UK's Notable Stocks That May Be Trading Below Estimated Value October 2024

As the United Kingdom's FTSE 100 index faces downward pressure due to weak trade data from China and global economic uncertainties, investors are keenly observing how these macroeconomic factors influence market valuations. In such a climate, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to navigate the current challenges effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.657 | £1.31 | 49.8% |

| GlobalData (AIM:DATA) | £1.91 | £3.71 | 48.6% |

| On the Beach Group (LSE:OTB) | £1.536 | £3.06 | 49.8% |

| S&U (LSE:SUS) | £19.20 | £36.53 | 47.4% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.256 | £2.48 | 49.4% |

| Redcentric (AIM:RCN) | £1.25 | £2.41 | 48.2% |

| Loungers (AIM:LGRS) | £2.67 | £5.34 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.18975 | £0.37 | 48.7% |

| St. James's Place (LSE:STJ) | £8.55 | £16.33 | 47.6% |

| Genel Energy (LSE:GENL) | £0.792 | £1.53 | 48.1% |

Let's explore several standout options from the results in the screener.

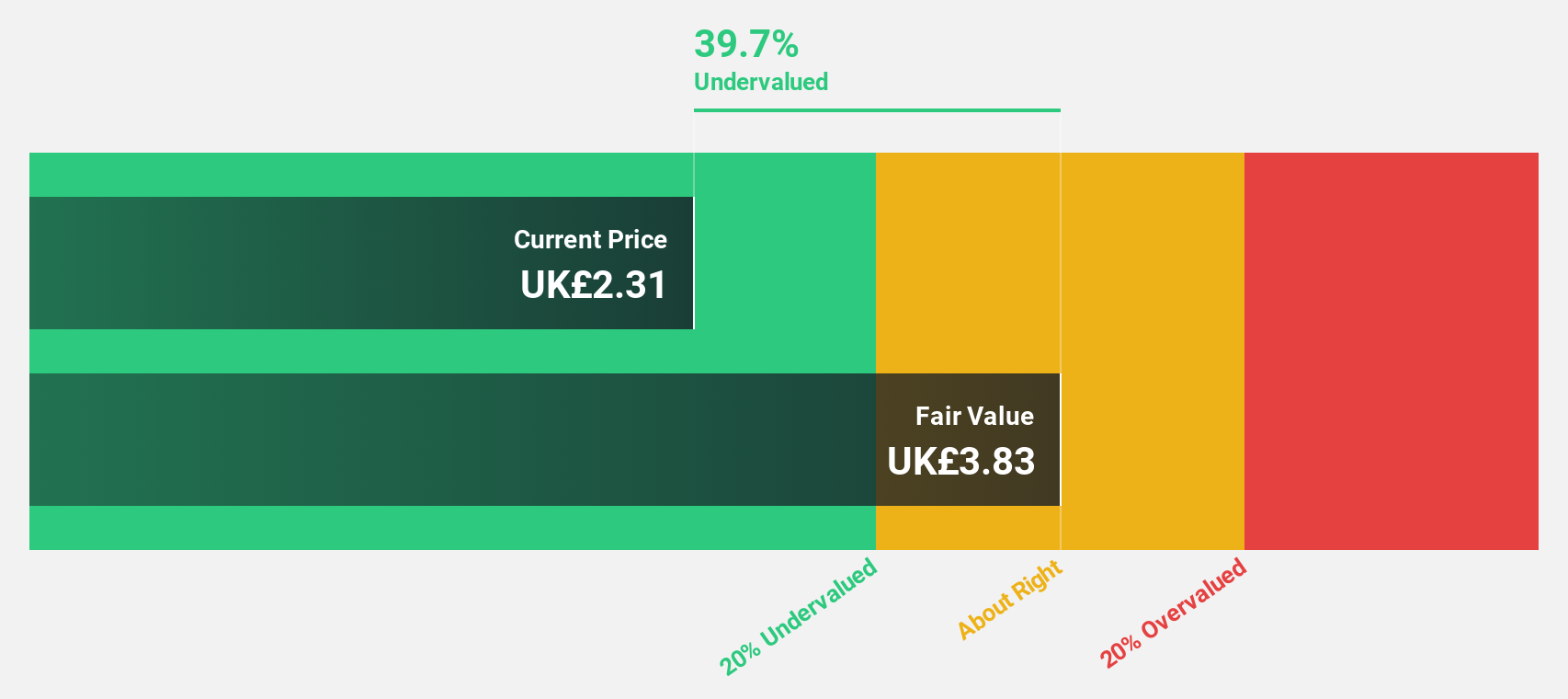

GB Group (AIM:GBG)

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally with a market cap of £824.92 million.

Operations: The company generates revenue from three main segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million).

Estimated Discount To Fair Value: 35.8%

GB Group is trading significantly below its estimated fair value of £5.09, currently priced at £3.27, suggesting it may be undervalued based on cash flows. Analysts agree on a potential price increase of 29.1%. While revenue growth is expected to outpace the UK market at 6.3% annually, profit growth projections are strong at 89.84% per year over the next three years despite low forecasted return on equity of 3.4%.

- In light of our recent growth report, it seems possible that GB Group's financial performance will exceed current levels.

- Get an in-depth perspective on GB Group's balance sheet by reading our health report here.

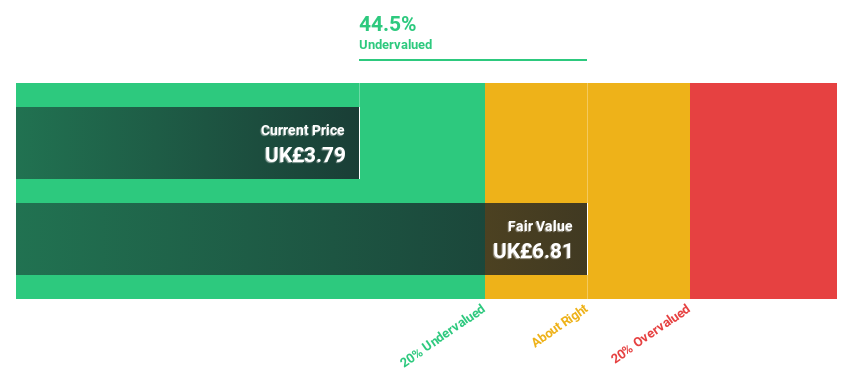

Chemring Group (LSE:CHG)

Overview: Chemring Group PLC is a company that supplies countermeasures, sensors, information, and energetic products globally, with a market cap of £1.04 billion.

Operations: The company's revenue is derived from two primary segments: Sensors & Information, which contributes £200.60 million, and Countermeasures & Energetics, which accounts for £289.10 million.

Estimated Discount To Fair Value: 43.9%

Chemring Group's current share price of £3.83 is considerably below its estimated fair value of £6.82, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 9.5% to 6.4%, earnings are projected to grow significantly at 23.1% annually, outpacing the UK market's growth rate of 14.1%. However, the company's return on equity forecast remains modest at 14%, and recent financial results include large one-off items impacting quality earnings.

- Our comprehensive growth report raises the possibility that Chemring Group is poised for substantial financial growth.

- Click here to discover the nuances of Chemring Group with our detailed financial health report.

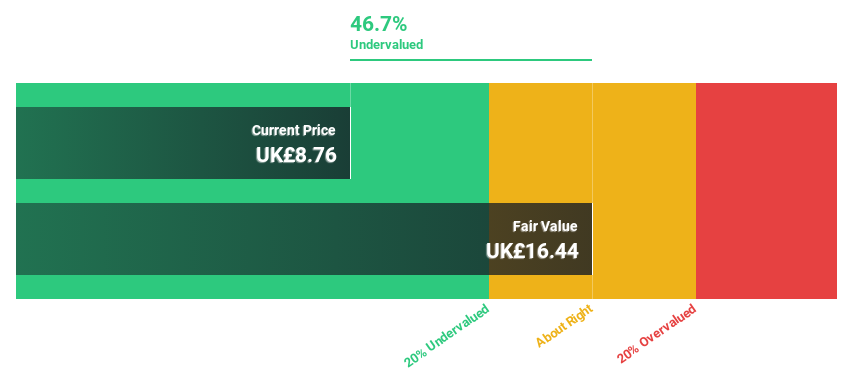

St. James's Place (LSE:STJ)

Overview: St. James's Place plc is a publicly owned investment manager with a market cap of £4.62 billion.

Operations: The company generates revenue primarily through its Wealth Management Business, which accounts for £26.80 billion.

Estimated Discount To Fair Value: 47.6%

St. James's Place is trading at £8.55, significantly below its estimated fair value of £16.33, suggesting undervaluation based on cash flows. Despite expectations of a dramatic revenue decline over the next three years, earnings are forecast to grow 27.4% annually and return on equity is projected to reach 22.8%. Recent share repurchases and a reduced interim dividend reflect strategic capital management amid volatile share prices, potentially enhancing long-term shareholder value despite current challenges in revenue growth forecasts.

- Insights from our recent growth report point to a promising forecast for St. James's Place's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of St. James's Place.

Taking Advantage

- Delve into our full catalog of 60 Undervalued UK Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal