Emerging South Korean Stocks With Promising Potential

The South Korean stock market has recently experienced a slight downturn, with the KOSPI index dipping just below the 2,610-point mark. Despite this, global forecasts suggest mild upside potential driven by decent earnings and economic news, creating an intriguing backdrop for investors exploring emerging opportunities. In such a dynamic environment, identifying stocks with solid fundamentals and growth potential becomes crucial for capitalizing on future gains.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

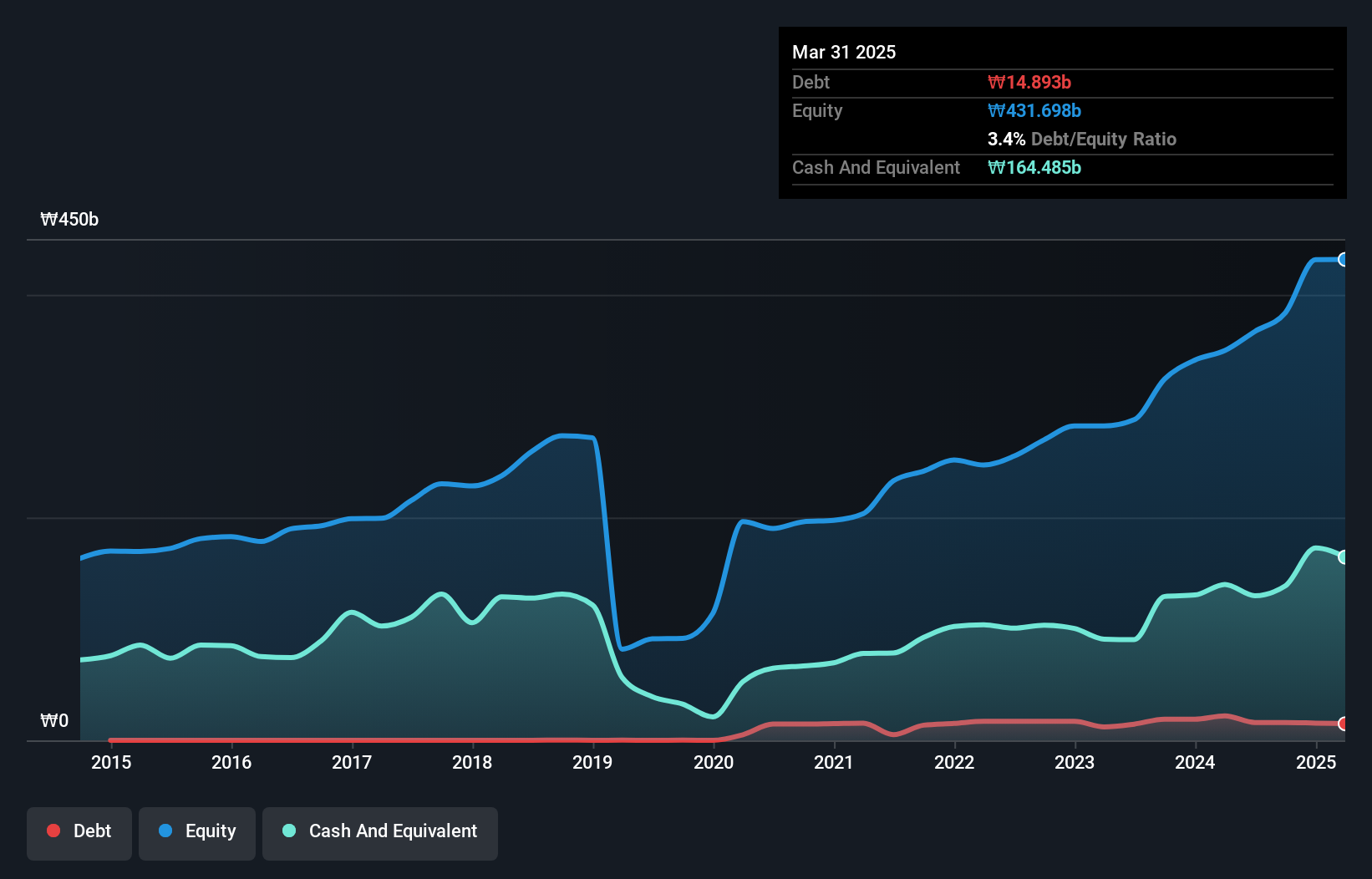

Overview: PSK HOLDINGS Inc. is a company that manufactures and sells semiconductor manufacturing and flat panel display equipment on a global scale, with a market cap of ₩1.18 trillion.

Operations: The primary revenue stream for PSK HOLDINGS comes from semiconductor manufacturing equipment, generating ₩132.98 billion.

PSK Holdings, a notable player in South Korea's semiconductor sector, has demonstrated impressive earnings growth of 40.8% over the past year, outpacing the industry average of -10%. The company is cash-rich with more cash than its total debt, indicating a robust financial position. Despite this strength, shareholders have faced dilution in the past year. The recent addition to the S&P Global BMI Index on September 23 highlights its rising prominence. However, it's worth noting that large one-off gains amounting to ₩26.4 billion have impacted recent financial results as of June 2024.

- Click to explore a detailed breakdown of our findings in PSK HOLDINGS' health report.

Evaluate PSK HOLDINGS' historical performance by accessing our past performance report.

Dongwon Industries (KOSE:A006040)

Simply Wall St Value Rating: ★★★★★☆

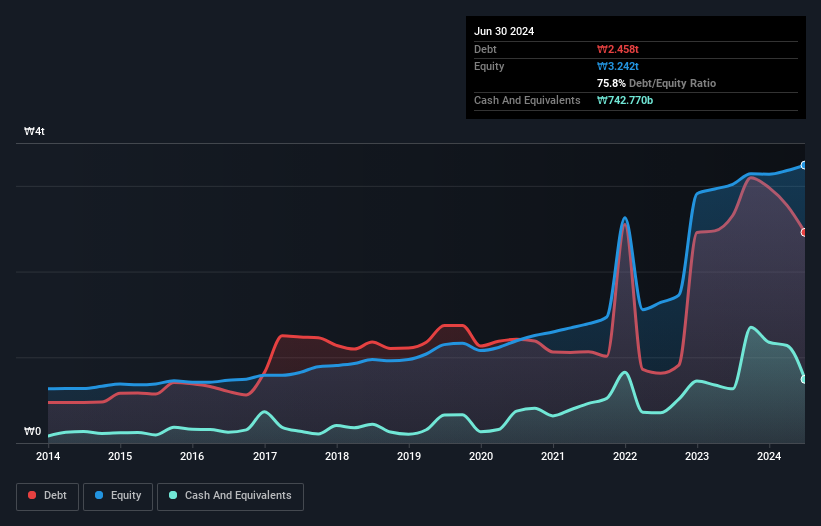

Overview: Dongwon Industries Co., Ltd. operates in the marine and fisheries, distribution, and logistics sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩1.26 trillion.

Operations: Dongwon Industries generates revenue primarily from its Food Processing and Distribution Sector, contributing ₩6.49 trillion, followed by the Logistics Business at ₩1.41 trillion. The company also earns from its Packaging Material and Fisheries sectors with revenues of ₩1.31 trillion and ₩690 billion respectively.

Dongwon Industries, a notable player in the South Korean market, has shown robust financial performance with a net income of KRW 37.96 million for Q2 2024, up from KRW 37.13 million the previous year. The company's earnings per share also rose to KRW 1,054 from KRW 1,029. Over the past year, Dongwon's earnings growth of 51.7% outpaced the food industry average of 23.2%, indicating strong operational momentum. Despite its high net debt to equity ratio at 52.9%, interest payments are well covered by EBIT at a multiple of 5.1x, reflecting sound financial management and resilience in its operations.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

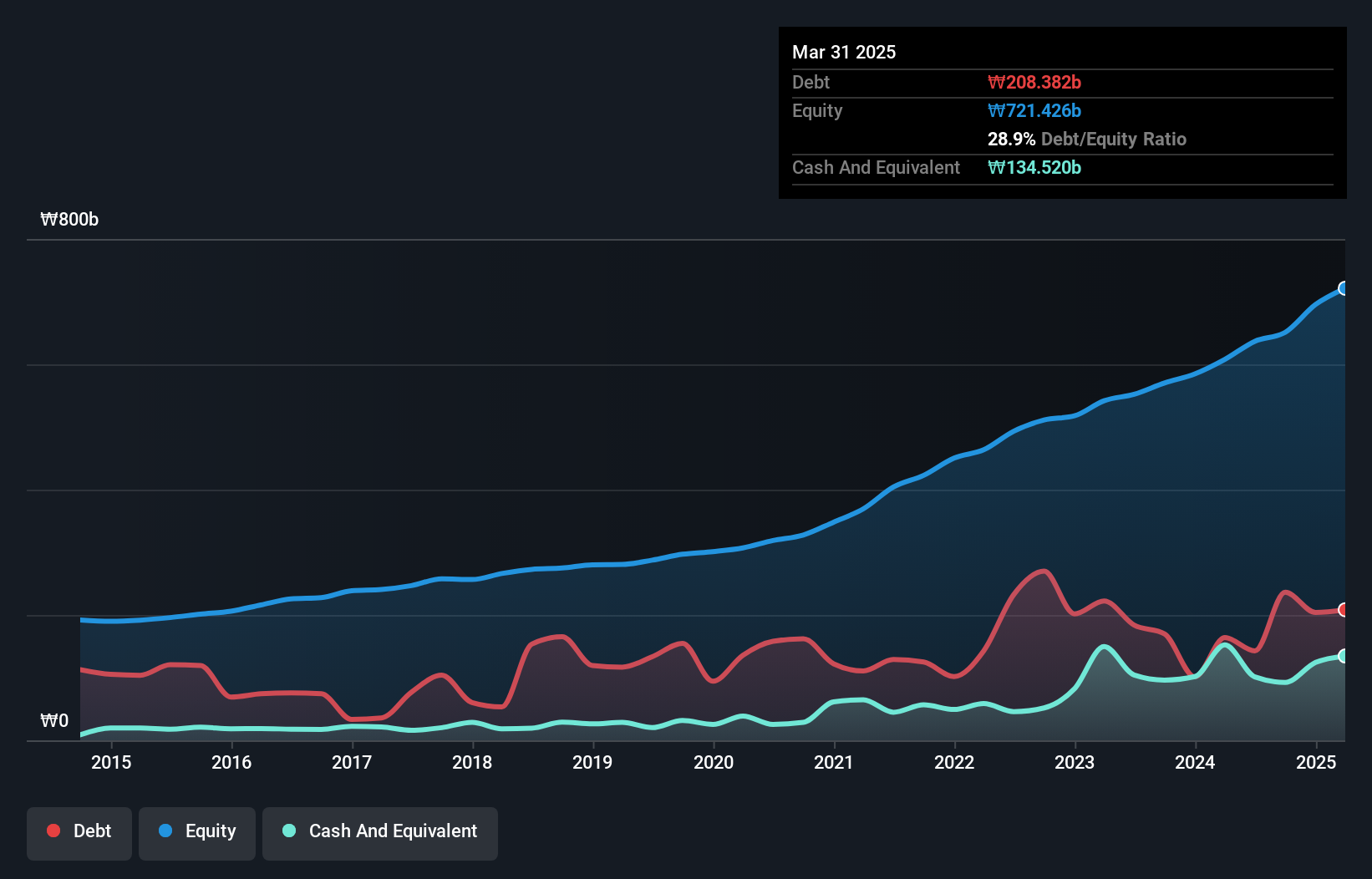

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company that specializes in the manufacturing and sale of machinery and heat combustion equipment, with a market cap of ₩1.31 trillion.

Operations: Kyung Dong Navien generates revenue primarily from its air conditioning manufacturing and sale segment, amounting to ₩1.29 billion.

Kyung Dong Navien, a notable player in the South Korean market, has shown impressive financial health with earnings growth of 85% over the past year, surpassing the building industry's average of 29%. The company's debt management is commendable, as its debt to equity ratio improved from 46% to 22% over five years. Interest payments are comfortably covered by EBIT at a multiple of 27.4x, highlighting robust operational efficiency. With high-quality earnings and positive free cash flow, Kyung Dong Navien seems well-positioned for continued success in its sector.

- Navigate through the intricacies of Kyung Dong Navien with our comprehensive health report here.

Examine Kyung Dong Navien's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Take a closer look at our KRX Undiscovered Gems With Strong Fundamentals list of 183 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal