3 Chinese Growth Companies With High Insider Ownership To Watch

As Chinese equities face challenges amid fading optimism about Beijing's stimulus measures, the Shanghai Composite Index and the blue-chip CSI 300 have both experienced notable declines. Despite these headwinds, growth companies with high insider ownership can offer unique insights and potential resilience in such a market environment.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 23.9% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

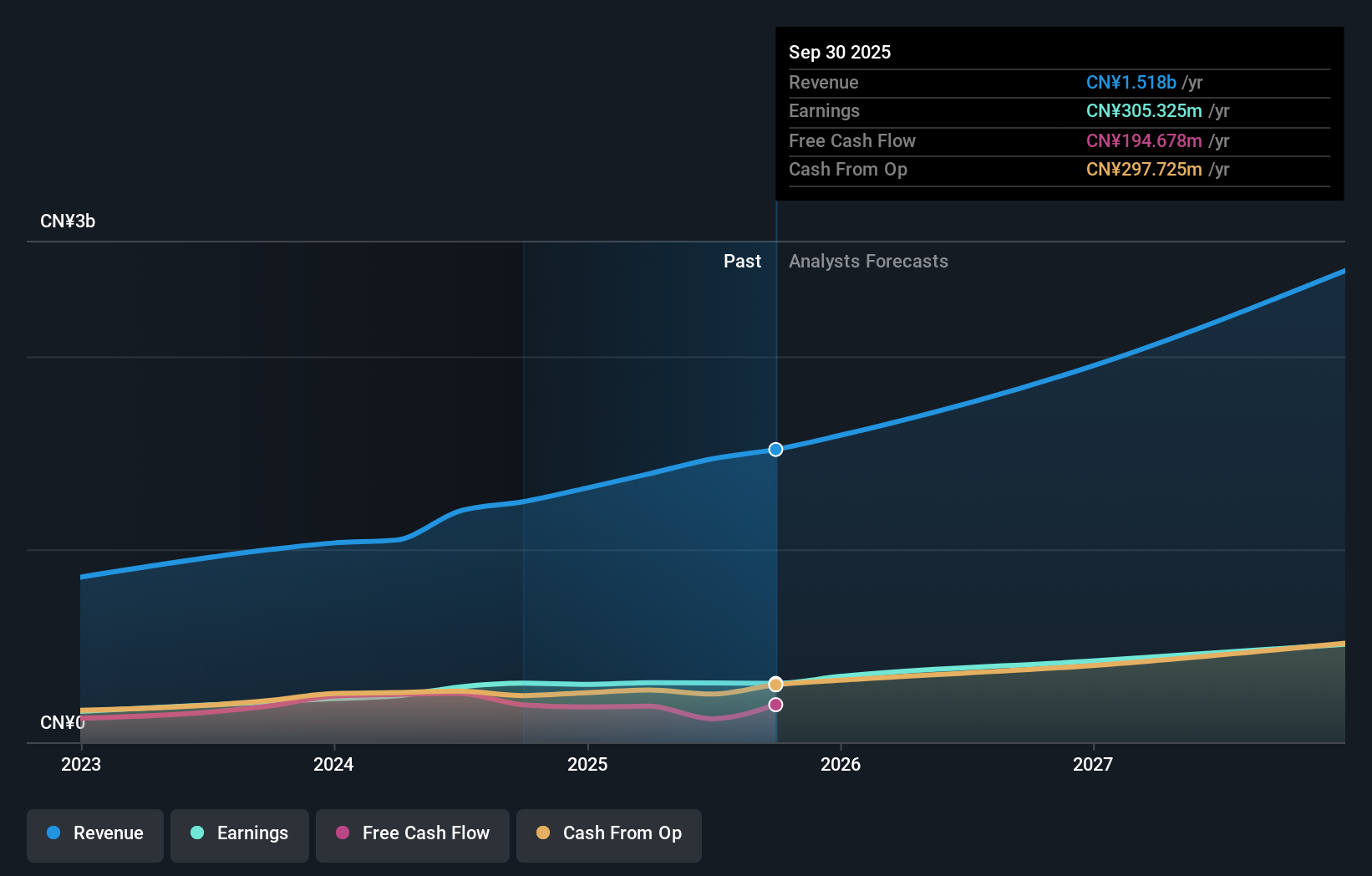

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. focuses on the research, production, and sale of mosquito repellent products, baby care products, and essential oil products, with a market cap of CN¥9.64 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to CN¥1.20 billion.

Insider Ownership: 33.1%

Earnings Growth Forecast: 22.2% p.a.

Runben Biotechnology demonstrates strong growth potential with recent earnings increasing by 48.7% over the past year, and revenue for the half-year rising to CNY 744.03 million from CNY 579.15 million previously. Despite an unstable dividend track record, its forecasted revenue growth of 24.2% per year surpasses the market average of 13.2%. However, its expected earnings growth of 22.2% per year is slightly below the Chinese market's anticipated rate of 23.4%.

- Navigate through the intricacies of Runben Biotechnology with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Runben Biotechnology's shares may be trading at a premium.

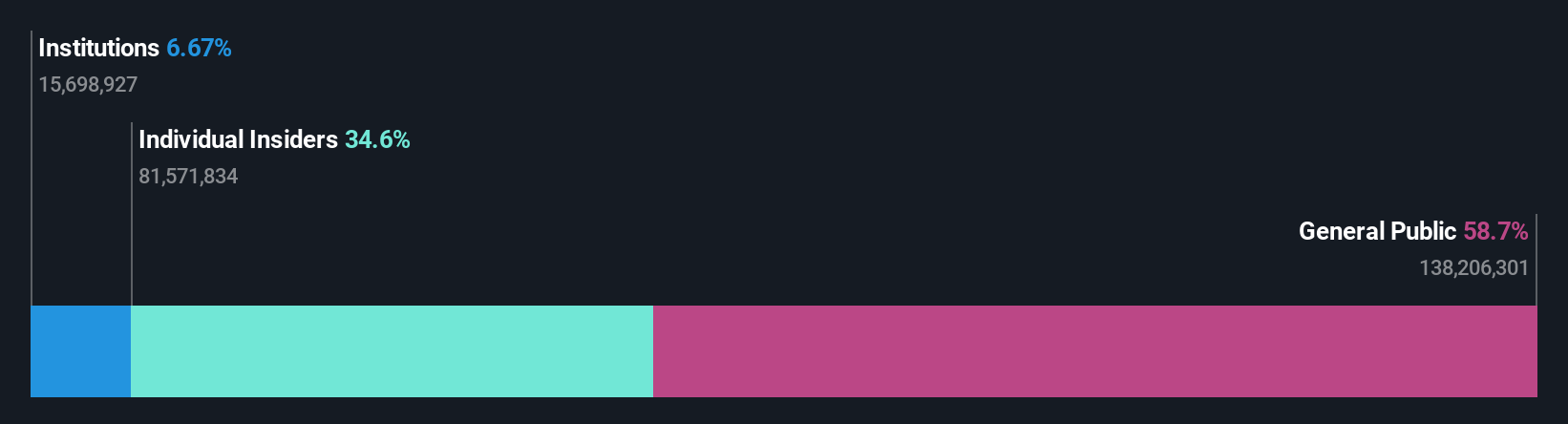

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. operates in the optical and magnetic components industry, with a market cap of CN¥4.87 billion.

Operations: The company's revenue segments include Power Adapter (CN¥178.67 million), Magnetic Components (CN¥847.96 million), Optical Communication Products (CN¥477.45 million), and Communication Power Supply System Equipment (CN¥83.67 million).

Insider Ownership: 34.8%

Earnings Growth Forecast: 154.4% p.a.

Dongguan Mentech Optical & Magnetic is poised for significant growth, with earnings projected to increase by 154.37% annually and revenue expected to grow 40.2% per year, outpacing the Chinese market average of 13.2%. Despite past shareholder dilution and a recent net loss of CNY 79.2 million for the half-year, insider ownership remains stable without substantial buying or selling in the last three months. Recent developments include its addition to the S&P Global BMI Index and a strategic stake acquisition by Shenzhen Jiayi Asset Management Co., Ltd., highlighting investor confidence in its future prospects.

- Click here to discover the nuances of Dongguan Mentech Optical & Magnetic with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Dongguan Mentech Optical & Magnetic is trading beyond its estimated value.

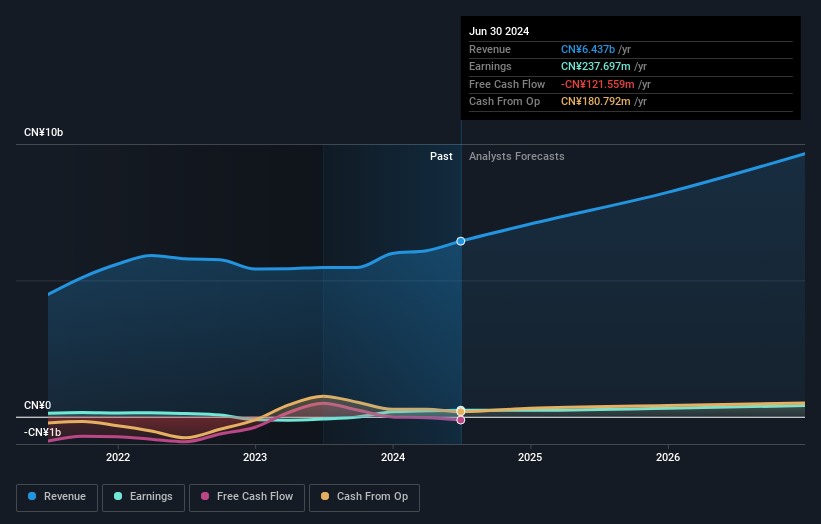

Guangdong Haomei New MaterialsLtd (SZSE:002988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Haomei New Materials Co., Ltd is engaged in the research, development, manufacturing, and sale of aluminum profiles in China with a market cap of CN¥4.02 billion.

Operations: The company's revenue is primarily derived from Industrial Aluminum Profiles (CN¥2.05 billion), Aluminum Profiles for Construction (CN¥2.24 billion), Automobile Lightweight Aluminum Material (CN¥1.57 billion), and System Doors and Windows Sales (CN¥553.24 million).

Insider Ownership: 23.1%

Earnings Growth Forecast: 23.9% p.a.

Guangdong Haomei New Materials showcases promising growth potential, with earnings expected to grow significantly at 23.95% annually, surpassing the Chinese market average. Despite past shareholder dilution and low forecasted return on equity of 10.7%, its price-to-earnings ratio of 16.9x suggests good value compared to the broader CN market. Recent activities include a completed share buyback for CNY 45 million and interim dividends, indicating proactive capital management amidst improving profitability metrics.

- Delve into the full analysis future growth report here for a deeper understanding of Guangdong Haomei New MaterialsLtd.

- Insights from our recent valuation report point to the potential undervaluation of Guangdong Haomei New MaterialsLtd shares in the market.

Key Takeaways

- Discover the full array of 383 Fast Growing Chinese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal