3 ASX Growth Stocks Insiders Are Betting On

The Australian market has recently faced challenges, with the ASX200 down 0.9% as commodity stocks weigh heavily and investors anticipate key economic data from China. Amidst this backdrop, almost all sectors are seeing declines, highlighting the importance of identifying growth companies with strong insider ownership as a potential indicator of confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 45.4% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 59.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.2% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's review some notable picks from our screened stocks.

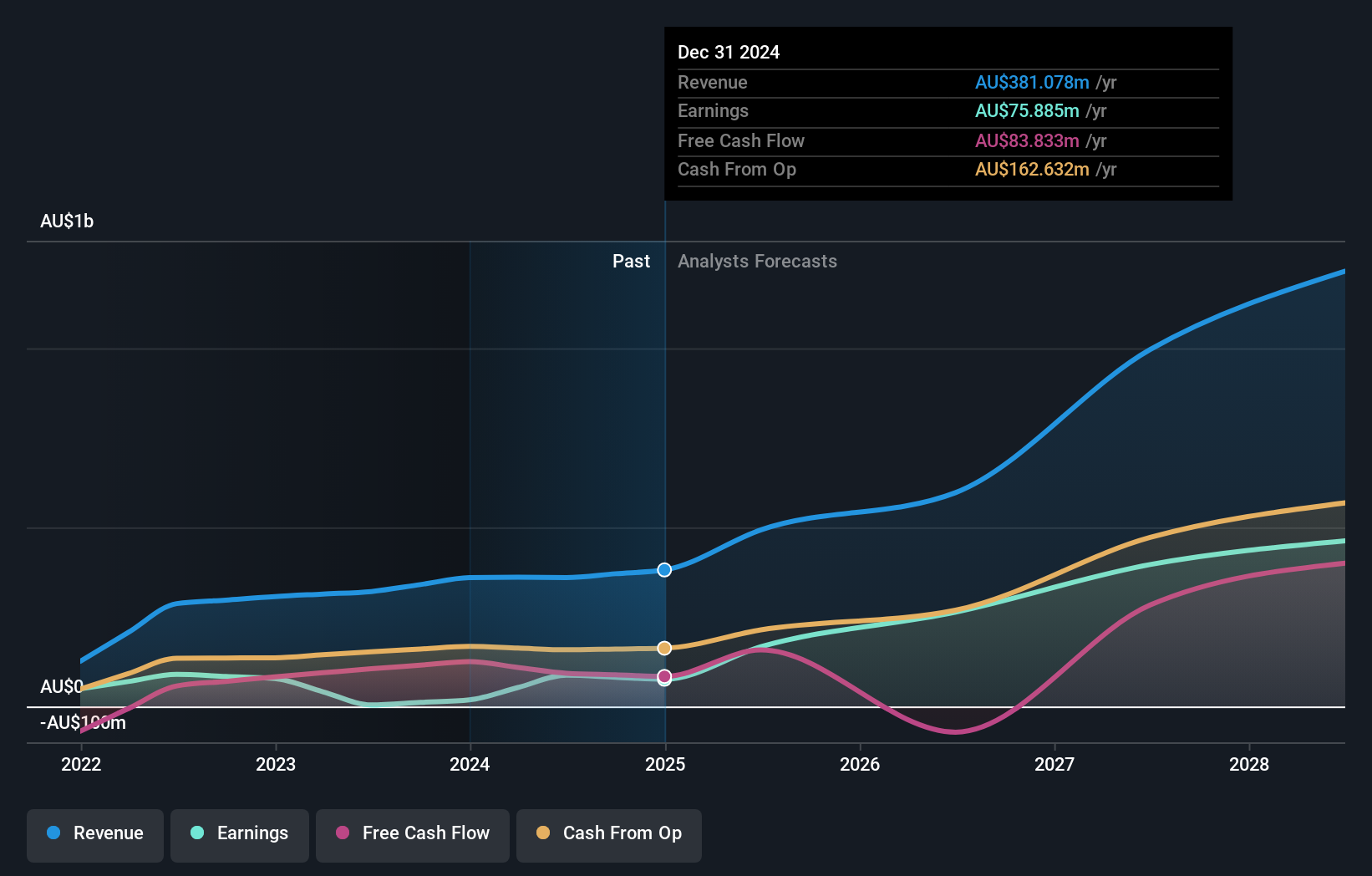

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties with a market capitalization of A$2.43 billion.

Operations: The company's revenue is primarily generated from its Karlawinda gold project, amounting to A$359.73 million.

Insider Ownership: 11.9%

Revenue Growth Forecast: 19.7% p.a.

Capricorn Metals demonstrates strong growth potential with earnings expected to grow significantly, surpassing the Australian market's average. The company reported a substantial increase in net income to A$87.14 million for the year ending June 2024, driven by expanded mineral reserves at its Karlawinda Gold Project. Trading below its estimated fair value, Capricorn's ongoing expansion study aims to boost production capacity by up to 55%, enhancing its long-term growth prospects despite slower revenue growth forecasts.

- Click to explore a detailed breakdown of our findings in Capricorn Metals' earnings growth report.

- Our expertly prepared valuation report Capricorn Metals implies its share price may be lower than expected.

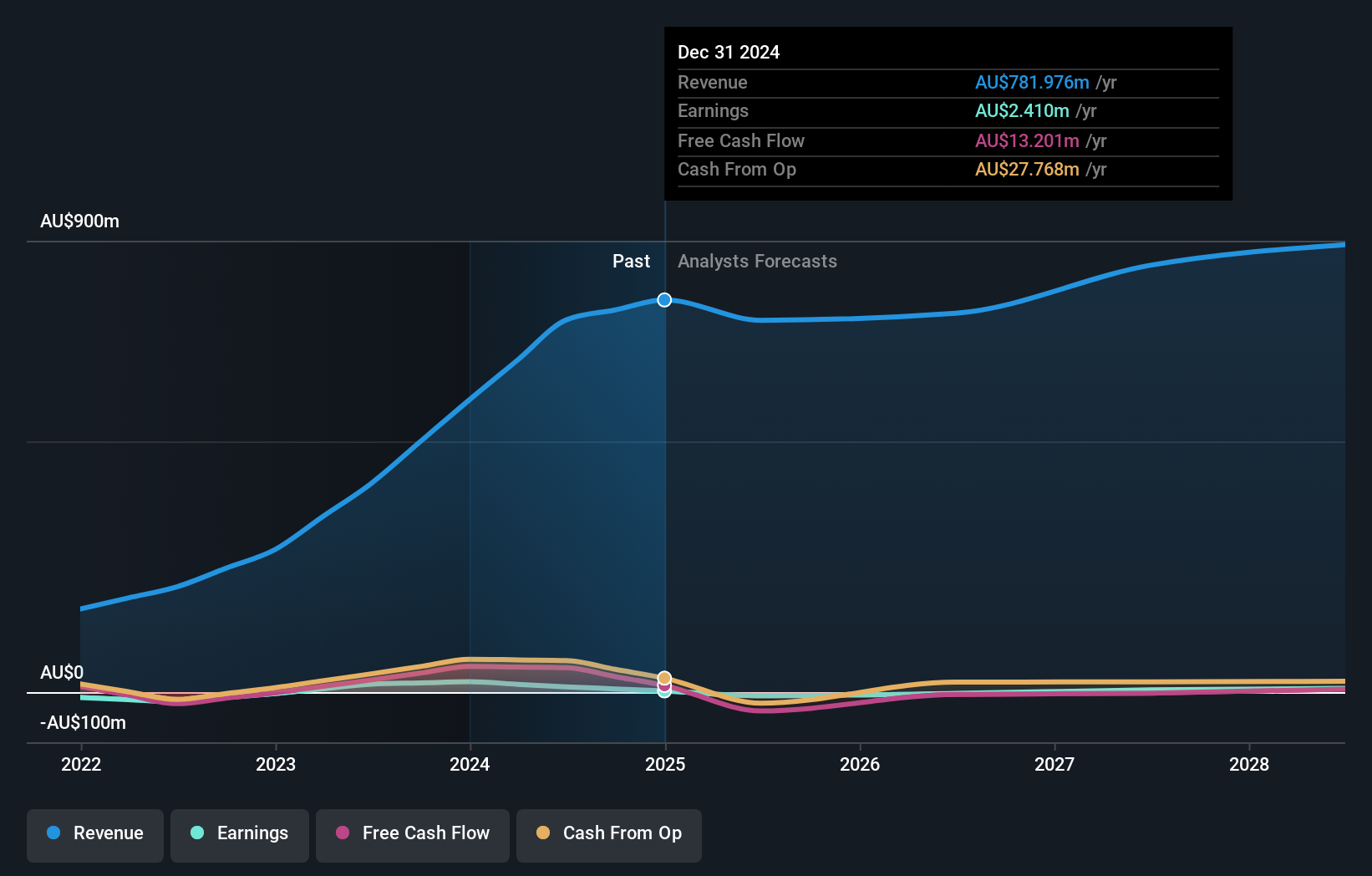

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$850.16 million.

Operations: The company's revenue is primarily generated from online retail sales, amounting to A$742.26 million.

Insider Ownership: 33.5%

Revenue Growth Forecast: 16.1% p.a.

Cettire shows promising growth with earnings projected to rise significantly, outpacing the Australian market. Despite a lower profit margin this year, revenue grew to A$742.26 million from A$416.23 million previously. Insider confidence is reflected in substantial share purchases recently, while no major sales occurred. The appointment of Caroline Elliott as an Independent Non-Executive Director adds strategic depth to the board amid expectations of continued healthy revenue growth into fiscal 2025's first quarter.

- Delve into the full analysis future growth report here for a deeper understanding of Cettire.

- Our valuation report here indicates Cettire may be overvalued.

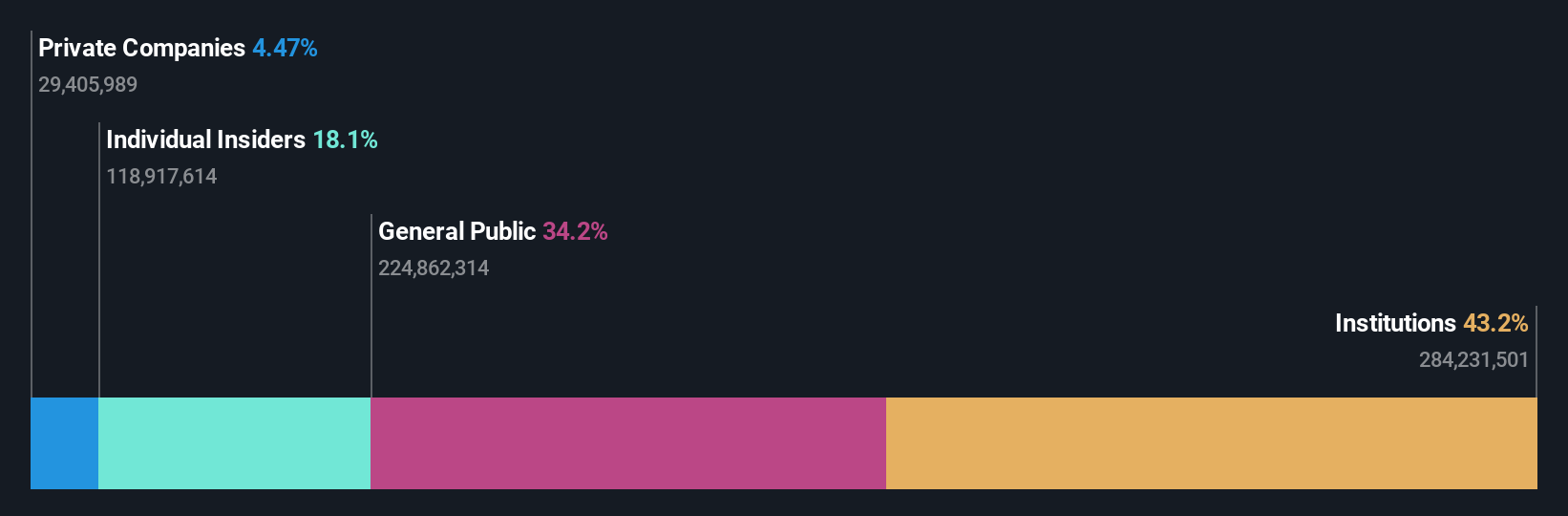

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.73 billion.

Operations: The company's revenue primarily comes from its mine operations, amounting to A$366.04 million.

Insider Ownership: 18%

Revenue Growth Forecast: 31.1% p.a.

Emerald Resources demonstrates strong growth potential, with earnings forecasted to grow significantly at 32.2% annually, surpassing the Australian market's average. Recent financial performance shows a rise in net income to A$84.27 million from A$59.36 million, alongside revenue growth to A$371.07 million. Despite past shareholder dilution, insider ownership remains high without substantial recent selling or buying activity. The retirement of influential board member Simon Lee may impact strategic direction but underscores the company's robust leadership history.

- Click here and access our complete growth analysis report to understand the dynamics of Emerald Resources.

- The valuation report we've compiled suggests that Emerald Resources' current price could be inflated.

Turning Ideas Into Actions

- Gain an insight into the universe of 97 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal