We Like These Underlying Return On Capital Trends At Sealink International Berhad (KLSE:SEALINK)

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So when we looked at Sealink International Berhad (KLSE:SEALINK) and its trend of ROCE, we really liked what we saw.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Sealink International Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.07 = RM18m ÷ (RM341m - RM81m) (Based on the trailing twelve months to June 2024).

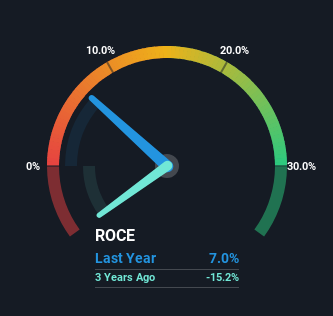

So, Sealink International Berhad has an ROCE of 7.0%. On its own, that's a low figure but it's around the 8.0% average generated by the Machinery industry.

View our latest analysis for Sealink International Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sealink International Berhad's ROCE against it's prior returns. If you're interested in investigating Sealink International Berhad's past further, check out this free graph covering Sealink International Berhad's past earnings, revenue and cash flow.

The Trend Of ROCE

It's great to see that Sealink International Berhad has started to generate some pre-tax earnings from prior investments. While the business is profitable now, it used to be incurring losses on invested capital five years ago. In regards to capital employed, Sealink International Berhad is using 37% less capital than it was five years ago, which on the surface, can indicate that the business has become more efficient at generating these returns. The reduction could indicate that the company is selling some assets, and considering returns are up, they appear to be selling the right ones.

The Key Takeaway

From what we've seen above, Sealink International Berhad has managed to increase it's returns on capital all the while reducing it's capital base. Given the stock has declined 34% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

On a final note, we've found 2 warning signs for Sealink International Berhad that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal