Undervalued Small Caps In United Kingdom With Insider Buying For October 2024

Amidst a challenging economic backdrop, the United Kingdom's market has been grappling with global pressures, as evidenced by the recent declines in both the FTSE 100 and FTSE 250 indices. With weak trade data from China impacting commodity prices and broader market sentiment, investors are increasingly seeking opportunities that may be overlooked within the small-cap sector. In this environment, identifying stocks with strong fundamentals and potential insider confidence can offer intriguing prospects for those looking to navigate these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.6x | 0.5x | 38.57% | ★★★★★★ |

| Bytes Technology Group | 22.5x | 5.7x | 10.41% | ★★★★★☆ |

| Genus | 173.8x | 2.1x | 6.97% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 27.09% | ★★★★★☆ |

| Essentra | 723.0x | 1.4x | 26.65% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.48% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 36.99% | ★★★★☆☆ |

| Robert Walters | 41.5x | 0.2x | 41.89% | ★★★☆☆☆ |

| Oxford Instruments | 23.7x | 2.6x | -32.92% | ★★★☆☆☆ |

| Petra Diamonds | NA | 0.2x | -36.01% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

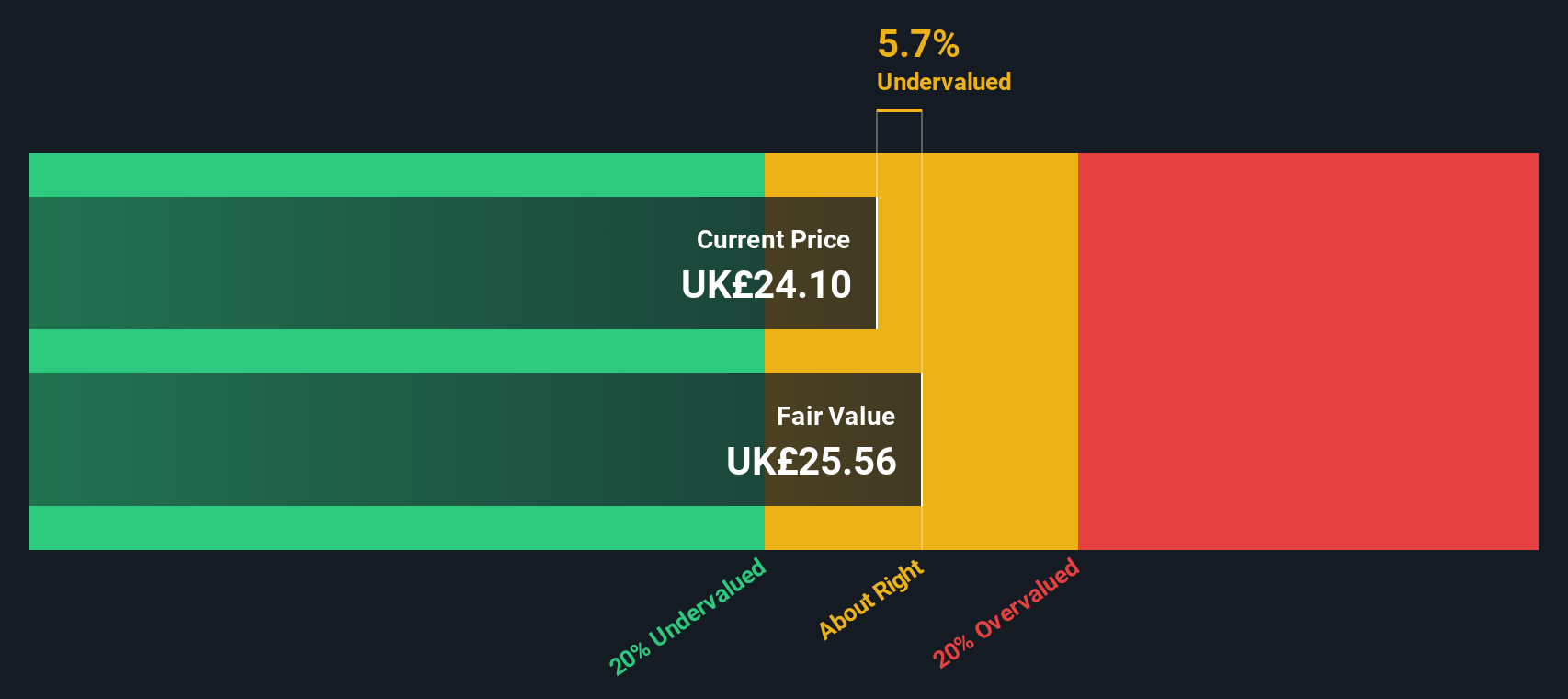

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company focused on animal genetics and breeding, with a market capitalization of approximately £1.76 billion.

Operations: Genus generates revenue primarily through its Genus ABS and Genus PIC segments, with the latter contributing slightly more. The company has experienced fluctuations in its gross profit margin, reaching as high as 53.78% and recently recorded at 38.17%. Operating expenses include significant allocations for research and development, which have shown a gradual increase over time.

PE: 173.8x

Genus, a UK-based company, has seen insider confidence with share purchases in recent months. Despite a challenging year with net income dropping to £7.9 million from £33.3 million and profit margins shrinking to 1.2%, the company remains attractive due to its forecasted earnings growth of 37% annually. Although reliant on higher-risk external borrowing, Genus maintains steady dividends at 21.7 pence per share, suggesting potential for future stability and growth within its sector.

- Dive into the specifics of Genus here with our thorough valuation report.

Examine Genus' past performance report to understand how it has performed in the past.

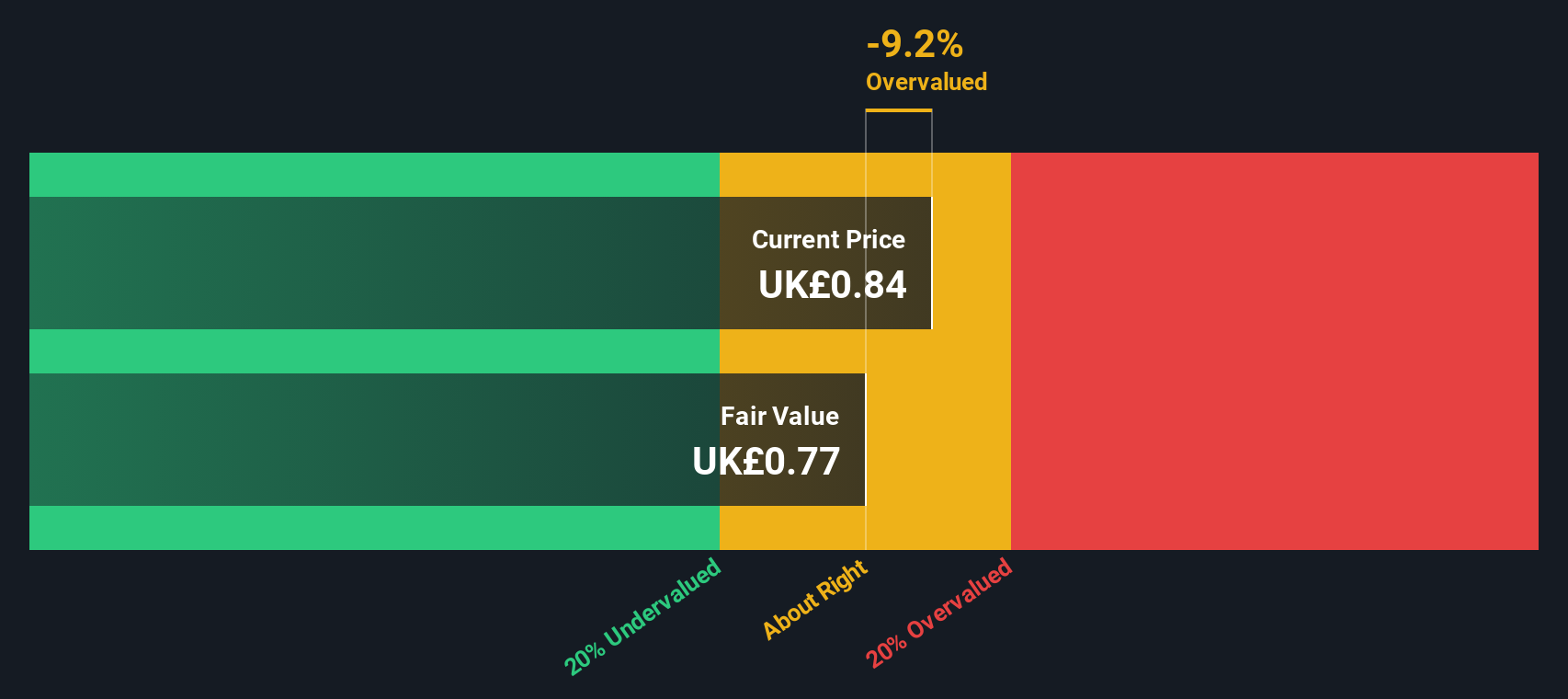

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Instruments is a company that specializes in providing high-technology tools and systems for research, discovery, service, healthcare, and materials characterisation, with a market cap of £1.38 billion.

Operations: Oxford Instruments generates revenue primarily from three segments: Materials & Characterisation, Research & Discovery, and Service & Healthcare. The company's net income margin has shown a fluctuating trend over the periods analyzed, with recent figures indicating a margin of 13.26% as of September 2023.

PE: 23.7x

Oxford Instruments, a small UK-based company, demonstrates potential for growth with earnings projected to increase by 9.82% annually. However, its reliance on external borrowing presents higher financial risk. Recent insider confidence is evident as they purchased shares in the last quarter of 2024, indicating belief in future prospects. The company actively engages in industry events like the Geotechnologist Symposium and NanoFabUK Symposium, showcasing its commitment to innovation and sector presence amidst leadership changes.

- Click here and access our complete valuation analysis report to understand the dynamics of Oxford Instruments.

Explore historical data to track Oxford Instruments' performance over time in our Past section.

Supermarket Income REIT (LSE:SUPR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Supermarket Income REIT focuses on investing in grocery store properties across the UK, with a market cap of £1.23 billion.

Operations: The company generates revenue primarily from real estate investments, with recent figures showing £107.23 million. Operating expenses have been increasing, reaching £5.75 million in the latest period, impacting net income significantly. The gross profit margin has consistently remained at 100%, but the net income margin has shown volatility, recently recording a negative -0.20%.

PE: -43.3x

Supermarket Income REIT, a UK-based investment trust, is gaining attention among undervalued stocks. Despite reporting a net loss of £21.18 million for the year ending June 2024, its sales grew to £107.23 million from £95.24 million the previous year. Insider confidence is evident with recent share purchases within the last quarter of 2023, suggesting potential optimism about future performance. The company also completed a significant debt refinancing totaling £170 million in July 2024, aimed at enhancing financial flexibility and supporting growth initiatives.

- Unlock comprehensive insights into our analysis of Supermarket Income REIT stock in this valuation report.

Learn about Supermarket Income REIT's historical performance.

Key Takeaways

- Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 29 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal