3 Chinese Dividend Stocks Yielding Up To 4.9%

Amid a challenging environment for Chinese equities, where optimism about Beijing's stimulus measures has waned and indices like the Shanghai Composite and Hang Seng have seen notable declines, investors are increasingly looking towards dividend stocks as a potential source of steady income. In such times, stocks that offer reliable dividends can be appealing for their ability to provide consistent returns despite market volatility.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.11% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.34% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.39% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.29% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.70% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.41% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.74% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.18% | ★★★★★★ |

Click here to see the full list of 211 stocks from our Top Chinese Dividend Stocks screener.

We'll examine a selection from our screener results.

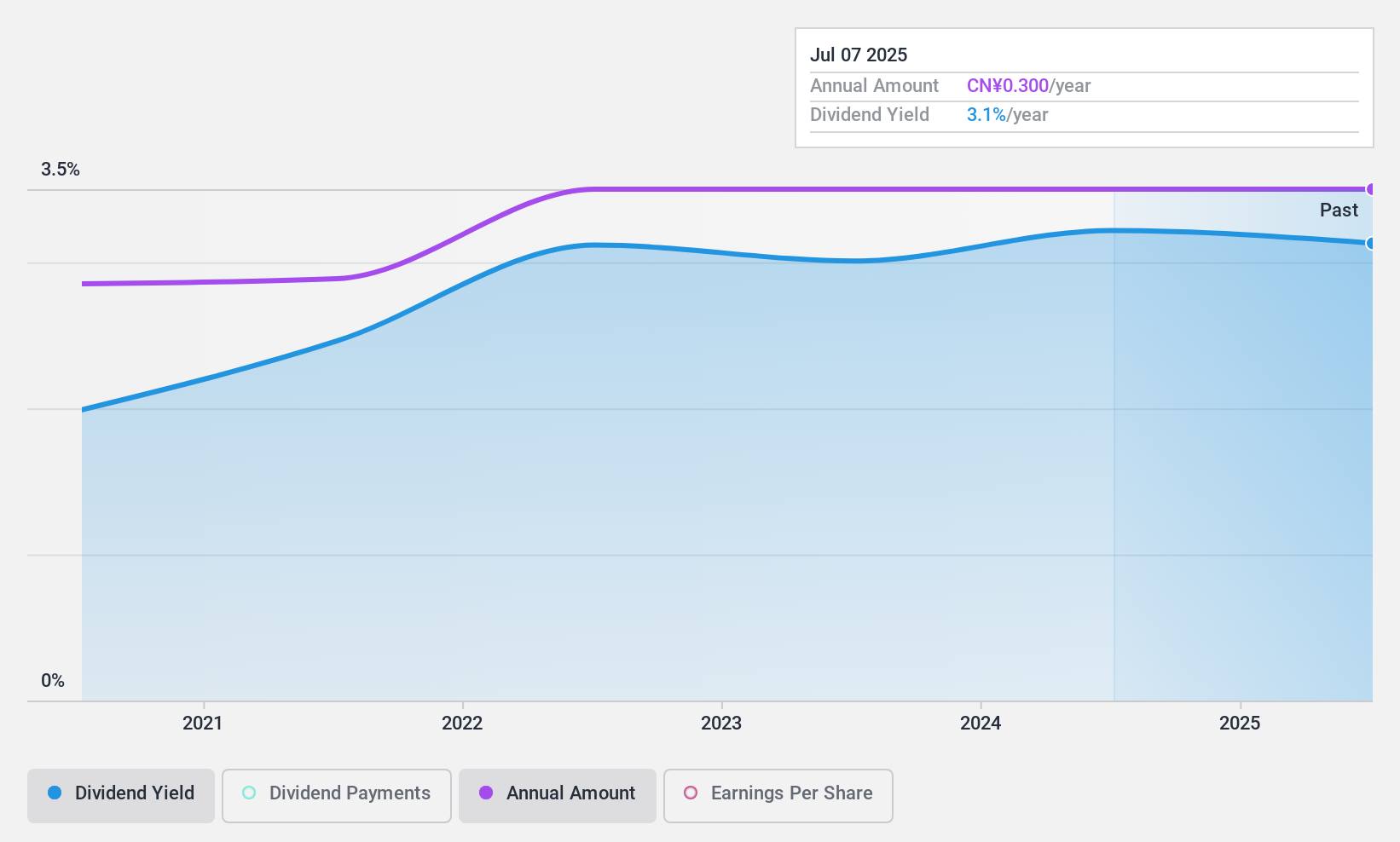

Chengdu Gas Group (SHSE:603053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Gas Group Corporation Ltd. operates in the urban gas supply business in China and has a market capitalization of CN¥8.57 billion.

Operations: Chengdu Gas Group Corporation Ltd.'s revenue is primarily derived from its urban gas supply operations in China.

Dividend Yield: 3.1%

Chengdu Gas Group has been paying dividends for four years, with stable and growing payments backed by a reasonable payout ratio of 58% and a cash payout ratio of 31.9%. Despite its short dividend history, the company's yield is in the top 25% of the Chinese market. However, recent earnings showed a decline in net income to ¥273.96 million from ¥338.59 million, which may impact future dividend sustainability.

- Get an in-depth perspective on Chengdu Gas Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Chengdu Gas Group's current price could be inflated.

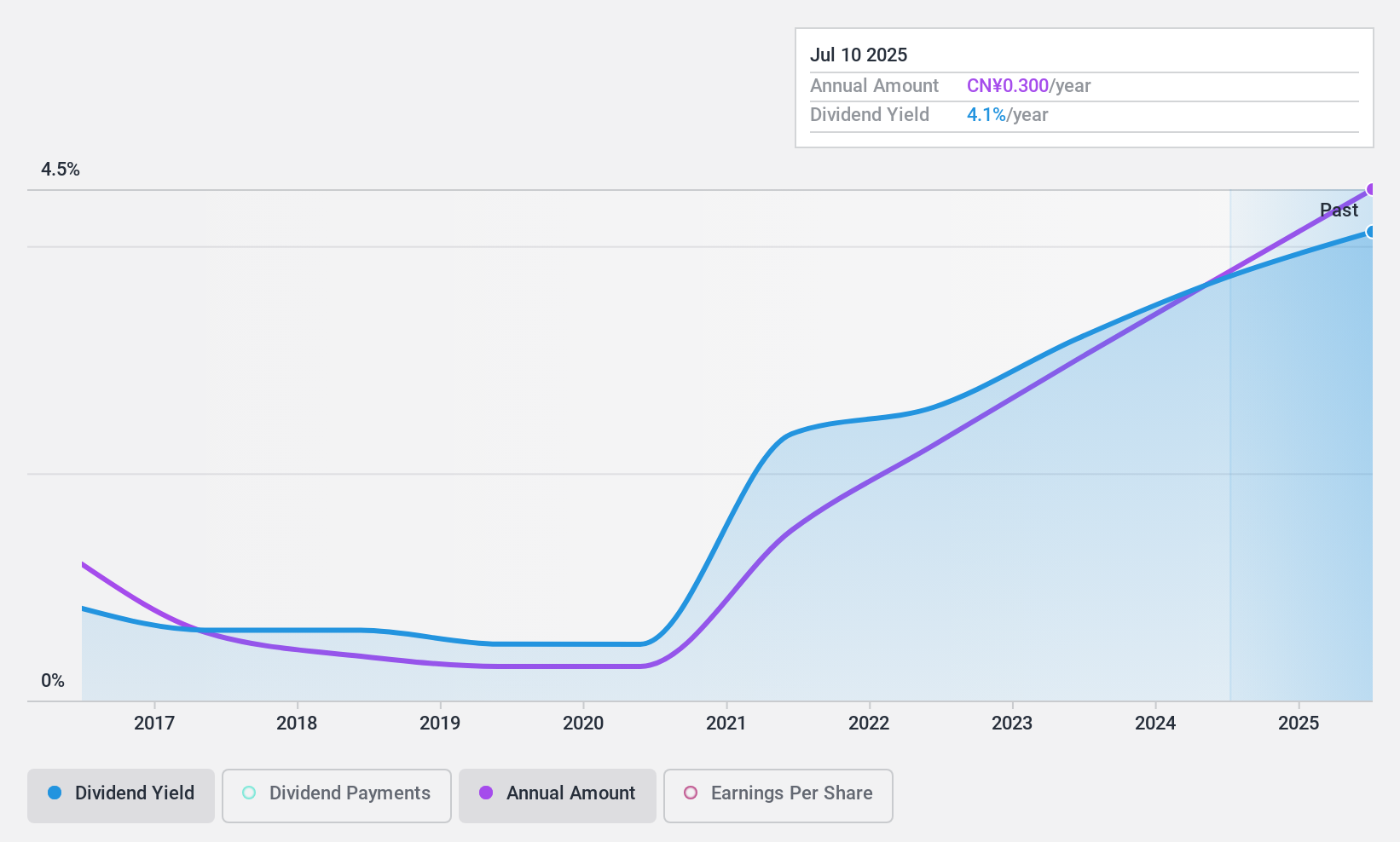

Changhong Huayi Compressor (SZSE:000404)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Changhong Huayi Compressor Co., Ltd. develops, manufactures, and sells various compressors both in China and internationally, with a market cap of CN¥4.80 billion.

Operations: Changhong Huayi Compressor Co., Ltd. generates its revenue primarily through the development, manufacturing, and sale of a variety of compressors across domestic and international markets.

Dividend Yield: 3.6%

Changhong Huayi Compressor's dividend yield of 3.62% places it in the top 25% of Chinese dividend payers, supported by a payout ratio of 41% and a cash payout ratio of 51.1%. Despite a volatile and unreliable dividend history over the past decade, recent earnings growth to ¥226.83 million from ¥164.78 million suggests improved coverage for dividends. The company's price-to-earnings ratio of 11.3x indicates good value compared to the broader market average.

- Dive into the specifics of Changhong Huayi Compressor here with our thorough dividend report.

- Our valuation report unveils the possibility Changhong Huayi Compressor's shares may be trading at a discount.

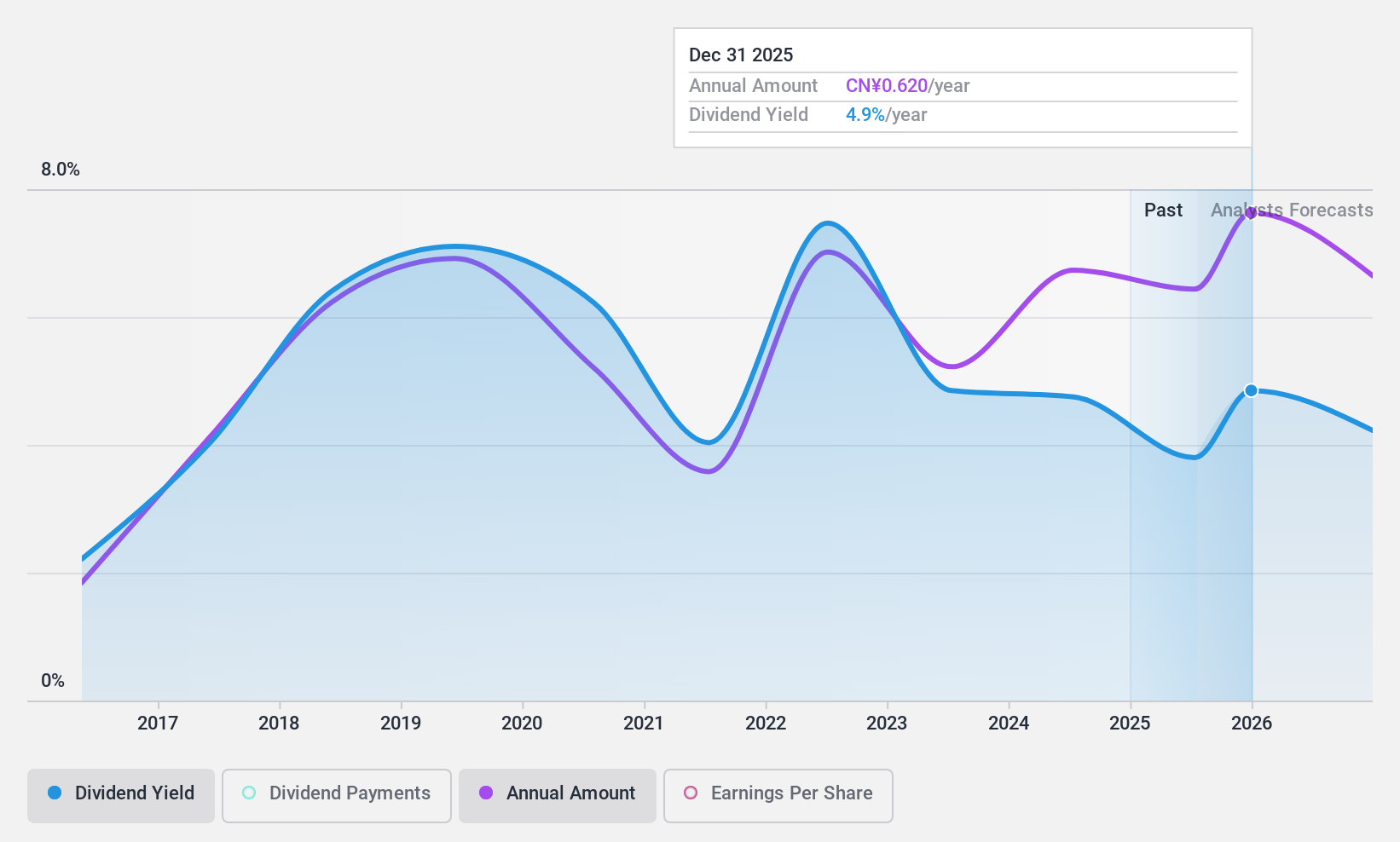

Guangdong Provincial Expressway Development (SZSE:000429)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Provincial Expressway Development Co., Ltd. operates expressways and bridges in China with a market cap of CN¥21.32 billion.

Operations: The company's revenue is primarily derived from Highway Transportations, amounting to CN¥4.70 billion.

Dividend Yield: 5%

Guangdong Provincial Expressway Development's dividend yield of 4.99% ranks it in the top 25% of Chinese dividend payers, with a payout ratio of 71.1% and cash payout ratio of 75.7%, indicating dividends are covered by earnings and cash flows. However, despite recent earnings growth to CNY 855.47 million, the company has a history of unstable and unreliable dividends over the past decade, impacting its appeal for consistent income investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Guangdong Provincial Expressway Development.

- In light of our recent valuation report, it seems possible that Guangdong Provincial Expressway Development is trading behind its estimated value.

Key Takeaways

- Unlock our comprehensive list of 211 Top Chinese Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal