High Growth Tech Stocks In Sweden With Promising Potential

As global markets experience a mix of highs and uncertainties, with European indices showing modest gains amid hopes for economic stimulus, the Swedish tech sector stands out as a dynamic force in the region. In such an environment, identifying high-growth stocks often involves looking for companies that demonstrate strong innovation potential and adaptability to changing market conditions.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.40% | 21.73% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Hemnet Group | 20.10% | 25.39% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Biovica International | 81.67% | 78.55% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Skolon | 32.63% | 122.14% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions worldwide, with a market capitalization of SEK291.66 billion.

Operations: Ericsson generates revenue primarily from three segments: Networks (SEK156.41 billion), Enterprise (SEK25.47 billion), and Cloud Software and Services (SEK62.74 billion). The company serves telecom operators and enterprise customers across various global regions, focusing on mobile connectivity solutions.

Telefonaktiebolaget LM Ericsson, amidst a transformative phase, reported a significant turnaround with its third-quarter earnings for 2024. Sales reached SEK 61.8 billion, recovering from a previous year's decline, and net income improved dramatically to SEK 3.81 billion after a substantial loss. This resurgence is underscored by robust R&D investments that align with Ericsson’s strategic focus on next-generation technologies in collaboration with industry leaders like Raytheon and MIT to advance microelectronics for future 5G/6G networks. These initiatives not only reflect Ericsson's commitment to innovation but also position it favorably within the tech ecosystem to leverage emerging opportunities in digital infrastructure development globally.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

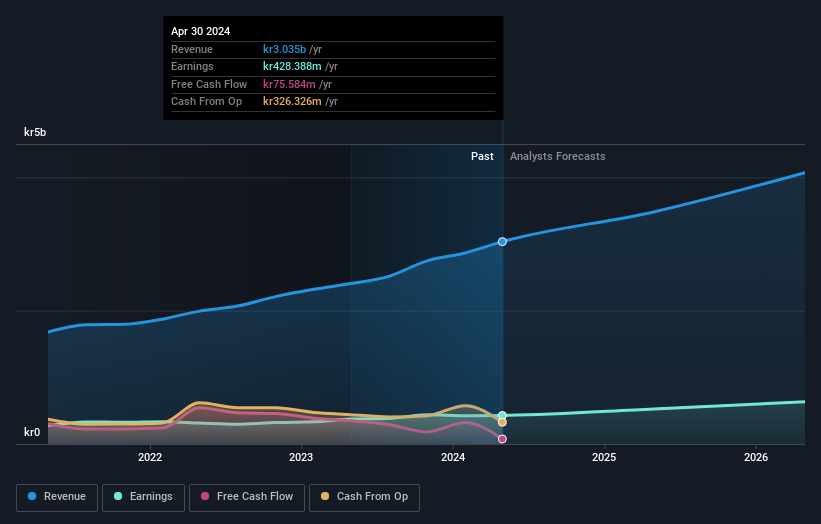

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK56.14 billion.

Operations: Sectra generates revenue primarily from its Imaging IT Solutions and Secure Communications segments, with SEK2.67 billion and SEK388.55 million, respectively. The company's focus on these sectors highlights its specialization in providing advanced technology solutions for healthcare imaging and secure communications across Europe.

Sectra, a Swedish tech firm specializing in medical imaging IT and cybersecurity, has shown robust financial and operational growth. In the first quarter of 2024, revenue surged to SEK 739.48 million from SEK 603.03 million year-over-year, with net income also rising from SEK 61.56 million to SEK 80.4 million. This growth is propelled by a significant R&D investment focus, which has been crucial in developing Sectra's advanced enterprise imaging solutions like Sectra One Cloud—a fully hosted public cloud service recently adopted by MaineGeneral Health for enhanced diagnostic capabilities and security across their network. These developments not only underscore Sectra’s commitment to innovation within healthcare technology but also position it well for continued expansion in a highly competitive sector.

- Dive into the specifics of Sectra here with our thorough health report.

Gain insights into Sectra's past trends and performance with our Past report.

Swedish Orphan Biovitrum (OM:SOBI)

Simply Wall St Growth Rating: ★★★★☆☆

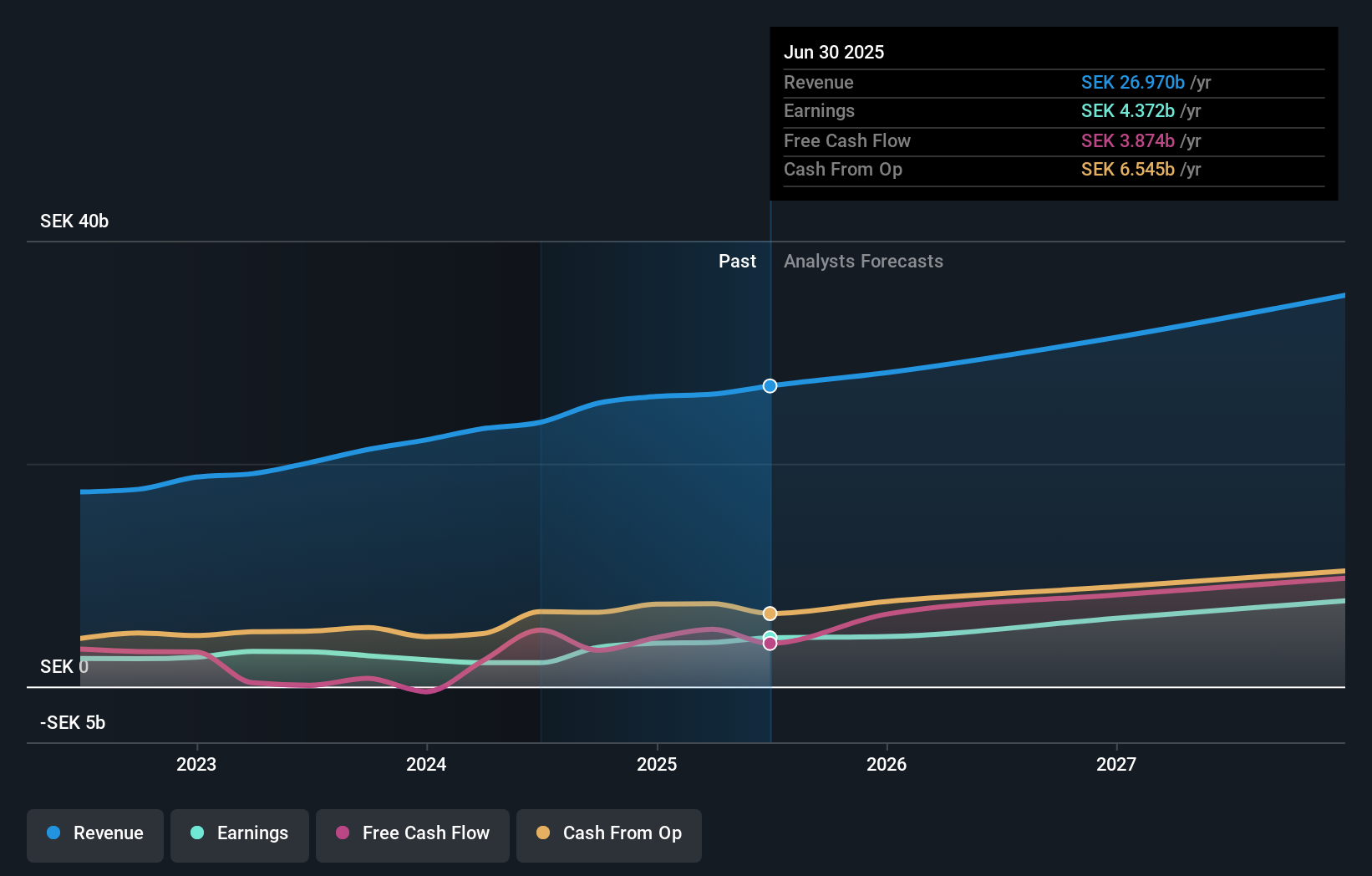

Overview: Swedish Orphan Biovitrum AB (publ) is an integrated biotechnology company that focuses on researching, developing, manufacturing, and selling pharmaceuticals in haematology, immunology, and specialty care across Europe, North America, the Middle East, Asia, and Australia with a market cap of approximately SEK103.79 billion.

Operations: The company generates revenue primarily from three segments: hematology (SEK15.07 billion), immunology (SEK7.49 billion), and specialty care (SEK1.15 billion).

Swedish Orphan Biovitrum (Sobi) has recently demonstrated significant strides in the biotech field with its latest clinical successes, notably in the VALIANT study where pegcetacoplan showed a 68% reduction in proteinuria for rare kidney diseases. This innovation underscores Sobi's robust commitment to R&D, which is evident from their expenses reaching 25.7% of their revenue, aligning with an aggressive growth trajectory. Moreover, Sobi's strategic focus on rare diseases has not only carved a niche but also set them apart in a competitive landscape, as evidenced by their expected annual profit growth of 25.7%. These developments suggest a promising outlook for Sobi amidst challenges like high debt levels and recent insider selling activities.

Taking Advantage

- Explore the 80 names from our Swedish High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal