3 Euronext Paris Stocks Estimated To Be Up To 41.5% Below Intrinsic Value

Amidst a cautiously optimistic European market environment, the CAC 40 Index in France has shown modest gains, reflecting investor hopes for potential interest rate cuts by the European Central Bank. In this context, identifying undervalued stocks becomes crucial as they may offer opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €29.40 | €57.34 | 48.7% |

| Vivendi (ENXTPA:VIV) | €10.58 | €18.09 | 41.5% |

| Lectra (ENXTPA:LSS) | €27.35 | €52.99 | 48.4% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.08 | 39.8% |

| EKINOPS (ENXTPA:EKI) | €4.06 | €6.98 | 41.8% |

| Solutions 30 (ENXTPA:S30) | €1.178 | €2.33 | 49.4% |

| Vogo (ENXTPA:ALVGO) | €3.25 | €6.28 | 48.2% |

| Prodways Group (ENXTPA:PWG) | €0.525 | €0.80 | 34.4% |

| Exail Technologies (ENXTPA:EXA) | €17.22 | €29.38 | 41.4% |

| OVH Groupe (ENXTPA:OVH) | €7.16 | €12.20 | 41.3% |

Here we highlight a subset of our preferred stocks from the screener.

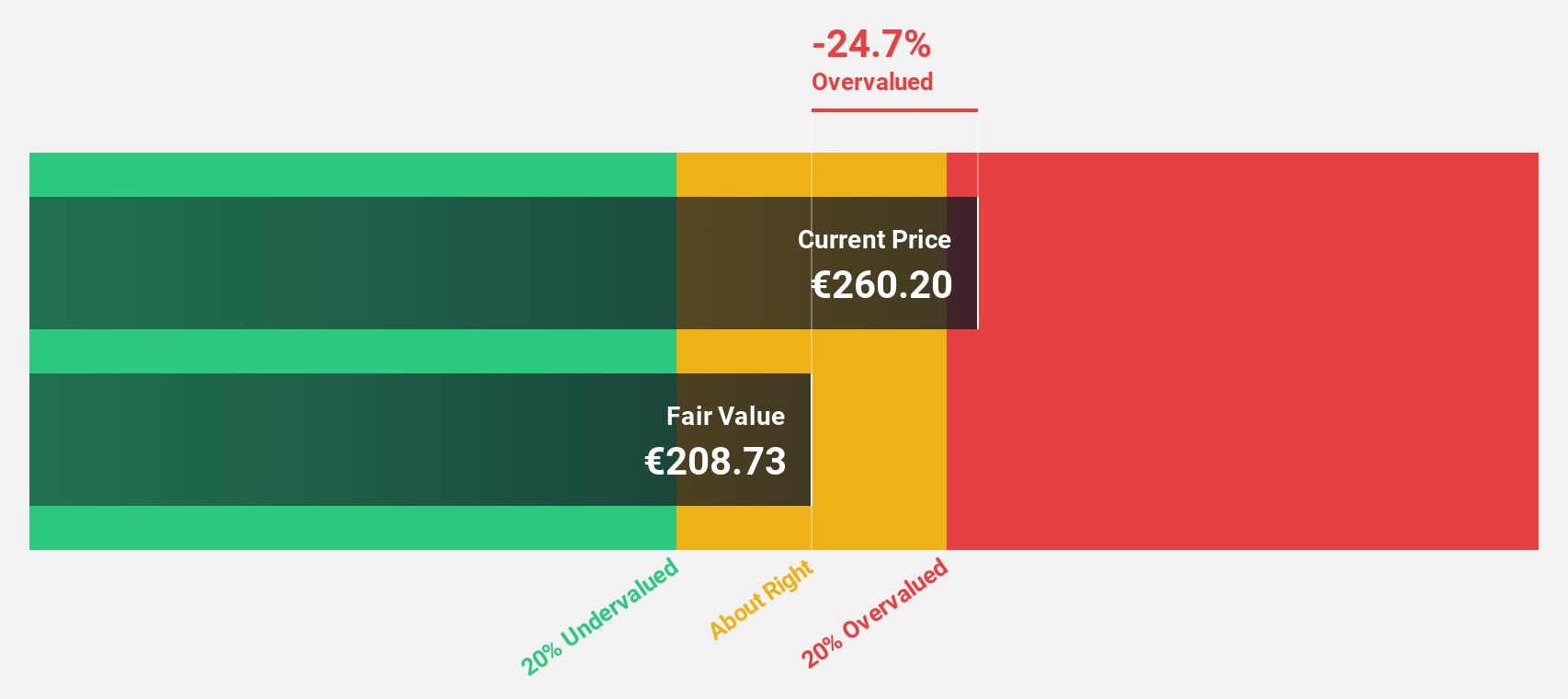

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally and has a market cap of €90.13 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

Estimated Discount To Fair Value: 25.5%

Safran is trading at €214.4, which is 25.5% below its estimated fair value of €287.95, indicating it may be undervalued based on cash flows. Despite a decline in profit margins from 14.4% to 6.4% over the past year, Safran's earnings are forecast to grow at 19.54% annually, outpacing the French market's growth rate of 12.1%. Recent half-year results showed increased revenue but significantly lower net income compared to last year.

- The growth report we've compiled suggests that Safran's future prospects could be on the up.

- Click here to discover the nuances of Safran with our detailed financial health report.

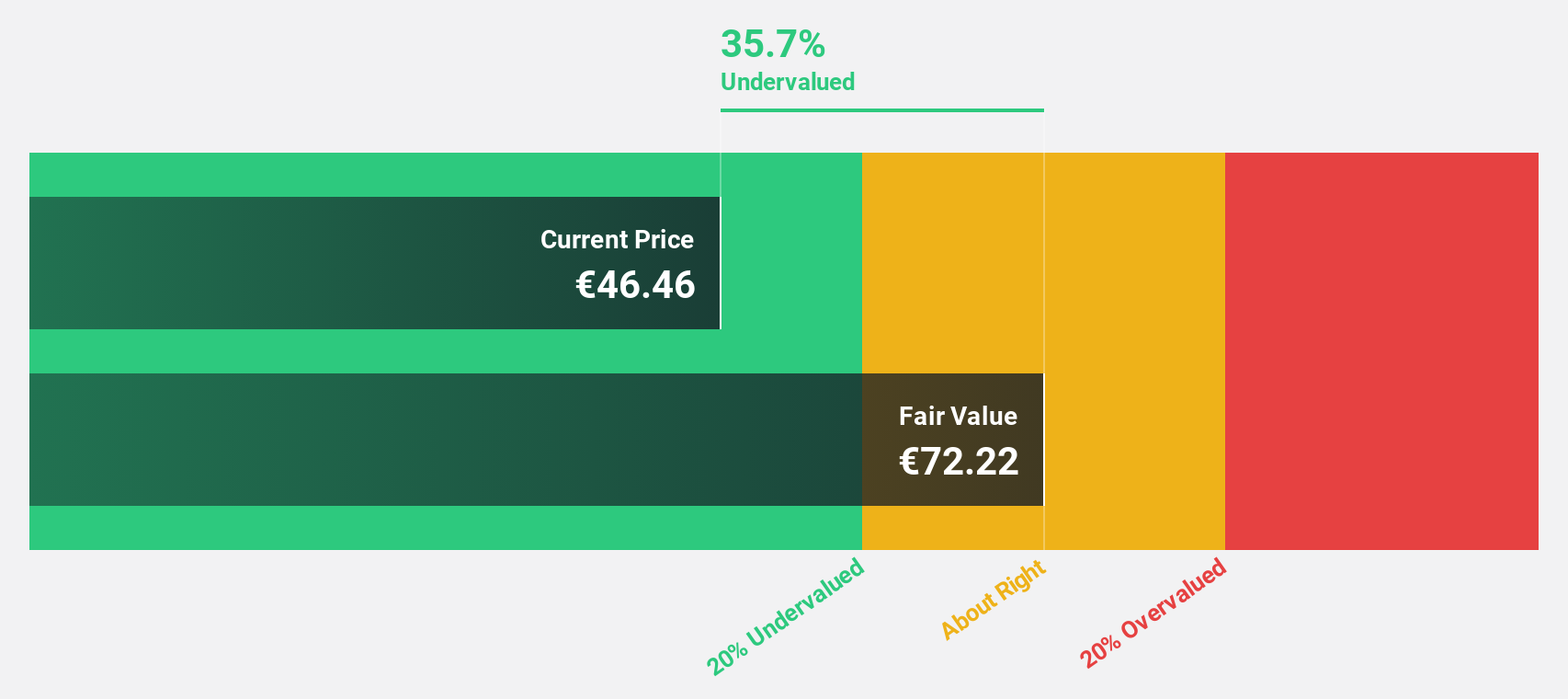

SPIE (ENXTPA:SPIE)

Overview: SPIE SA is a company that offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of €5.94 billion.

Operations: The company's revenue is primarily derived from North-Western Europe (€1.89 billion) and Global Services Energy (€684.90 million).

Estimated Discount To Fair Value: 34.1%

SPIE is trading at €35.6, significantly below its estimated fair value of €54.02, highlighting its potential undervaluation based on cash flows. The company's revenue and earnings are projected to grow faster than the French market, with expected annual profit growth of 20%. However, SPIE's high debt level and unstable dividend track record pose risks. Recent half-year results revealed increased sales but a decline in net income compared to the previous year.

- In light of our recent growth report, it seems possible that SPIE's financial performance will exceed current levels.

- Get an in-depth perspective on SPIE's balance sheet by reading our health report here.

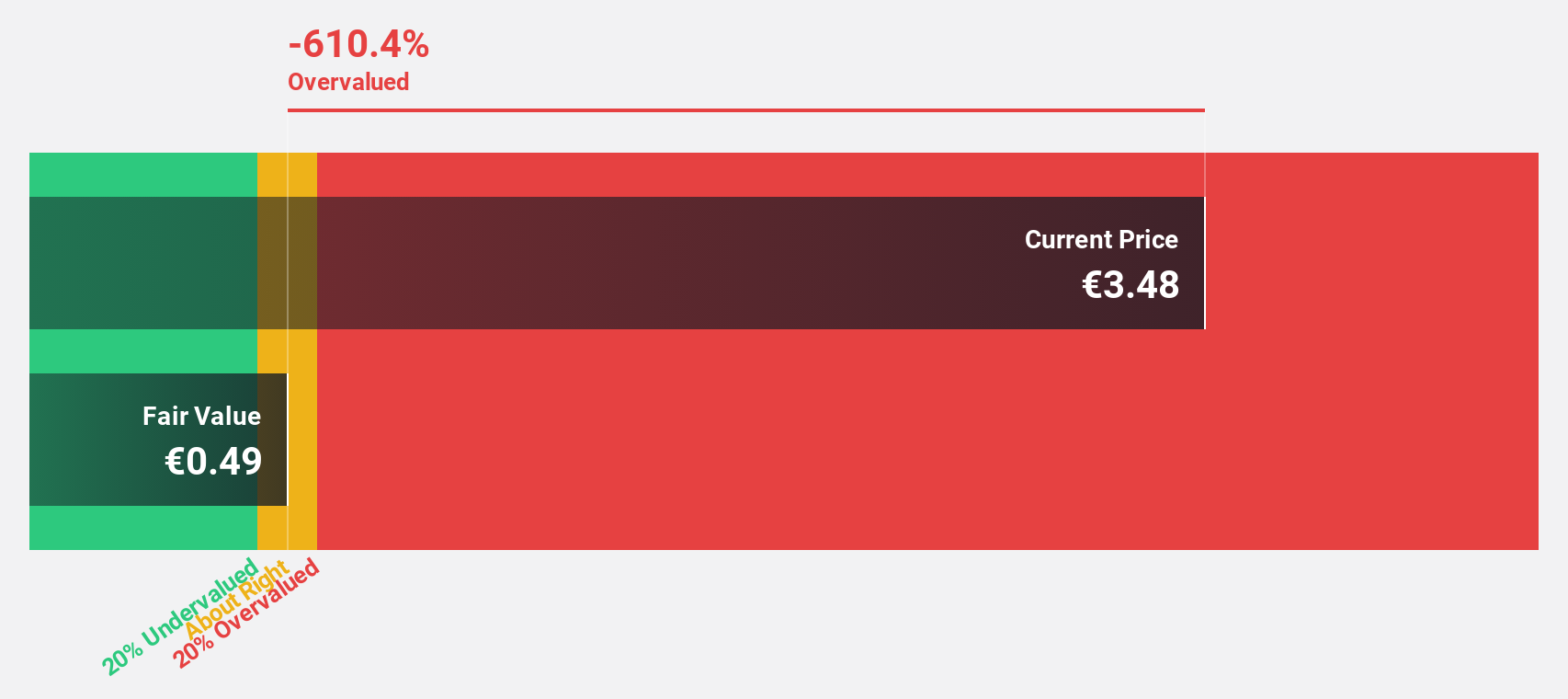

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is an entertainment, media, and communication company operating across France, Europe, the Americas, Asia/Oceania, and Africa with a market cap of €10.67 billion.

Operations: The company's revenue is derived from several segments, including Canal + Group (€6.20 billion), Havas Group (€2.92 billion), Gameloft (€304 million), Prisma Media (€303 million), Vivendi Village (€151 million), New Initiatives (€176 million), and a Segment Adjustment of €4.86 billion.

Estimated Discount To Fair Value: 41.5%

Vivendi is trading at €10.58, well below its estimated fair value of €18.09, suggesting significant undervaluation based on cash flows. The company's revenue and earnings are forecast to grow faster than the French market, with earnings expected to increase significantly at 30.6% annually over the next three years. Despite becoming profitable this year, Vivendi's return on equity is projected to remain low and it has an unstable dividend track record. Recent results show increased sales but a slight decline in net income compared to last year.

- Our earnings growth report unveils the potential for significant increases in Vivendi's future results.

- Delve into the full analysis health report here for a deeper understanding of Vivendi.

Seize The Opportunity

- Click here to access our complete index of 20 Undervalued Euronext Paris Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal