It's A Story Of Risk Vs Reward With Guizhou Panjiang Refined Coal Co.,Ltd. (SHSE:600395)

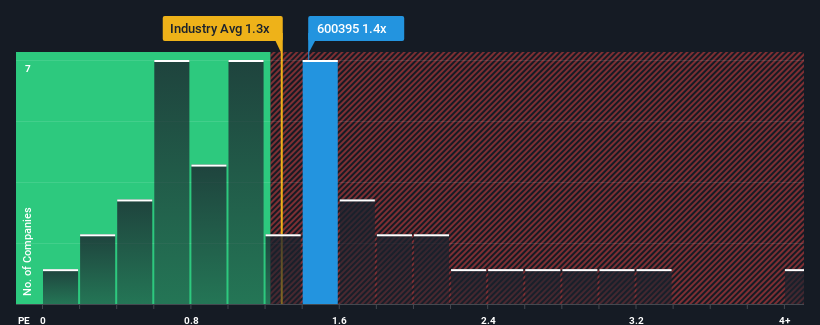

There wouldn't be many who think Guizhou Panjiang Refined Coal Co.,Ltd.'s (SHSE:600395) price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S for the Oil and Gas industry in China is similar at about 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Guizhou Panjiang Refined CoalLtd

How Guizhou Panjiang Refined CoalLtd Has Been Performing

With revenue that's retreating more than the industry's average of late, Guizhou Panjiang Refined CoalLtd has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Guizhou Panjiang Refined CoalLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Guizhou Panjiang Refined CoalLtd would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 16% over the next year. That's shaping up to be materially higher than the 5.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Guizhou Panjiang Refined CoalLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Guizhou Panjiang Refined CoalLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 4 warning signs for Guizhou Panjiang Refined CoalLtd (3 are concerning!) that we have uncovered.

If you're unsure about the strength of Guizhou Panjiang Refined CoalLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal