Top Dividend Stocks On Euronext Amsterdam For October 2024

As European markets show signs of optimism with the pan-European STOXX Europe 600 Index rising amid hopes for quicker interest rate cuts by the ECB, investors are increasingly looking at dividend stocks on Euronext Amsterdam as a stable income source. In this climate, selecting strong dividend stocks involves evaluating companies with solid financial health and consistent payout histories, which can offer reliable returns even amidst broader economic fluctuations.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.40% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.34% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.81% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.99% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.37% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.92% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.65% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

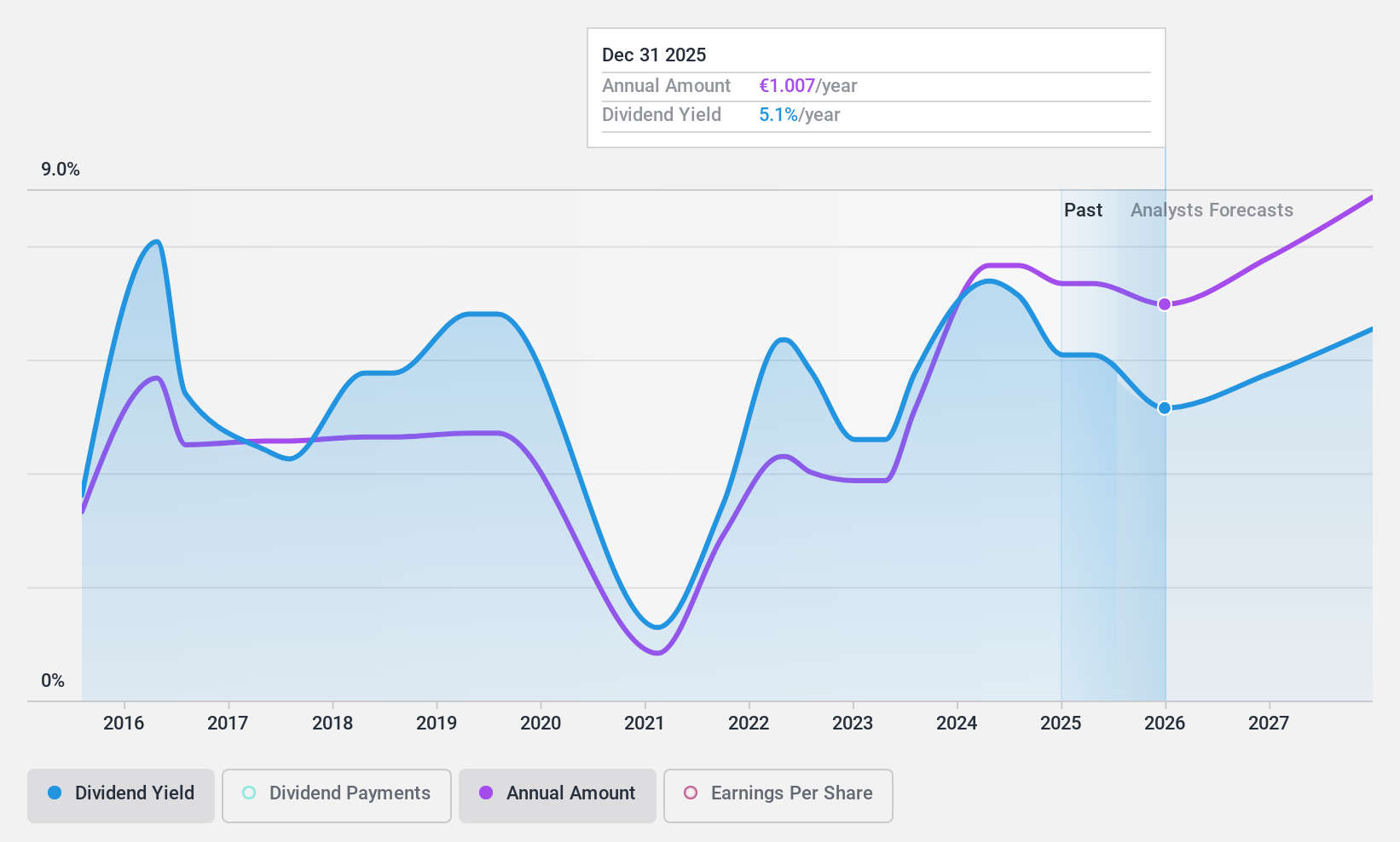

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V. operates in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients for the food and beverage industry globally with a market cap of €512.39 million.

Operations: Acomo N.V.'s revenue is primarily derived from its segments: Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

Dividend Yield: 6.6%

Acomo offers a dividend yield of 6.65%, placing it among the top 25% of Dutch dividend payers, but its high payout ratio of 95.7% raises concerns about sustainability given earnings coverage issues. Despite a reasonable cash payout ratio of 51%, dividends have been volatile over the past decade with reliability issues. Recent earnings show a decline, with net income at €17.94 million for H1 2024, affecting overall financial stability and dividend prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Acomo.

- In light of our recent valuation report, it seems possible that Acomo is trading beyond its estimated value.

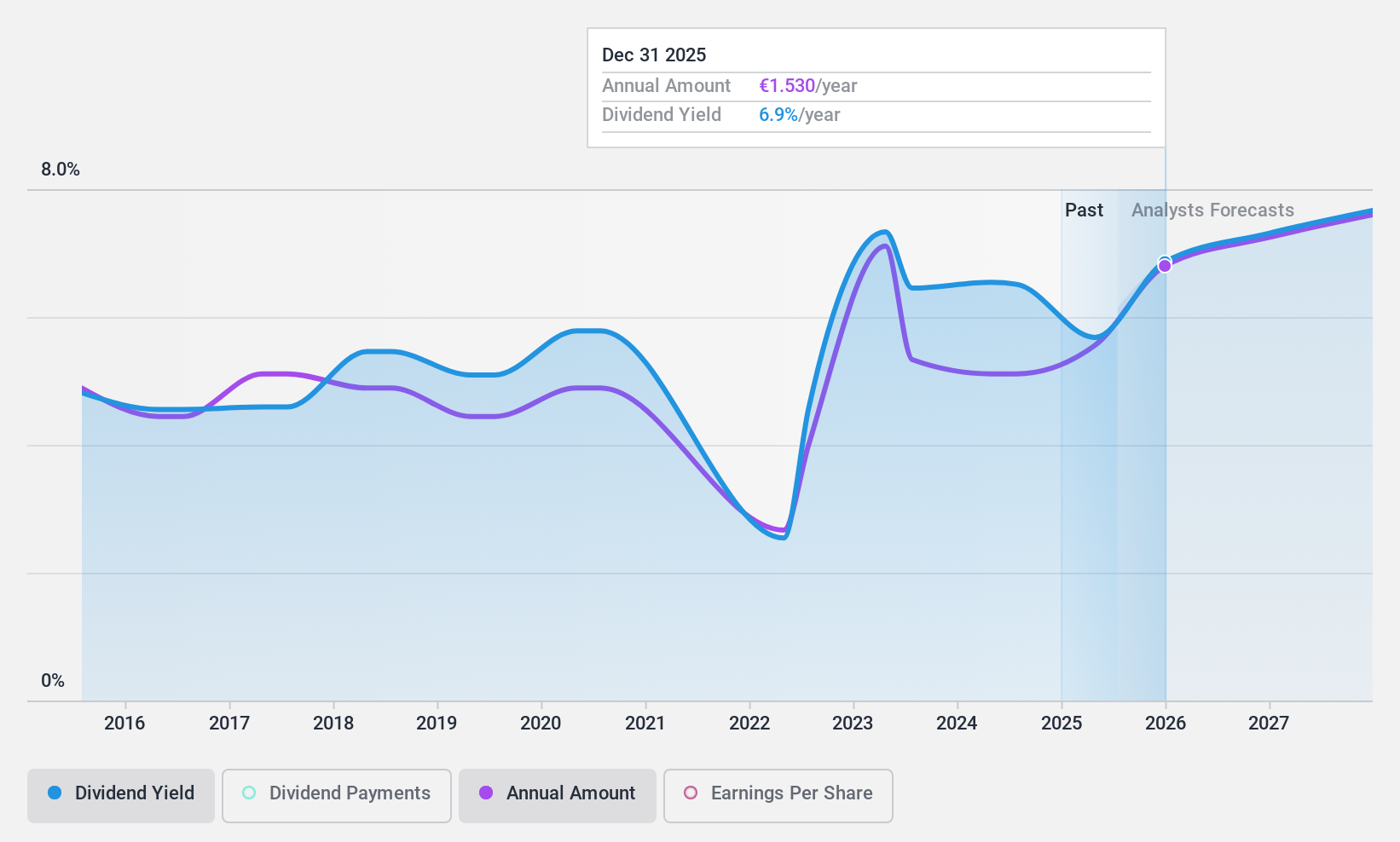

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a wide range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and internationally, with a market cap of €50.30 billion.

Operations: ING Groep N.V.'s revenue is primarily derived from Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and the Corporate Line (€334 million).

Dividend Yield: 6.9%

ING Groep's dividend yield of 6.92% ranks it in the top 25% of Dutch dividend payers, supported by a moderate payout ratio of 69.8%, indicating earnings coverage. However, its dividends have been volatile over the past nine years, raising reliability concerns. Recent share buybacks totaling €2.49 billion reflect strategic capital management but coincide with declining net income figures for H1 2024 at €3.36 billion, potentially impacting future dividend stability and growth prospects.

- Unlock comprehensive insights into our analysis of ING Groep stock in this dividend report.

- Our expertly prepared valuation report ING Groep implies its share price may be lower than expected.

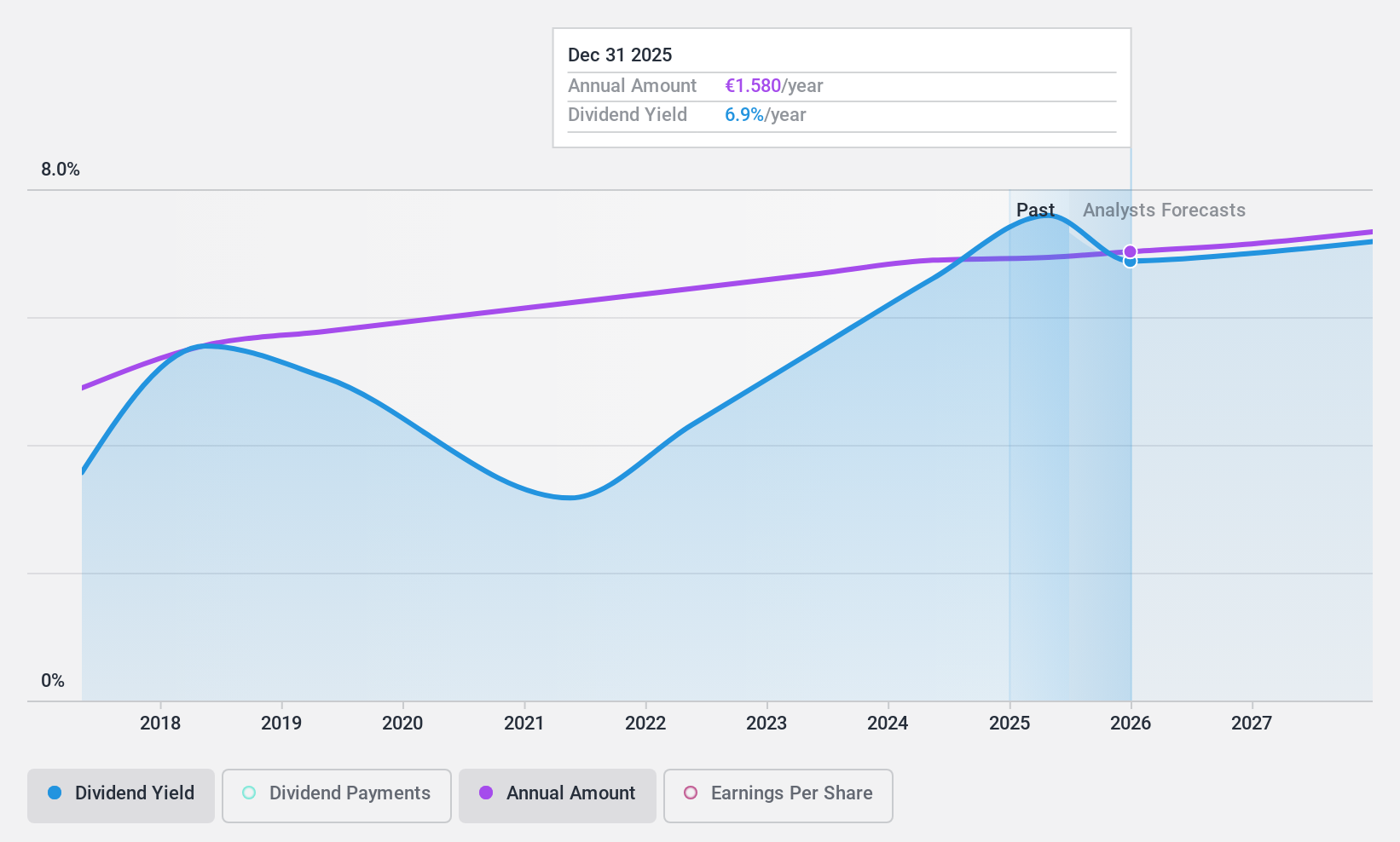

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally, with a market cap of €2.80 billion.

Operations: Signify N.V.'s revenue segments include €519 million from Conventional lighting.

Dividend Yield: 7.0%

Signify's dividend yield of 6.99% places it among the top 25% of Dutch dividend payers, with a payout ratio of 80.4%, indicating earnings coverage. However, its dividends have been volatile and unreliable over its eight-year history. Despite a strong cash flow coverage at a 34.2% cash payout ratio, the recent drop from the FTSE All-World Index and fluctuating sales figures highlight potential challenges to maintaining stable dividends in the future.

- Navigate through the intricacies of Signify with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Signify is priced lower than what may be justified by its financials.

Key Takeaways

- Get an in-depth perspective on all 7 Top Euronext Amsterdam Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal