company's revenue segments include Infrastructure (£84.17 million), Private Equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Insider Ownership: 31.9%

Earnings Growth Forecast: 29.0% p.a.

Foresight Group Holdings is poised for substantial growth, with earnings projected to rise 29% annually, significantly outpacing the UK market's 14.1%. Despite revenue growth being moderate at 10.7%, it surpasses the UK's average. The company's Return on Equity is forecast to be very high in three years, reflecting strong potential profitability. However, its dividend of 4.48% lacks coverage by earnings. Recent inclusion in the S&P Global BMI Index underscores its increasing prominence in financial markets.

- Delve into the full analysis future growth report here for a deeper understanding of Foresight Group Holdings.

- Our expertly prepared valuation report Foresight Group Holdings implies its share price may be too high.

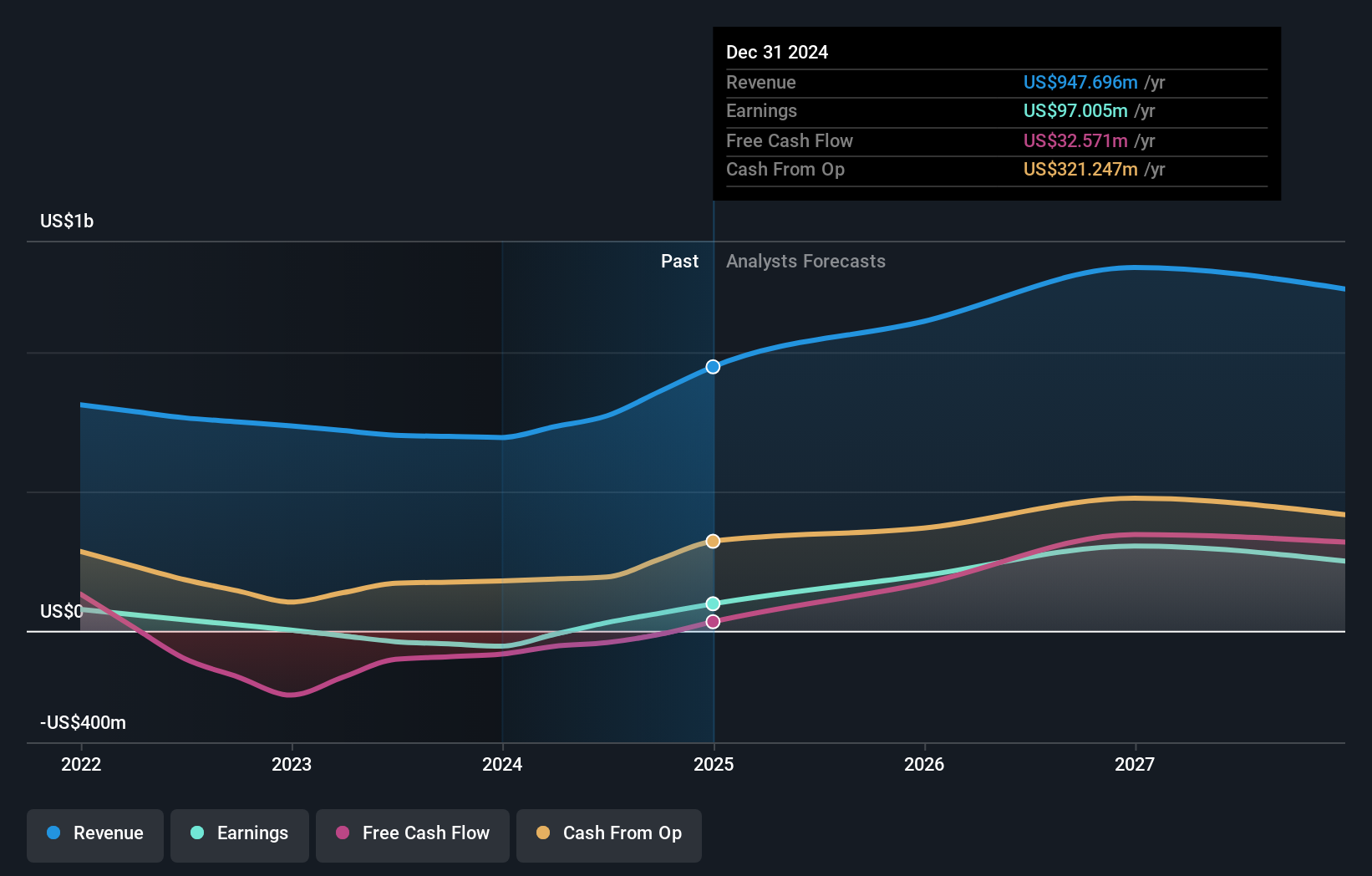

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.22 billion.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 49.8% p.a.

Hochschild Mining's recent earnings report shows a turnaround with net income of US$39.52 million, contrasting a previous loss. While revenue growth is moderate at 8.1% annually, it surpasses the UK market average. Earnings are forecast to grow significantly at 49.8% per year, though high debt levels pose risks. Despite volatile share prices and low projected Return on Equity (17.1%), the company remains profitable with no significant insider trading activity recently noted.

- Dive into the specifics of Hochschild Mining here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading beyond its estimated value.

Where To Now?

- Navigate through the entire inventory of 62 Fast Growing UK Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal