Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative And 2 Other Undiscovered Gems In France

As the French CAC 40 Index shows modest gains amid broader European market optimism, attention is turning to smaller, lesser-known stocks that could offer unique opportunities in a dynamic economic landscape. In this context, identifying promising companies involves assessing their resilience and potential for growth despite prevailing economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

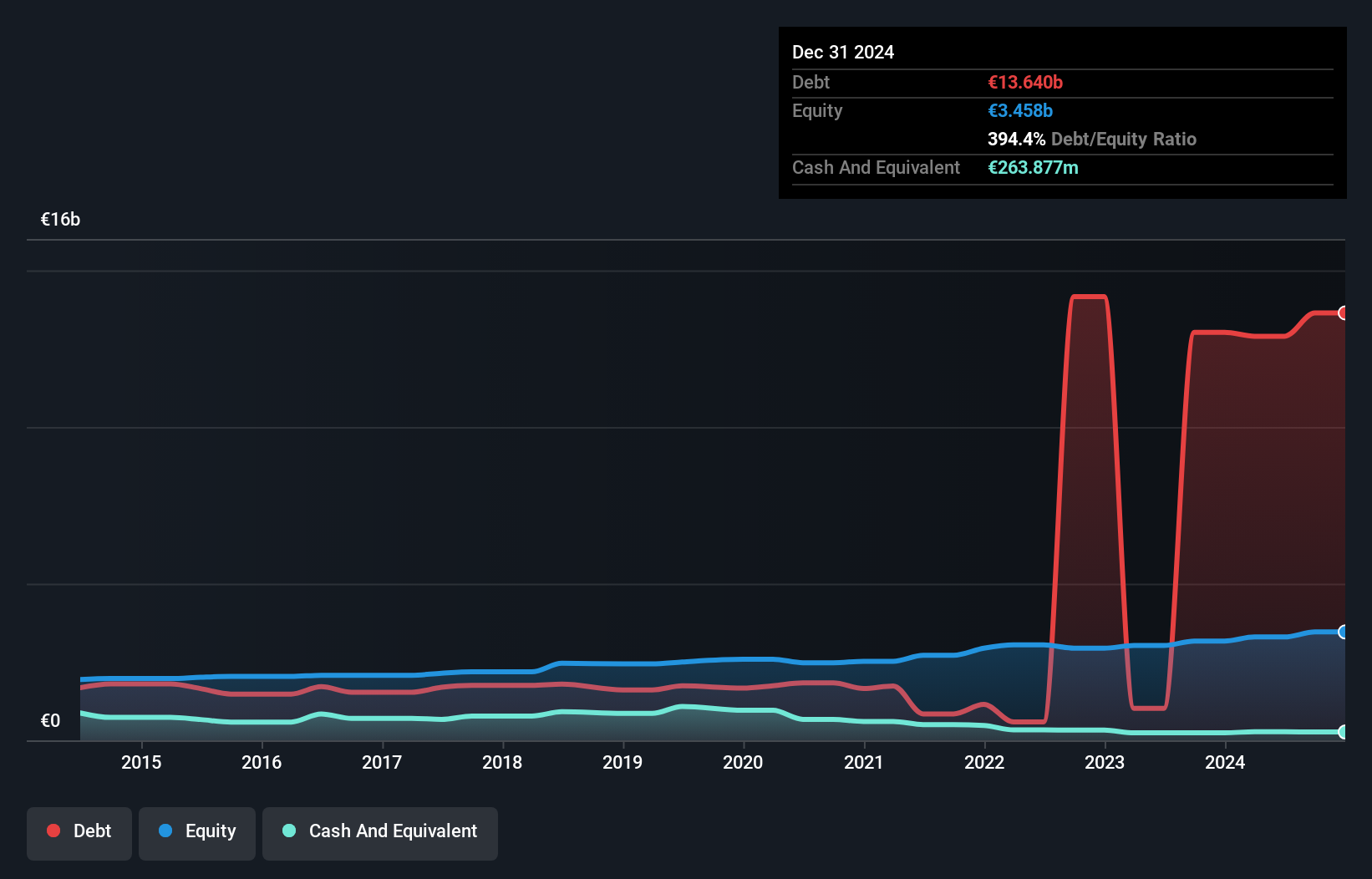

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative offers a range of banking products and services in France, with a market capitalization of approximately €550.41 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative generates its revenue primarily from retail banking, amounting to approximately €434.27 million.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative, a financial player with total assets of €26.2 billion and equity of €3.3 billion, offers an intriguing investment profile. With total deposits at €9 billion and loans reaching €18.8 billion, it has carved out a niche in the banking sector. Earnings have grown by 5% over the past year, surpassing the industry average of 4%. The bank's allowance for bad loans stands at a robust 109%, reflecting prudent risk management with non-performing loans at just 1.7%. However, its reliance on higher-risk funding sources could be concerning for some investors.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, with a market cap of €929.51 million.

Operations: The cooperative generates revenue primarily through its diverse banking products and services tailored for various client groups in France. It operates with a market cap of €929.51 million, focusing on serving individuals, professionals, farmers, businesses, and public entities.

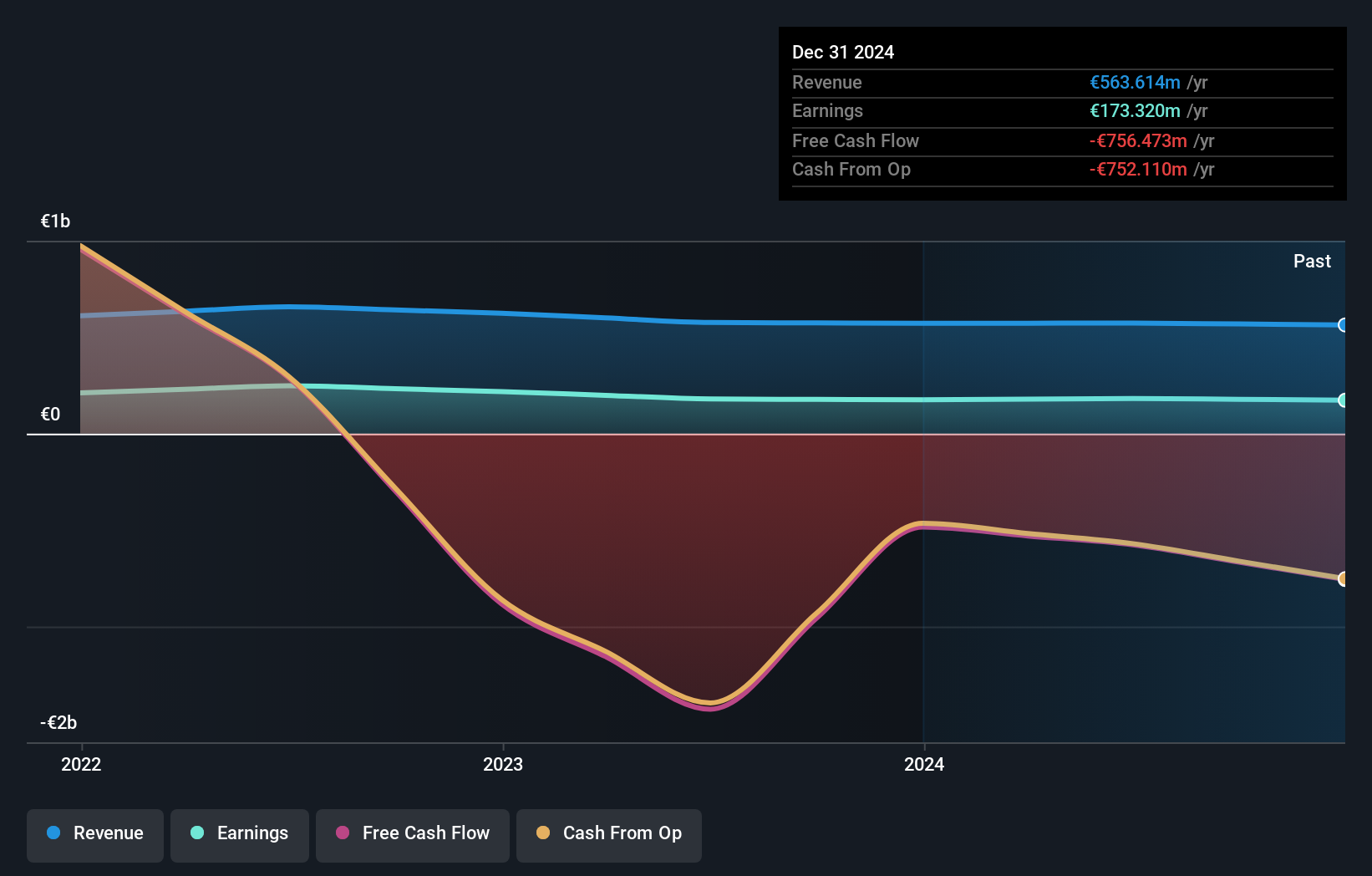

Crédit Agricole Languedoc, a cooperative bank with €35.3 billion in assets and €5.2 billion in equity, stands out for its low-risk funding strategy, relying on customer deposits that make up 94% of liabilities. Trading at 68% below estimated fair value, it offers potential appeal to investors seeking undervalued opportunities. The institution maintains a sufficient allowance for bad loans at 133%, ensuring stability amidst its lending activities totaling €29 billion against deposits of €28.2 billion. Although earnings growth over the past year was modest at 1.3%, high-quality earnings and an appropriate level of non-performing loans (1.4%) support its financial health narrative.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

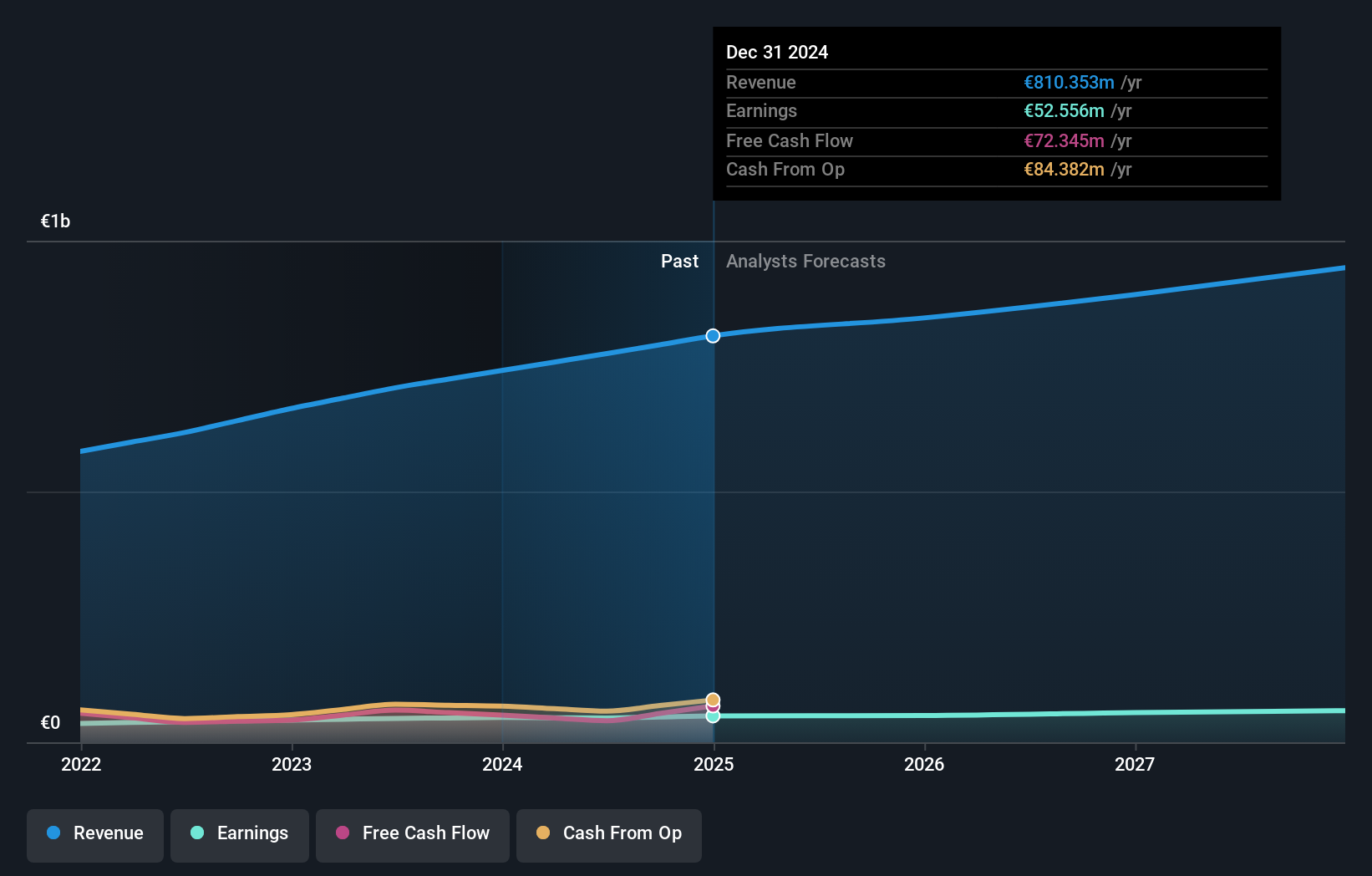

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services in France and internationally with a market cap of €1.09 billion.

Operations: Neurones generates revenue primarily through three segments: Infrastructure Services (€483.86 million), Application Services (€236.52 million), and Council (€54.53 million).

Neurones, a notable player in the IT sector, showcases resilience with its earnings growth of 1.8% over the past year, surpassing the industry's -5.6%. The company reported revenue of €402.43 million for the first half of 2024, up from €368.69 million previously, although net income slightly dipped to €24.5 million from €25.42 million last year. Neurones maintains a solid financial footing with more cash than total debt and a manageable debt-to-equity ratio that rose modestly to 2.8% over five years, indicating prudent financial management amidst challenging industry conditions.

- Click here to discover the nuances of Neurones with our detailed analytical health report.

Explore historical data to track Neurones' performance over time in our Past section.

Taking Advantage

- Reveal the 38 hidden gems among our Euronext Paris Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal