RMS Mezzanine (SEP:PVT) sheds 34% this week, as yearly returns fall more in line with earnings growth

The last three months have been tough on RMS Mezzanine, a.s. (SEP:PVT) shareholders, who have seen the share price decline a rather worrying 36%. But the silver lining is the stock is up over five years. In that time, it is up 61%, which isn't bad, but is below the market return of 106%. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 47% in the last three years.

While the stock has fallen 34% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for RMS Mezzanine

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

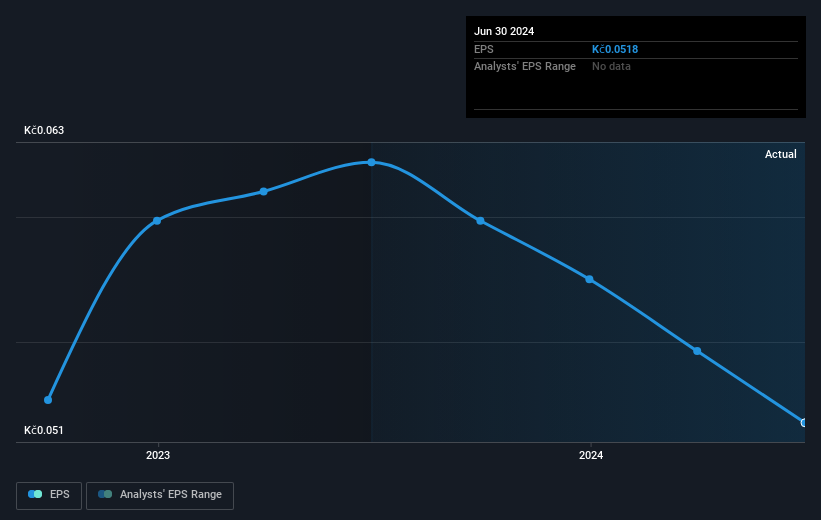

During five years of share price growth, RMS Mezzanine achieved compound earnings per share (EPS) growth of 16% per year. The EPS growth is more impressive than the yearly share price gain of 10% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into RMS Mezzanine's key metrics by checking this interactive graph of RMS Mezzanine's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 1.7% in the last year, RMS Mezzanine shareholders lost 31%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for RMS Mezzanine (of which 2 can't be ignored!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Czech exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal