Three Swedish Undiscovered Gems To Enhance Your Portfolio

As global markets experience a mix of highs and challenges, with European indices showing moderate gains amid hopes for economic stimulus, the spotlight turns to Sweden's market potential. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for portfolio enhancement by capitalizing on innovative growth sectors and resilient business models.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Creades | NA | -25.97% | -24.74% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that offers hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and internationally with a market cap of approximately SEK11.02 billion.

Operations: Clas Ohlson generates revenue primarily from its retail specialty segment, amounting to SEK10.66 billion.

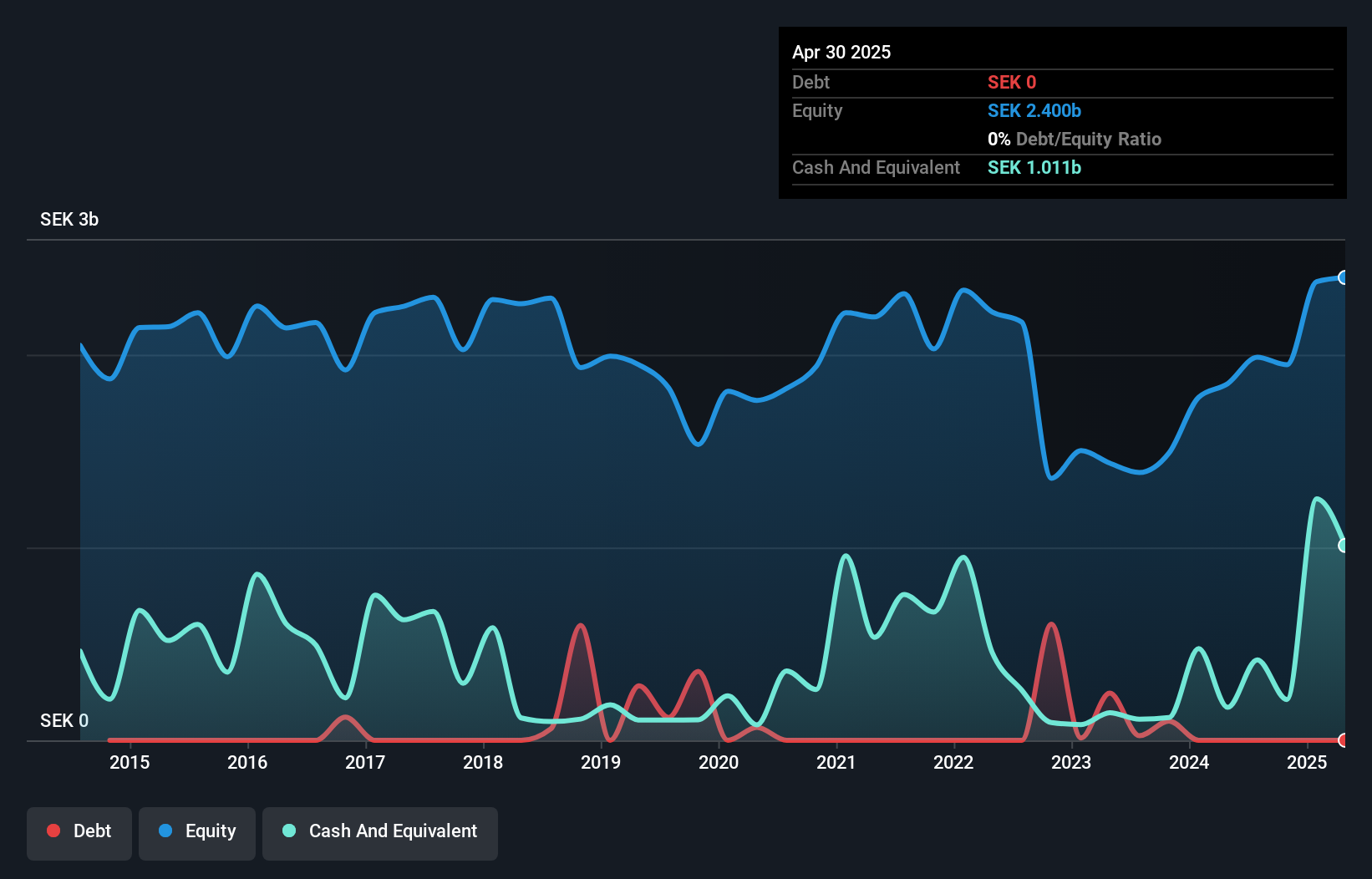

Clas Ohlson, a notable player in the Swedish retail sector, has shown impressive financial health with no debt compared to a 6.5% debt-to-equity ratio five years ago. Its earnings surged by 282% over the past year, outpacing industry growth of 20%. Recent sales figures reflect robust performance, reporting SEK 4.45 billion year-to-date against SEK 3.82 billion previously. The company trades at an attractive valuation, approximately 64% below estimated fair value and offers high-quality earnings without interest payment concerns due to its debt-free status.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

Overview: OEM International AB (publ), along with its subsidiaries, offers products and systems for industrial applications and has a market capitalization of SEK16.17 billion.

Operations: The company generates revenue primarily from Sweden (SEK 3.31 billion), with additional contributions from regions including Finland, the Baltic States, and China (SEK 1.03 billion), as well as Denmark, Norway, the British Isles, and East Central Europe (SEK 1.21 billion). The financial data reflects eliminations of SEK -514.60 million and segment adjustments of SEK 136.10 million in its reporting structure.

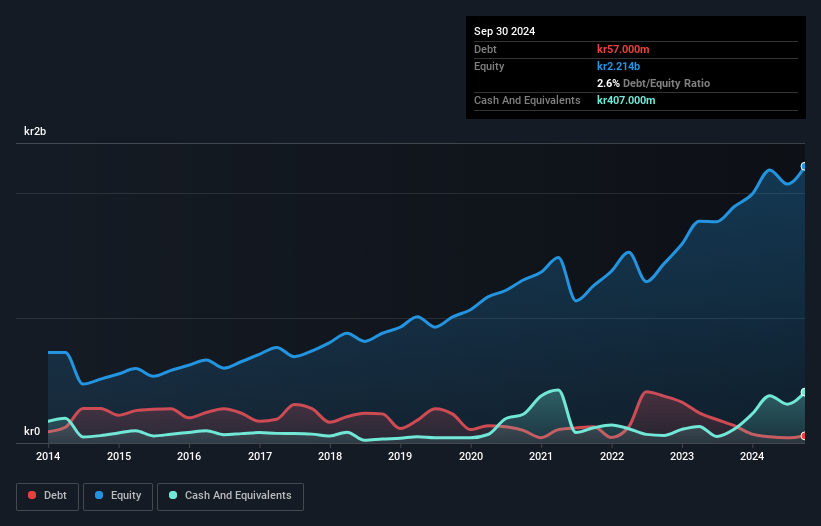

OEM International stands out with its robust financial health, boasting a debt to equity ratio reduction from 22.9% to 2.6% over five years and interest payments covered 244 times by EBIT. Despite negative earnings growth of -6.2%, it trades at a significant discount of 48.3% below estimated fair value, indicating potential upside for investors seeking undervalued opportunities in Sweden's trade distribution sector. Recent earnings showed modest sales growth to SEK 1,222 million in Q3 from SEK 1,198 million last year, with net income rising slightly to SEK 152 million from SEK 145 million.

- Delve into the full analysis health report here for a deeper understanding of OEM International.

Assess OEM International's past performance with our detailed historical performance reports.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK6.75 billion.

Operations: TF Bank generates revenue primarily from consumer banking services and e-commerce solutions. The company's financial performance is influenced by its proprietary IT platform, which supports these activities.

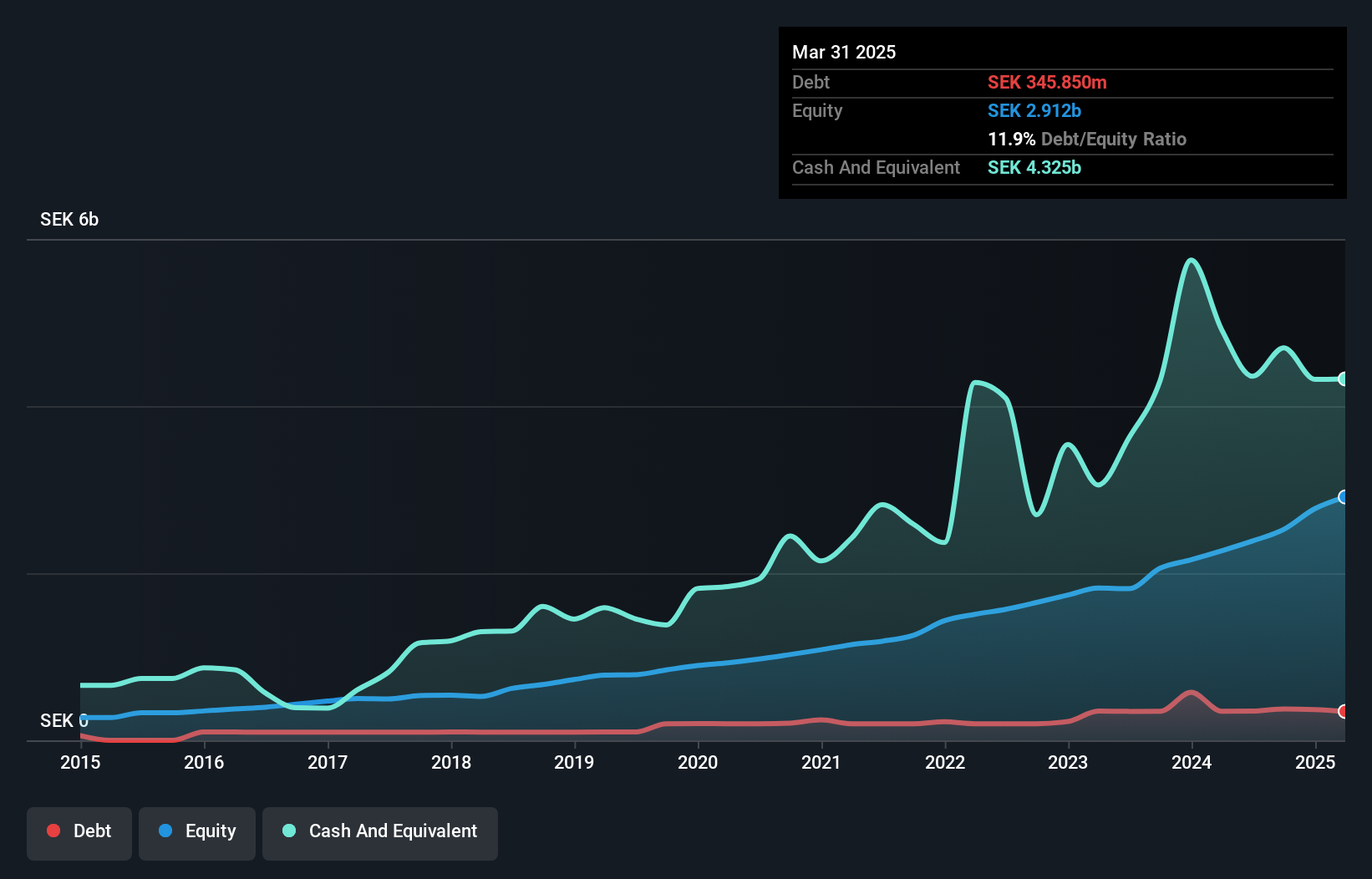

TF Bank, a growing player in Sweden's financial landscape, is trading at 48.7% below its estimated fair value. With total assets of SEK25.3 billion and total loans amounting to SEK19.4 billion, the bank is backed by low-risk funding sources, primarily customer deposits accounting for 95% of liabilities. However, it faces challenges with a high bad loan level at 10.6%. Recent strategic moves include establishing Rediem Capital to manage non-performing exposures efficiently.

- Unlock comprehensive insights into our analysis of TF Bank stock in this health report.

Examine TF Bank's past performance report to understand how it has performed in the past.

Where To Now?

- Click this link to deep-dive into the 53 companies within our Swedish Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal