Xin Yuan Enterprises Group Limited's (HKG:1748) Share Price Is Still Matching Investor Opinion Despite 34% Slump

Xin Yuan Enterprises Group Limited (HKG:1748) shareholders won't be pleased to see that the share price has had a very rough month, dropping 34% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 57%, which is great even in a bull market.

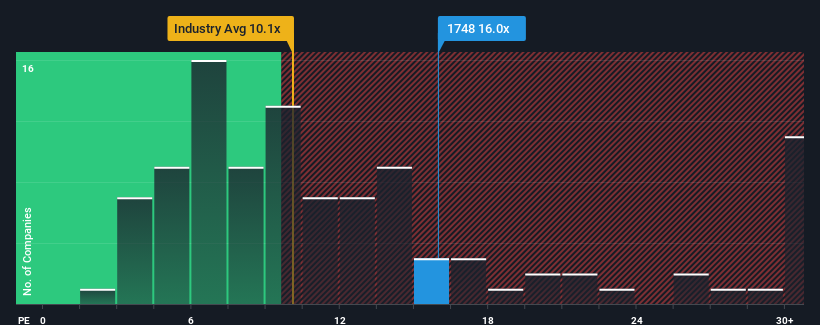

Although its price has dipped substantially, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may still consider Xin Yuan Enterprises Group as a stock to avoid entirely with its 16x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Xin Yuan Enterprises Group has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Xin Yuan Enterprises Group

Is There Enough Growth For Xin Yuan Enterprises Group?

The only time you'd be truly comfortable seeing a P/E as steep as Xin Yuan Enterprises Group's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. This was backed up an excellent period prior to see EPS up by 169% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Xin Yuan Enterprises Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate Xin Yuan Enterprises Group's very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Xin Yuan Enterprises Group maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Xin Yuan Enterprises Group that you should be aware of.

If these risks are making you reconsider your opinion on Xin Yuan Enterprises Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal