3 German Stocks Estimated To Be Trading At Discounts Of Up To 44.3%

As the German economy faces a challenging period with forecasts indicating a contraction in 2024, investors are keenly observing market movements for potential opportunities. Despite this economic backdrop, certain stocks may be trading at significant discounts, presenting intriguing possibilities for value-focused investors. Identifying undervalued stocks often involves looking at companies with strong fundamentals that might be temporarily overlooked by the market amidst broader economic concerns.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €15.95 | €30.70 | 48% |

| init innovation in traffic systems (XTRA:IXX) | €36.00 | €52.15 | 31% |

| 2G Energy (XTRA:2GB) | €23.25 | €41.15 | 43.5% |

| Formycon (XTRA:FYB) | €52.00 | €81.58 | 36.3% |

| CeoTronics (DB:CEK) | €5.35 | €10.01 | 46.5% |

| Schweizer Electronic (XTRA:SCE) | €3.84 | €7.19 | 46.6% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.33 | 42.2% |

| LPKF Laser & Electronics (XTRA:LPK) | €9.15 | €12.42 | 26.3% |

| MTU Aero Engines (XTRA:MTX) | €312.70 | €561.56 | 44.3% |

| Basler (XTRA:BSL) | €8.14 | €12.52 | 35% |

Let's explore several standout options from the results in the screener.

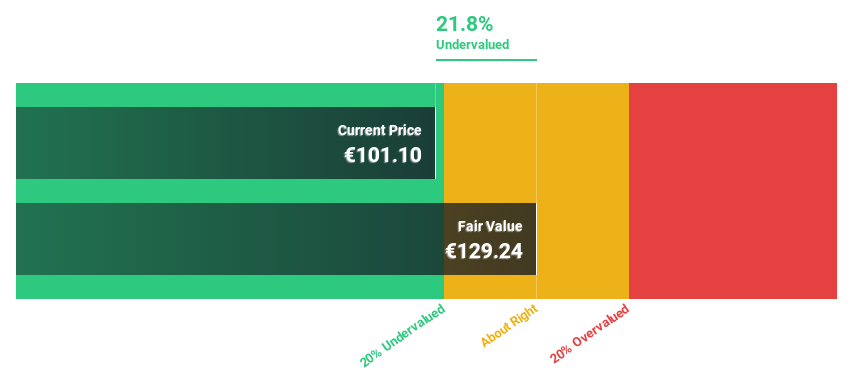

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €2.97 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions both in Germany and internationally.

Operations: The company's revenue segments include Plastics & Devices (€1.13 billion), Advanced Technologies (€5.83 million), and Primary Packaging Glass (€885.56 million).

Estimated Discount To Fair Value: 23.6%

Gerresheimer is trading at €85.9, significantly below its estimated fair value of €112.38, suggesting undervaluation based on cash flows. Despite lowering earnings guidance for 2024 and 2025, the company reported solid Q3 results with sales increasing to €498.5 million and net income rising to €40.1 million year-over-year. Analysts expect strong annual earnings growth of 21.67% over the next three years, outpacing the German market's forecasted growth rate of 19.8%.

- Upon reviewing our latest growth report, Gerresheimer's projected financial performance appears quite optimistic.

- Dive into the specifics of Gerresheimer here with our thorough financial health report.

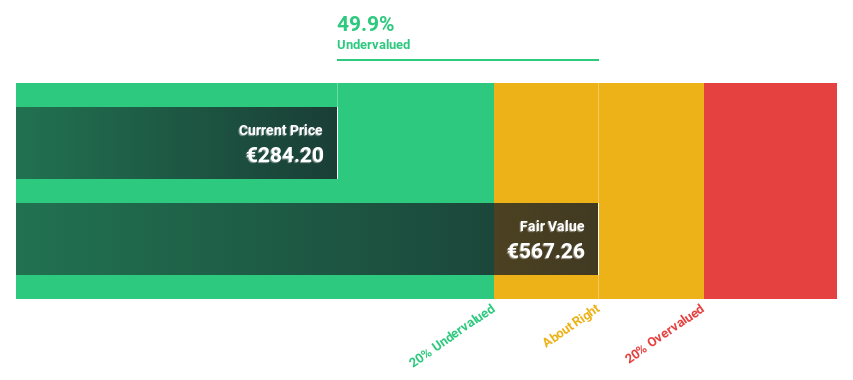

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG is involved in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally, with a market cap of €16.83 billion.

Operations: The company's revenue is primarily derived from its Commercial Maintenance Business (MRO) segment, generating €4.45 billion, and its Commercial and Military Engine Business (OEM) segment, contributing €1.32 billion.

Estimated Discount To Fair Value: 44.3%

MTU Aero Engines is trading at €312.7, well below its estimated fair value of €561.56, highlighting potential undervaluation based on cash flows. The company reported half-year sales of €3.39 billion and net income of €285 million, both up from the previous year. Analysts forecast earnings to grow 33.95% annually, with revenue growth expected to surpass the German market average at 11.8% per year, indicating robust future prospects despite recent fixed-income offerings totaling approximately €745 million.

- Insights from our recent growth report point to a promising forecast for MTU Aero Engines' business outlook.

- Navigate through the intricacies of MTU Aero Engines with our comprehensive financial health report here.

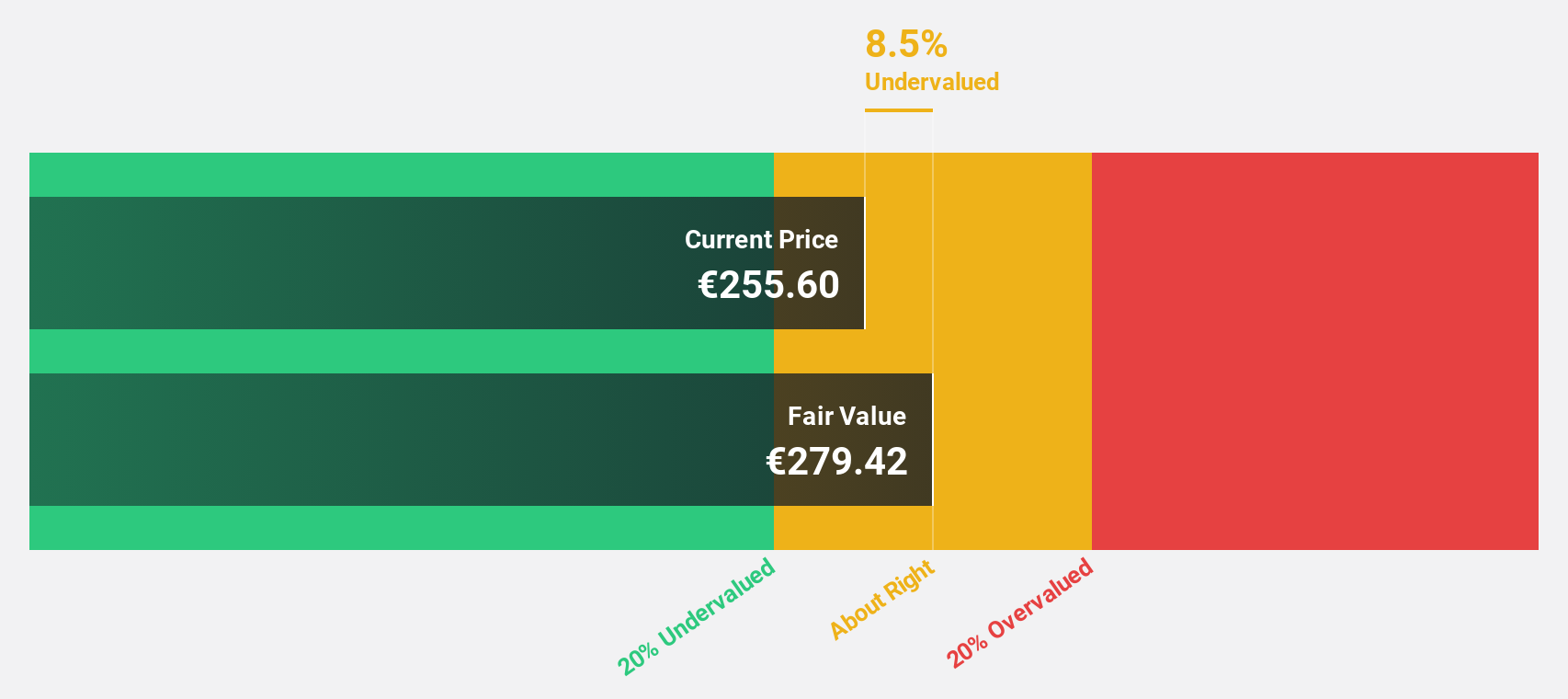

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally with a market capitalization of approximately €246.17 billion.

Operations: SAP's revenue from its Applications, Technology & Services segment amounts to €32.54 billion.

Estimated Discount To Fair Value: 23.1%

SAP is currently trading at €211.6, significantly below its estimated fair value of €275.25, suggesting potential undervaluation based on cash flows. Recent integrations with AI technologies like DeepHow and UiPath enhance SAP's offerings in automation and training, potentially boosting operational efficiency for clients. Despite a dip in net income to €918 million for Q2 2024 from the previous year, earnings are projected to grow significantly at 37.94% annually, with revenue growth expected to outpace the German market average.

- The analysis detailed in our SAP growth report hints at robust future financial performance.

- Take a closer look at SAP's balance sheet health here in our report.

Summing It All Up

- Delve into our full catalog of 20 Undervalued German Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal