Undiscovered Gems in India for October 2024

In the last week, the Indian market has stayed flat but it is up 40% over the past year with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover undiscovered gems that align well with these promising conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.88% | -1.47% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Avantel | 5.92% | 33.97% | 37.33% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Akums Drugs and Pharmaceuticals (NSEI:AKUMS)

Simply Wall St Value Rating: ★★★★★☆

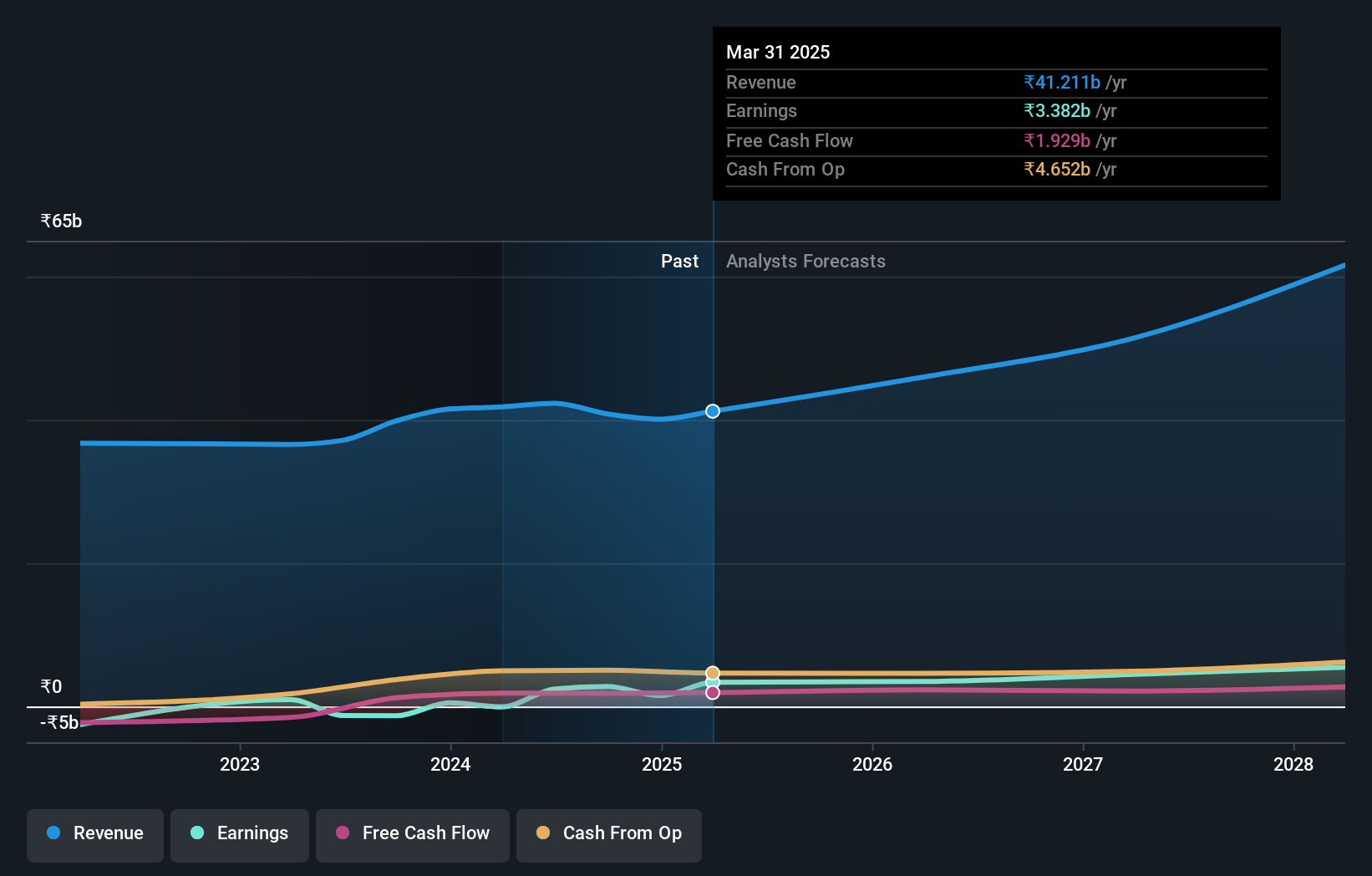

Overview: Akums Drugs and Pharmaceuticals Limited is engaged in the manufacturing and sale of pharmaceutical products and active pharmaceutical ingredients both in India and internationally, with a market cap of ₹143.83 billion.

Operations: Akums generates revenue primarily from its CDMO segment, contributing ₹36.32 billion, followed by branded and generic formulations at ₹6.76 billion, and APIs at ₹3.03 billion.

Akums Drugs and Pharmaceuticals, a vibrant player in the Indian market, recently turned profitable with a net income of ₹601.71 million for Q1 2024, contrasting a previous loss of ₹1.88 billion. Its net debt to equity ratio stands at 40%, deemed satisfactory, while interest payments are well-covered by EBIT at 9.7 times coverage. The company has secured exclusive rights to develop and market Triple Hair Inc's products in India, signaling strategic expansion efforts within the pharmaceutical sector.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

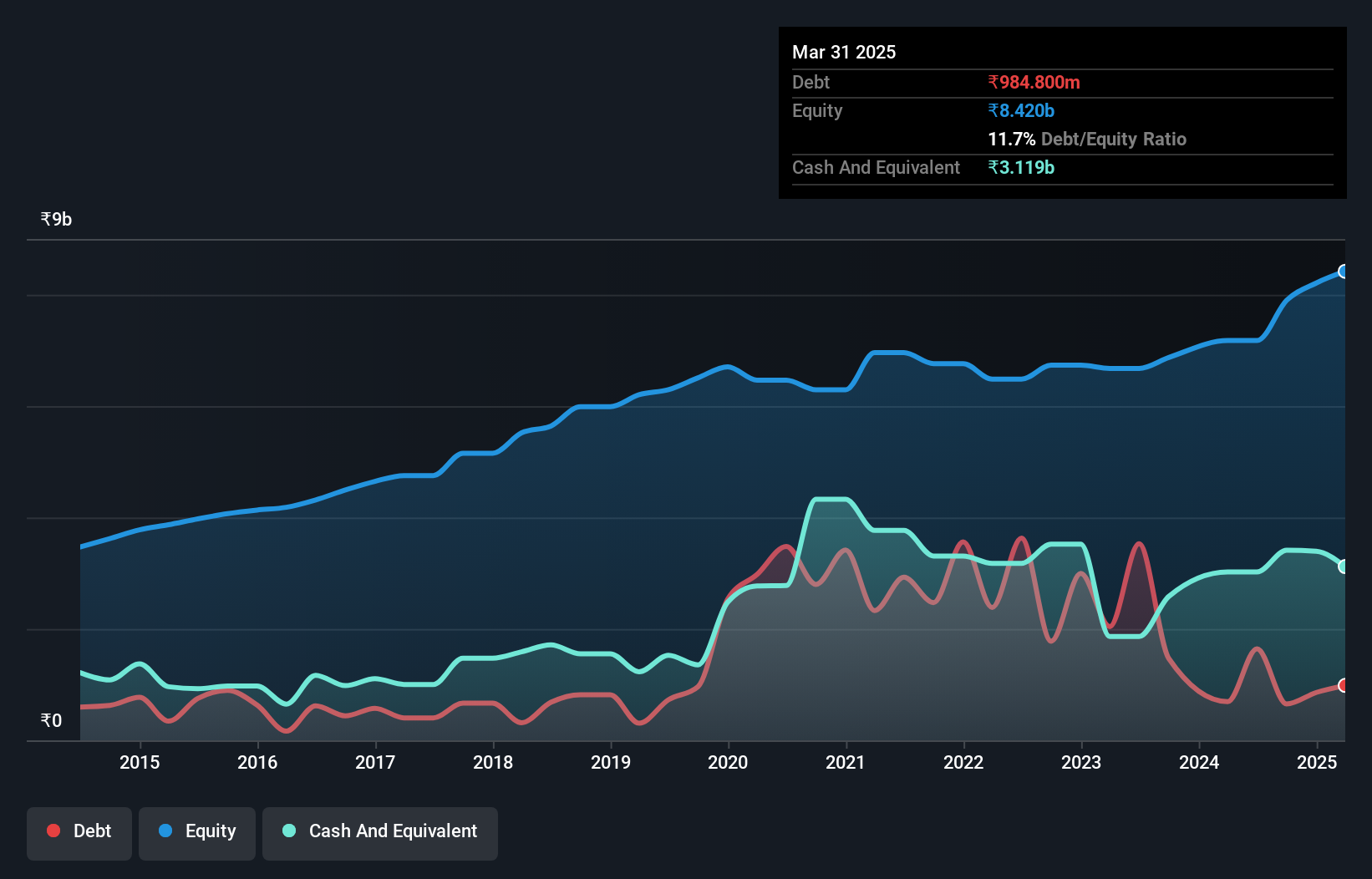

Overview: IFB Industries Limited, along with its subsidiaries, is engaged in the manufacturing and trading of home appliances both in India and globally, with a market capitalization of ₹92.43 billion.

Operations: IFB Industries generates revenue primarily from its Home Appliances segment, contributing ₹36.32 billion, followed by Engineering at ₹8.55 billion. The Steel and Motor segments add ₹1.65 billion and ₹670 million respectively to the total revenue streams.

IFB Industries, a notable player in the consumer durables sector, has shown impressive earnings growth of 612.7% over the past year, outpacing its industry peers. Despite an increase in its debt-to-equity ratio from 11.6% to 22.9% over five years, the company maintains a strong financial footing with interest payments well-covered by EBIT at 7.5 times coverage. Recent quarterly results highlight a turnaround with net income reaching INR 375 million compared to a loss last year, indicating robust operational performance and potential for future growth.

- Navigate through the intricacies of IFB Industries with our comprehensive health report here.

Examine IFB Industries' past performance report to understand how it has performed in the past.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

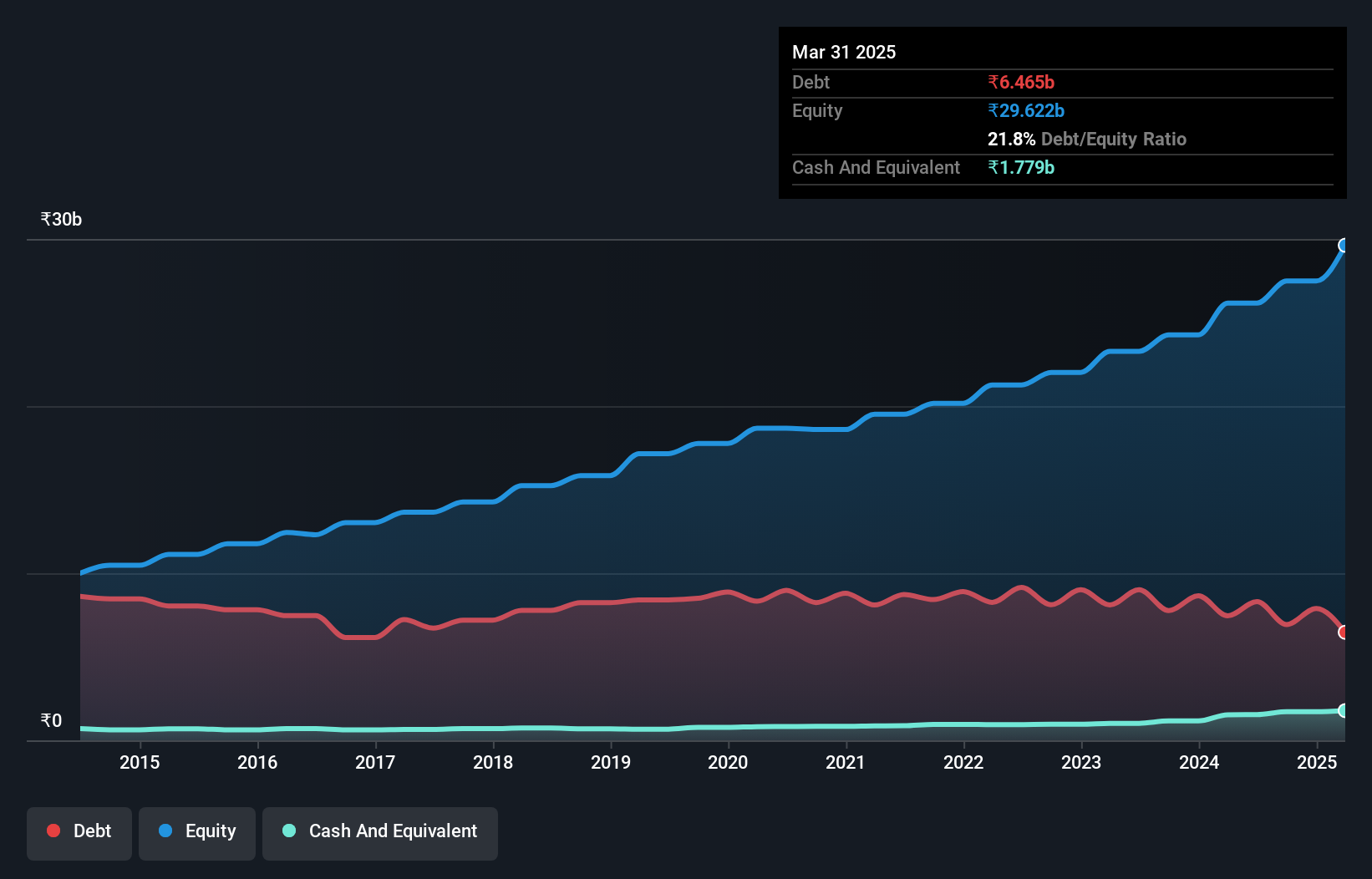

Overview: Time Technoplast Limited is involved in the manufacture and sale of polymer and composite products both in India and internationally, with a market cap of ₹102.95 billion.

Operations: Time Technoplast's revenue primarily comes from its Polymer Products segment, generating ₹33.43 billion, followed by the Composite Products segment at ₹18 billion.

Time Technoplast has shown impressive financial strides, with earnings growing by 44.6% over the past year, outpacing the industry growth of 8.7%. The debt-to-equity ratio has decreased from 49% to 31.7% in five years, indicating improved financial health. A recent dividend increase to INR 2 per share and a price-to-earnings ratio of 30.9x below the market average suggest good value potential. Additionally, its interest coverage is strong at 5.7x EBIT, reflecting solid operational performance.

- Get an in-depth perspective on Time Technoplast's performance by reading our health report here.

Assess Time Technoplast's past performance with our detailed historical performance reports.

Next Steps

- Investigate our full lineup of 468 Indian Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal