Exploring High Growth Tech Stocks In China October 2024

As global markets experience varying degrees of movement, Chinese equities have seen a decline amid fading optimism about Beijing's stimulus measures, with the Shanghai Composite Index and the CSI 300 both posting losses in early October 2024. In this context, identifying high-growth tech stocks in China requires a focus on companies that demonstrate resilience and adaptability to economic shifts while leveraging technological advancements to capture emerging opportunities.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.62% | 31.72% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Sun Create Electronics (SHSE:600990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sun Create Electronics Co., Ltd specializes in the research, design, manufacturing, and marketing of radar and security systems with a market cap of CN¥7.08 billion.

Operations: The company focuses on the electronic industry, generating revenue of CN¥1.83 billion from its radar and security systems.

Sun Create Electronics, amidst a challenging fiscal period with a net loss of CNY 38.95 million for the first half of 2024, still shows promising signs of growth. The company's revenue growth forecast at 20.8% annually outpaces the broader Chinese market projection of 13.2%, signaling robust potential despite current profitability challenges. Moreover, an impressive expected earnings surge by approximately 116.9% per annum underscores a swift turnaround strategy focusing on innovation and market adaptation. This strategic pivot is further evidenced by their R&D commitment, crucial for sustaining long-term competitiveness in the high-tech sector. The firm's dedication to research and development not only aligns with industry demands but also positions it well for future technological advancements and customer needs fulfillment. While Sun Create navigates its path to profitability—expected within three years—it remains vital to monitor how its investment in R&D could catalyze its standing in an increasingly competitive landscape, especially considering its current financial position where debt is not sufficiently covered by operating cash flow.

- Delve into the full analysis health report here for a deeper understanding of Sun Create Electronics.

Evaluate Sun Create Electronics' historical performance by accessing our past performance report.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quectel Wireless Solutions Co., Ltd. is involved in the global research, development, design, production, and sales of wireless communication modules and solutions with a market cap of CN¥13.54 billion.

Operations: Quectel Wireless Solutions focuses on the global market for wireless communication modules and solutions, engaging in activities from research and development to sales. The company's operations encompass a comprehensive approach to the production and design of these technologies.

Quectel Wireless Solutions, with a robust 32.5% forecasted annual earnings growth, outstrips the broader Chinese tech sector's expectations. The company's recent unveiling of innovative antenna products underscores its commitment to expanding its technological footprint and enhancing product offerings, crucial for sustaining competitive advantage in the fast-evolving telecommunications landscape. Moreover, Quectel’s R&D expenses have grown significantly, reflecting a strategic emphasis on innovation to drive future growth—evidenced by a substantial revenue increase to CNY 8.25 billion from CNY 6.51 billion year-over-year. This focus on advanced product development and market expansion is poised to bolster Quectel’s position in global markets while catering to evolving consumer and industrial needs.

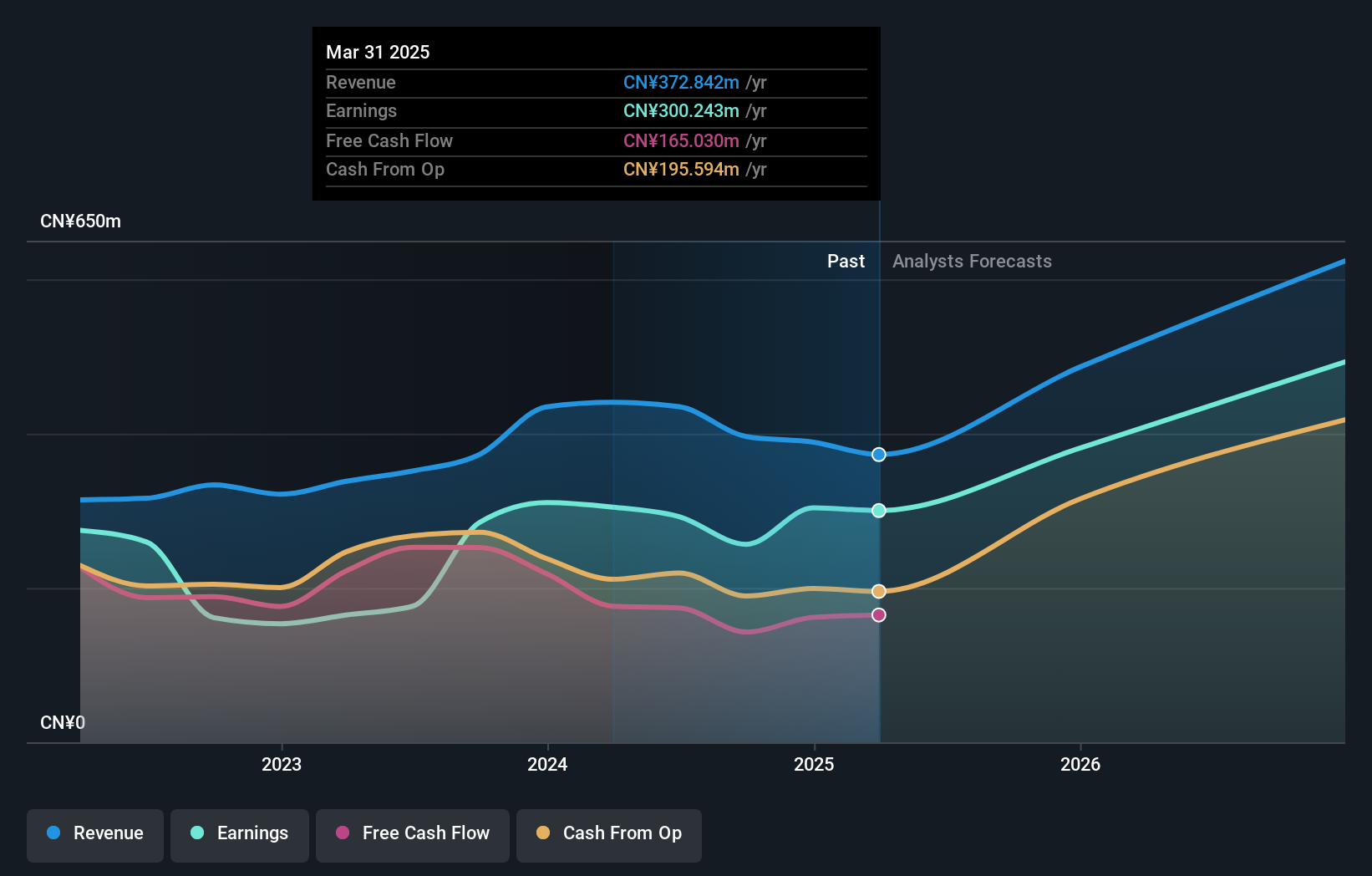

Shenzhen Fortune Trend technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Fortune Trend Technology Co., Ltd. is a company with a market cap of CN¥26.86 billion, focusing on providing technology solutions and services.

Operations: Shenzhen Fortune Trend Technology Co., Ltd. generates revenue primarily through its technology solutions and services, contributing significantly to its financial performance. The company operates with a market capitalization of CN¥26.86 billion, reflecting its scale in the industry.

Shenzhen Fortune Trend Technology, amid a volatile market, has demonstrated resilience with a 26.4% forecasted annual revenue growth, surpassing the broader Chinese tech sector's average of 13.2%. This robust expansion is supported by its R&D commitment, with expenses significantly contributing to innovative developments; however, recent earnings reports show a dip in net income to CNY 100.39 million from CNY 118.73 million year-over-year despite higher sales figures of CNY 147.63 million compared to last year's CNY 147.42 million on June end. The company's strategic focus on high-quality non-cash earnings and anticipated significant profit growth of 28.1% annually positions it well for future scalability and market penetration.

Key Takeaways

- Click here to access our complete index of 258 Chinese High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal