3 Chinese Growth Companies With High Insider Ownership To Watch

As China's equity markets recently experienced a downturn amid fading optimism about government stimulus measures, investors are increasingly focused on identifying promising growth opportunities within the region. In this context, companies with high insider ownership can be particularly appealing as they often indicate strong alignment between management and shareholder interests, making them noteworthy candidates in the current market environment.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 23.9% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genew Technologies Co., Ltd. is involved in the research, development, production, and sale of communication and network products globally, with a market capitalization of CN¥3.97 billion.

Operations: I'm sorry, but it seems that the revenue segment details for Genew Technologies Ltd (ticker: SHSE:688418) are missing from the provided text. If you can provide those details, I would be happy to help summarize them for you.

Insider Ownership: 16.7%

Genew Technologies Ltd. demonstrates significant growth potential, with revenue expected to increase 37% annually, outpacing the Chinese market's average. Recent earnings show a turnaround with CNY 7.73 million net income from a previous loss, indicating improving profitability prospects over the next three years. Despite high share price volatility and no recent insider trading activity, it trades at good value compared to peers, suggesting investor confidence in its growth trajectory remains strong.

- Get an in-depth perspective on Genew TechnologiesLtd's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Genew TechnologiesLtd is trading behind its estimated value.

Shenzhen LihexingLtd (SZSE:301013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Lihexing Co., Ltd. focuses on the research, development, production, and sale of automation and intelligent equipment for the information and communication technology industry in China, with a market cap of CN¥3.18 billion.

Operations: Shenzhen Lihexing Co., Ltd. generates its revenue through the research, development, production, and sale of automation and intelligent equipment tailored for the information and communication technology sector in China.

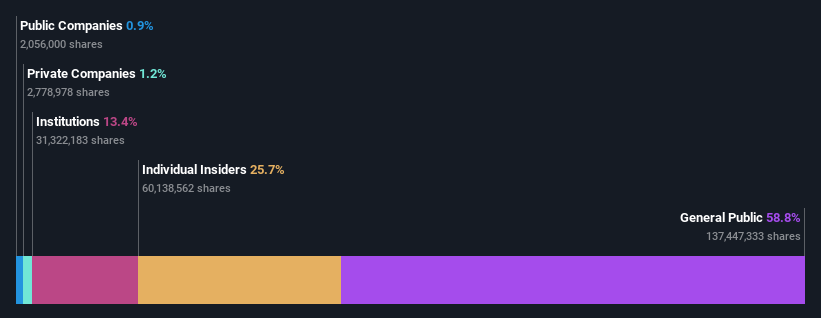

Insider Ownership: 25.7%

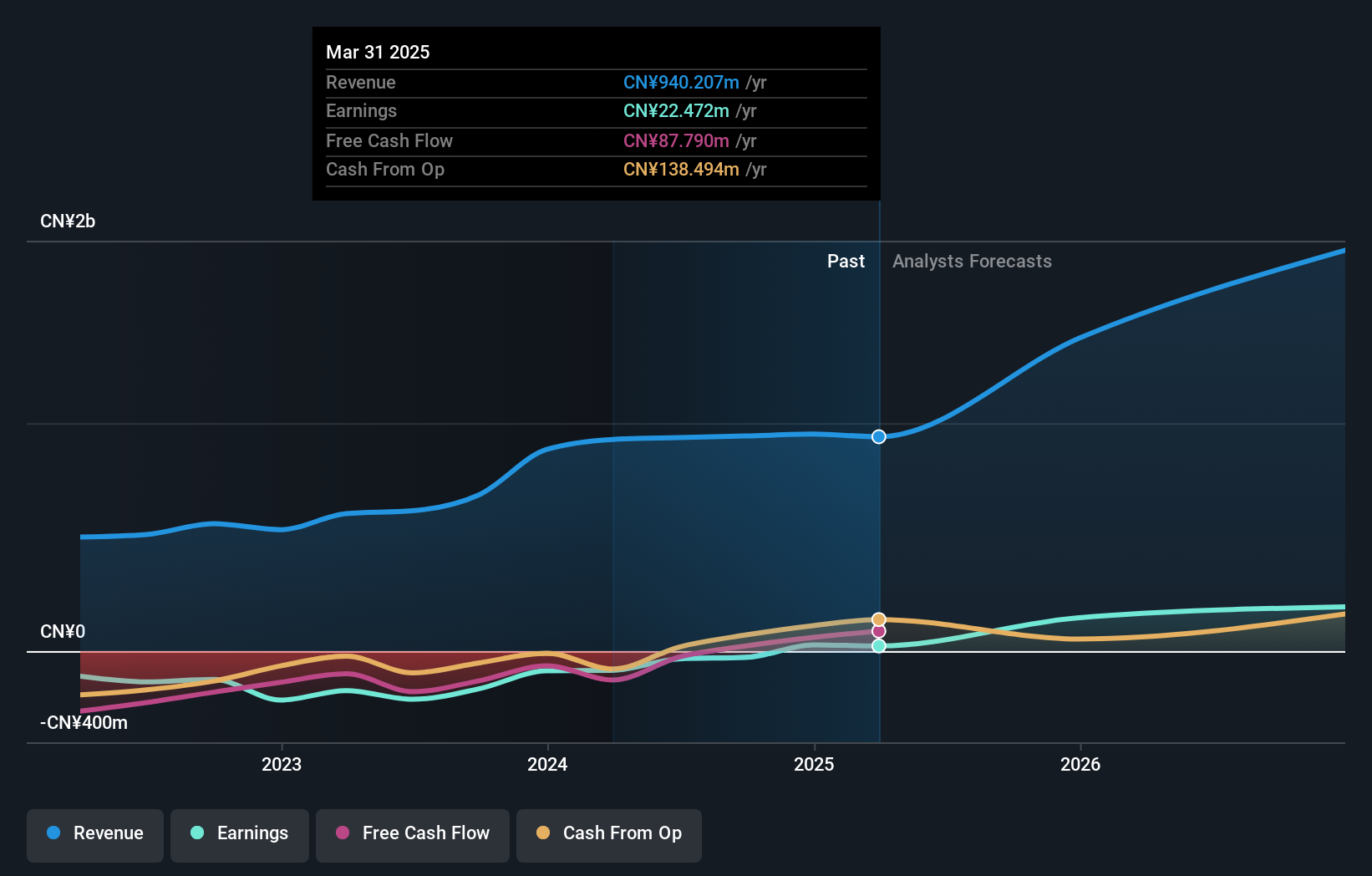

Shenzhen Lihexing Ltd. shows robust growth potential with revenue expected to increase by 34.7% annually, surpassing the Chinese market average. The recent earnings report highlights a turnaround, with net income of CNY 13.45 million compared to a previous loss, pointing toward profitability within three years. Despite high share price volatility and no significant insider trading activity recently, its financial trajectory suggests promising growth prospects in the competitive landscape.

- Click here to discover the nuances of Shenzhen LihexingLtd with our detailed analytical future growth report.

- The analysis detailed in our Shenzhen LihexingLtd valuation report hints at an inflated share price compared to its estimated value.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sale of functional materials in China with a market cap of CN¥4.27 billion.

Operations: GuangDong Suqun New Material Co., Ltd. generates its revenue primarily through the research, development, production, and sale of functional materials in China.

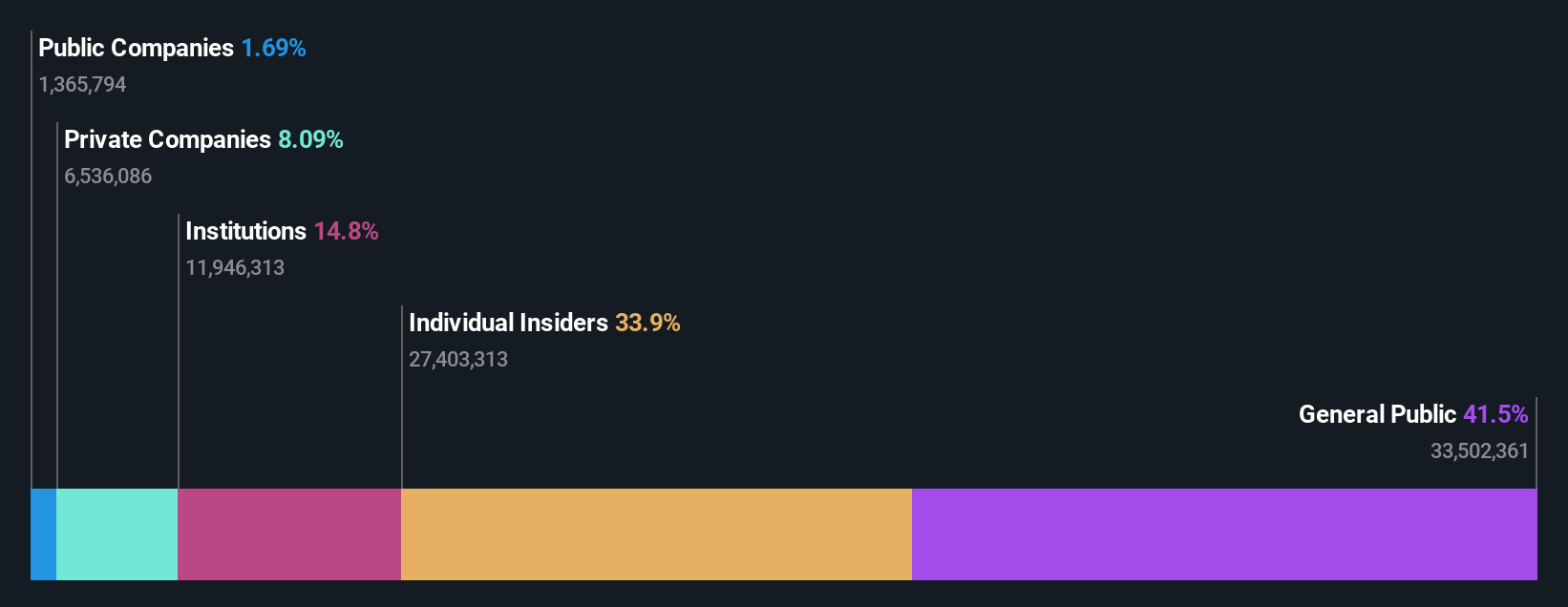

Insider Ownership: 37.9%

GuangDong Suqun New Material Ltd. is poised for significant growth, with revenue expected to rise by 33% annually, outpacing the Chinese market average. Despite recent earnings showing a slight dip in net income to CNY 22.91 million, the company maintains strong growth forecasts with earnings anticipated to increase by 45.5% per year. However, high share price volatility and low forecasted return on equity present challenges amidst its promising financial outlook and stable insider ownership profile.

- Unlock comprehensive insights into our analysis of GuangDong Suqun New MaterialLtd stock in this growth report.

- Upon reviewing our latest valuation report, GuangDong Suqun New MaterialLtd's share price might be too optimistic.

Make It Happen

- Click this link to deep-dive into the 383 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal