Subdued Growth No Barrier To Inner Mongolia Furui Medical Science Co., Ltd. (SZSE:300049) With Shares Advancing 35%

Inner Mongolia Furui Medical Science Co., Ltd. (SZSE:300049) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

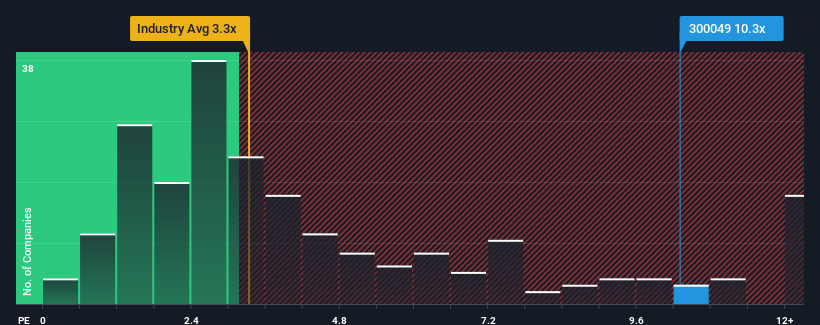

Following the firm bounce in price, you could be forgiven for thinking Inner Mongolia Furui Medical Science is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.3x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Inner Mongolia Furui Medical Science

What Does Inner Mongolia Furui Medical Science's P/S Mean For Shareholders?

Recent times haven't been great for Inner Mongolia Furui Medical Science as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inner Mongolia Furui Medical Science.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Inner Mongolia Furui Medical Science's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 47% over the next year. Meanwhile, the rest of the industry is forecast to expand by 140%, which is noticeably more attractive.

With this information, we find it concerning that Inner Mongolia Furui Medical Science is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Inner Mongolia Furui Medical Science's P/S?

Inner Mongolia Furui Medical Science's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Inner Mongolia Furui Medical Science, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Inner Mongolia Furui Medical Science with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Inner Mongolia Furui Medical Science, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal