October 2024 KRX Growth Stocks With High Insider Confidence

Despite recent fluctuations, the South Korean stock market has shown resilience, with the KOSPI index hovering just below the 2,610-point mark amid mixed performances across sectors. In this environment, growth companies with high insider ownership are particularly noteworthy as they often signal strong internal confidence and potential stability amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Vuno (KOSDAQ:A338220) | 19.4% | 110.9% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Underneath we present a selection of stocks filtered out by our screen.

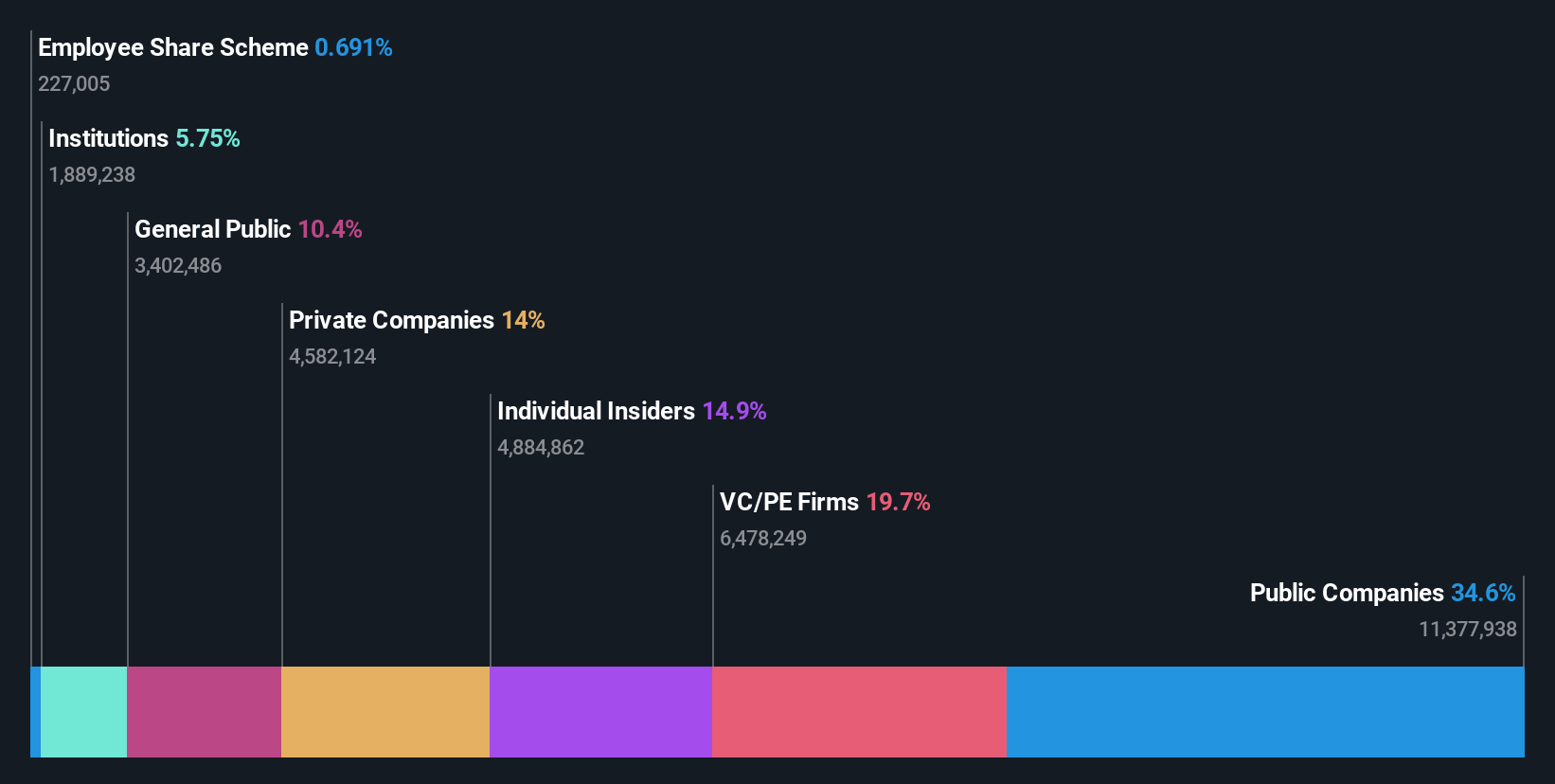

Oscotec (KOSDAQ:A039200)

Simply Wall St Growth Rating: ★★★★★★

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of approximately ₩1.54 billion.

Operations: The company generates revenue from its Food Business Division (₩1.69 billion), Medical Business Sector (₩1.63 billion), New Drug Business Division (₩990.90 million), and Functional Materials Division (₩310.71 million).

Insider Ownership: 26.1%

Earnings Growth Forecast: 122% p.a.

Oscotec is expected to experience significant growth, with earnings forecasted to increase by 122% annually and revenue projected to rise at 68.9% per year, outpacing the South Korean market. The company is trading at a substantial discount, 38.7% below its estimated fair value. Despite these promising growth metrics, Oscotec's current revenue remains relatively low at ₩5 billion and its share price has been highly volatile over the past three months.

- Dive into the specifics of Oscotec here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Oscotec is priced higher than what may be justified by its financials.

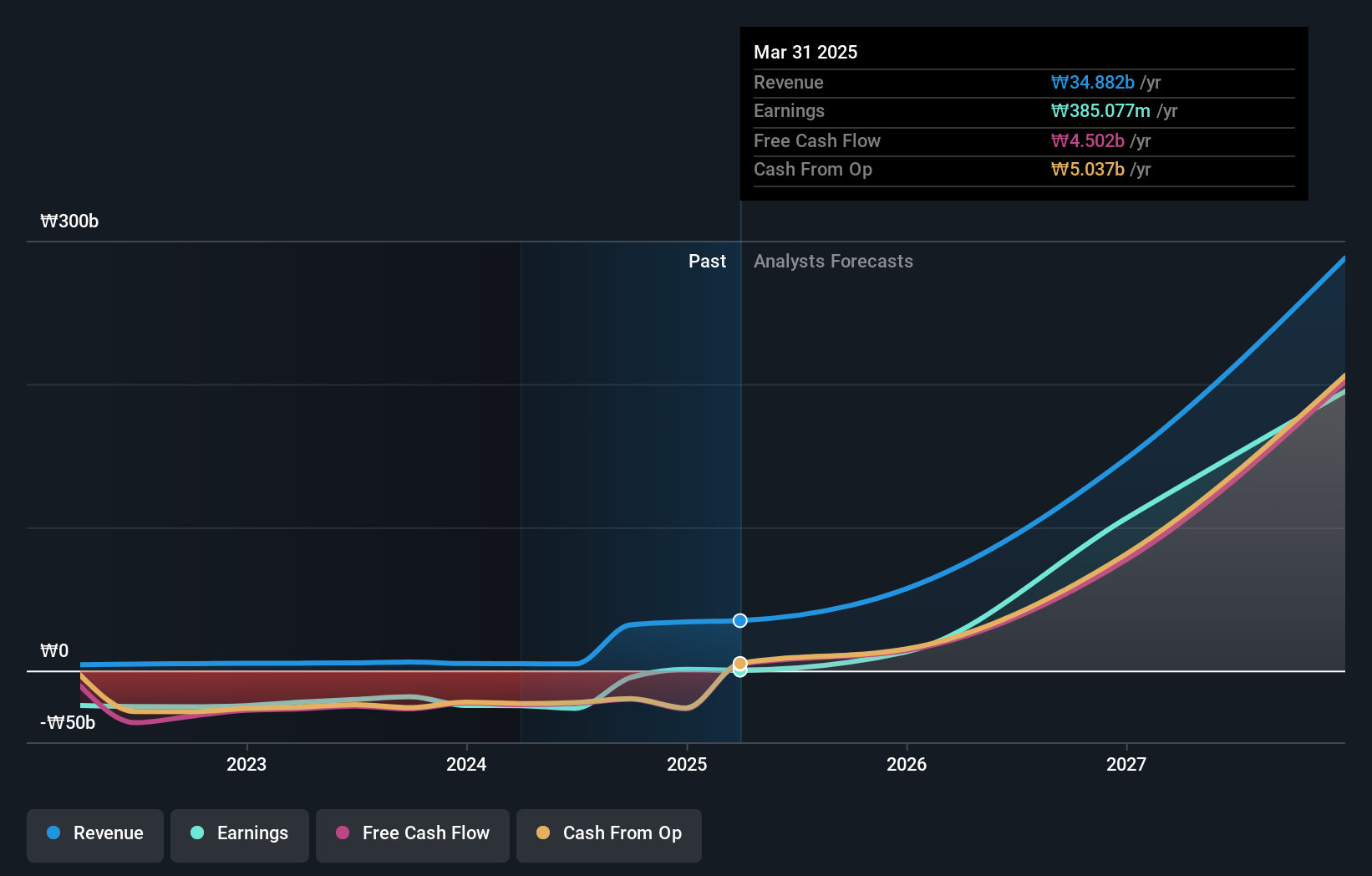

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.40 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, totaling ₩90.79 billion.

Insider Ownership: 26.6%

Earnings Growth Forecast: 99.5% p.a.

ALTEOGEN is trading at a significant discount, 70.5% below its estimated fair value, with earnings expected to grow by 99.46% annually. The company is projected to become profitable within three years, surpassing average market growth rates. Revenue growth is forecasted at 64.2% per year, well above the South Korean market average of 10.3%. However, the share price has been highly volatile recently and shareholders experienced dilution over the past year.

- Get an in-depth perspective on ALTEOGEN's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that ALTEOGEN's share price might be on the expensive side.

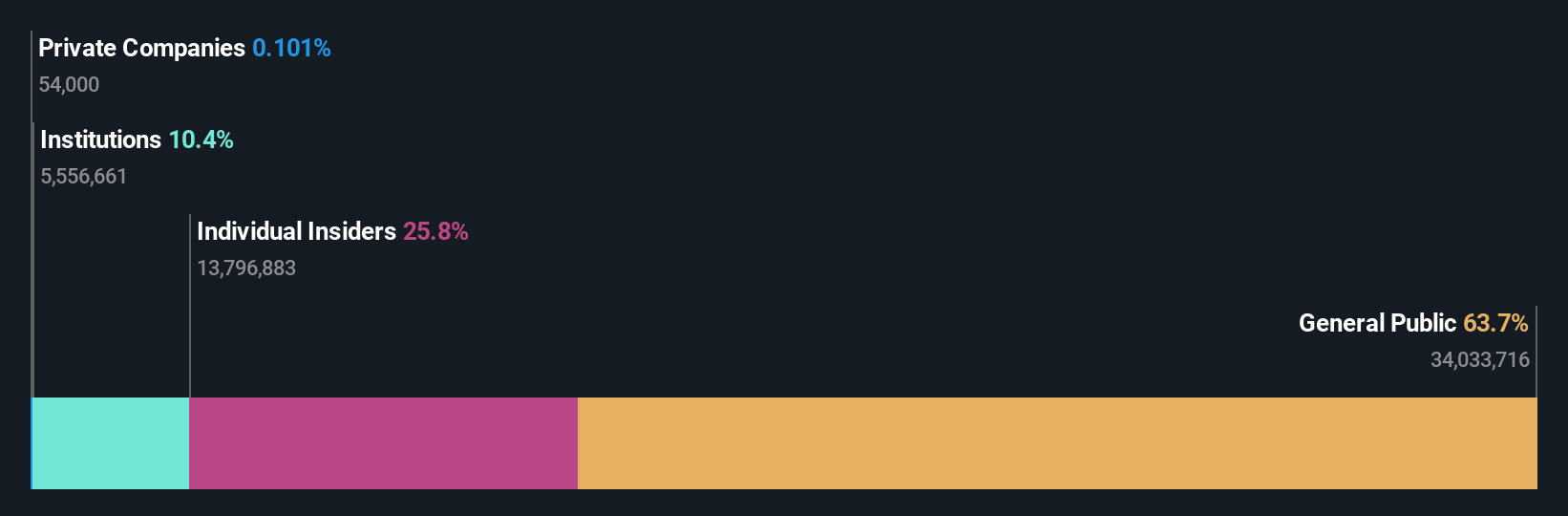

SOCAR (KOSE:A403550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SOCAR Inc. is a mobility company based in South Korea with a market capitalization of ₩593.20 billion.

Operations: The company's revenue is primarily generated from car sharing, which accounts for ₩372.90 billion, followed by micro mobility at ₩22.03 billion and platform parking services contributing ₩7.80 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 106.1% p.a.

SOCAR is trading at a substantial discount, 88% below its estimated fair value. Despite reporting increased net losses recently, the company is expected to achieve profitability within three years, outperforming average market growth. Revenue is anticipated to grow at 18% annually, faster than the South Korean market's average of 10.3%. Analysts agree on a potential stock price increase of 47.5%, although return on equity remains low with forecasts at just 7.1%.

- Click to explore a detailed breakdown of our findings in SOCAR's earnings growth report.

- Our comprehensive valuation report raises the possibility that SOCAR is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click this link to deep-dive into the 86 companies within our Fast Growing KRX Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal