3 UK Dividend Stocks Yielding Up To 3.8%

The United Kingdom market has experienced a positive trend, rising 1.6% in the last week and 11% over the past year, with earnings projected to grow by 14% annually. In this favorable environment, selecting dividend stocks that offer stable yields and potential for growth can be an effective strategy for investors looking to benefit from both income and capital appreciation.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| Burberry Group (LSE:BRBY) | 8.87% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.32% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 6.75% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.98% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.98% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.78% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.60% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.39% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.45% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

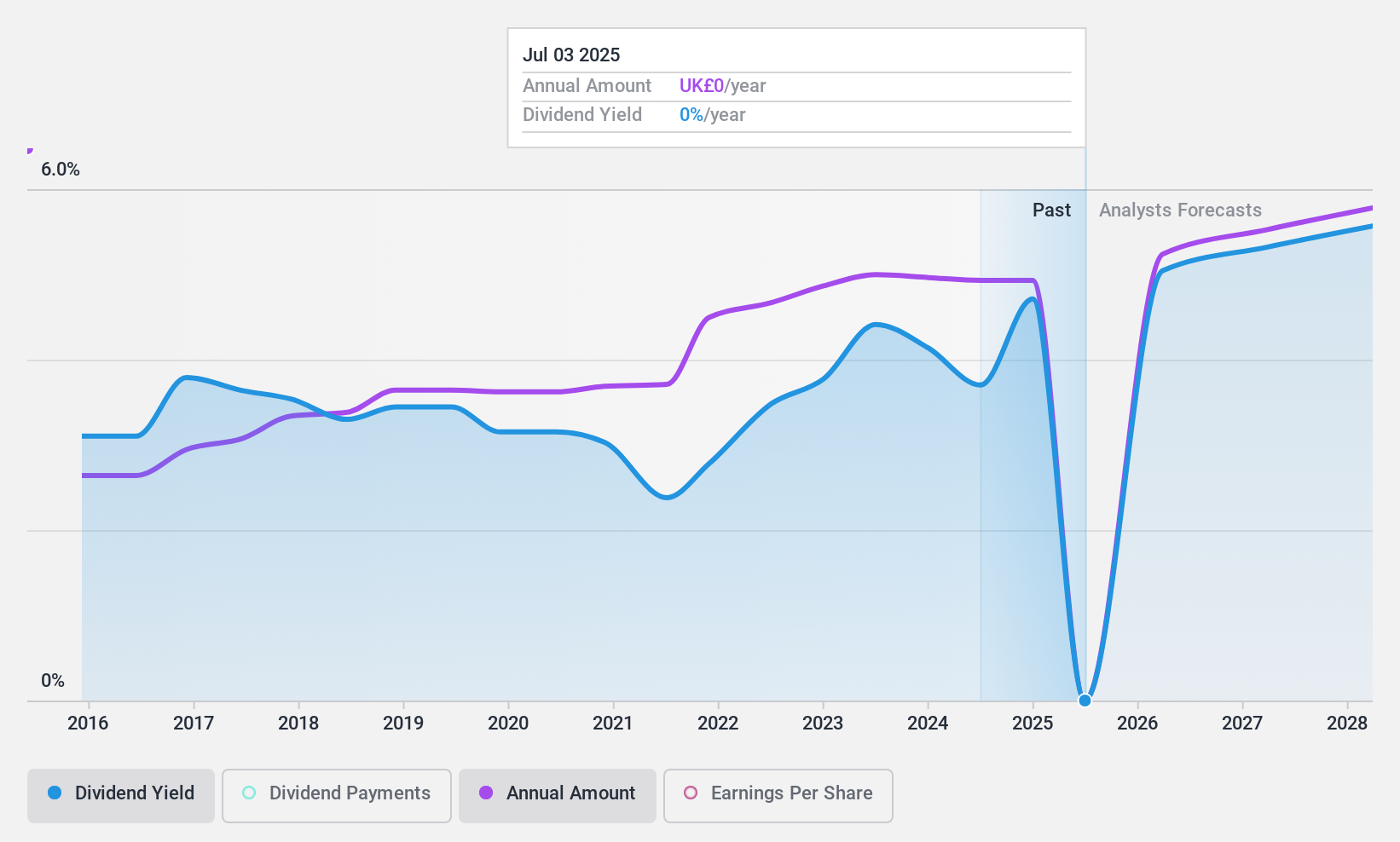

Big Yellow Group (LSE:BYG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group is the UK's leading brand in self-storage, with a market cap of £2.45 billion.

Operations: Big Yellow Group generates revenue of £199.62 million from providing self storage and related services.

Dividend Yield: 3.6%

Big Yellow Group offers a reliable dividend history with stable and growing payments over the past decade, though its current yield of 3.6% is below the top UK payers. The dividends are covered by earnings and cash flows, with payout ratios at 81.4% and 84.4%, respectively. Despite recent revenue growth to £50.2 million in Q1 2024, earnings are expected to decline slightly over the next three years, impacting future dividend sustainability considerations.

- Delve into the full analysis dividend report here for a deeper understanding of Big Yellow Group.

- Insights from our recent valuation report point to the potential undervaluation of Big Yellow Group shares in the market.

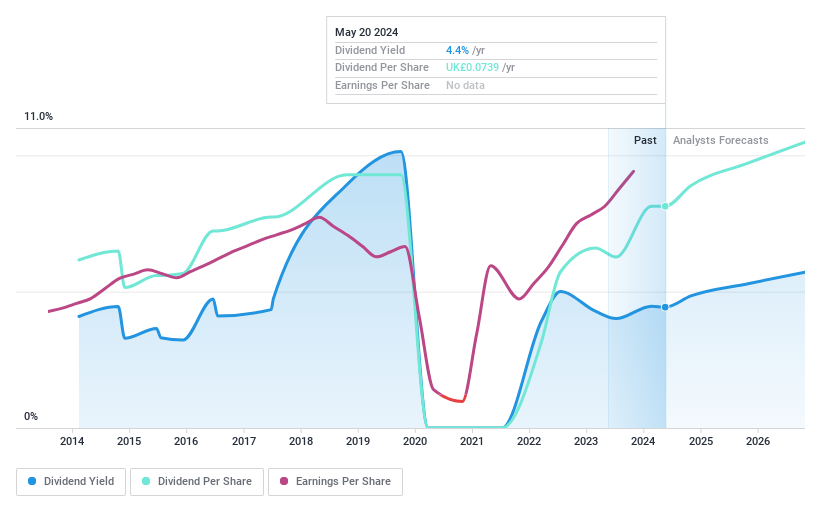

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £774.23 million.

Operations: ME Group International plc generates revenue from its Personal Services segment, amounting to £304.20 million.

Dividend Yield: 3.8%

ME Group International's dividend payments are reasonably covered by earnings with a payout ratio of 56.1%, though cash flow coverage is tighter at 87.4%. While dividends have increased over the past decade, they have been volatile, impacting reliability. The current yield of 3.83% is lower than top UK payers, but the stock trades at a significant discount to its estimated fair value. A new partnership with Motor Fuel Limited could enhance future revenue streams through innovative laundry services across UK sites.

- Click here to discover the nuances of ME Group International with our detailed analytical dividend report.

- The valuation report we've compiled suggests that ME Group International's current price could be quite moderate.

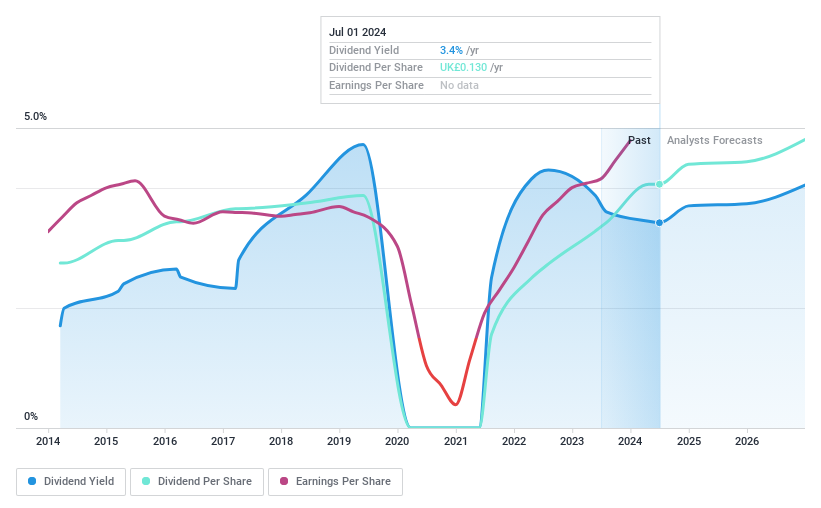

Mears Group (LSE:MER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £346.68 million, offers outsourced services to both public and private sectors across the United Kingdom.

Operations: Mears Group plc generates its revenue from two main segments: Management, which contributes £591.63 million, and Maintenance, accounting for £551.73 million.

Dividend Yield: 3.6%

Mears Group's dividend payments are well-covered by earnings and cash flows, with payout ratios of 33.4% and 10.8%, respectively, despite a history of volatility. The recent interim dividend increase to 4.75 pence signals positive momentum, yet the yield remains below top UK payers at 3.62%. Trading at a favorable valuation with a price-to-earnings ratio of 8.6x compared to the market's 16.7x, Mears has shown strong earnings growth but faces future decline forecasts.

- Navigate through the intricacies of Mears Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Mears Group's share price might be too pessimistic.

Key Takeaways

- Click this link to deep-dive into the 58 companies within our Top UK Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal