Pak Tak International Limited's (HKG:2668) Shares Climb 27% But Its Business Is Yet to Catch Up

Pak Tak International Limited (HKG:2668) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. The last 30 days were the cherry on top of the stock's 1,156% gain in the last year, which is nothing short of spectacular.

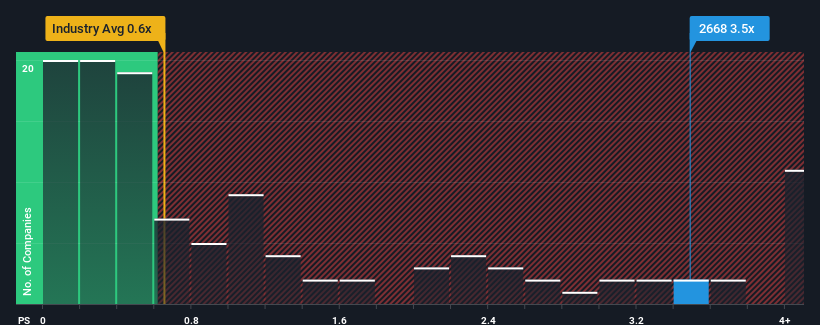

Since its price has surged higher, you could be forgiven for thinking Pak Tak International is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in Hong Kong's Luxury industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Pak Tak International

How Has Pak Tak International Performed Recently?

Recent times have been quite advantageous for Pak Tak International as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Pak Tak International, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Pak Tak International's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Pak Tak International's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 66% last year. Still, revenue has fallen 70% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's an unpleasant look.

In light of this, it's alarming that Pak Tak International's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Pak Tak International's P/S

Pak Tak International's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Pak Tak International currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Pak Tak International (at least 3 which don't sit too well with us), and understanding them should be part of your investment process.

If you're unsure about the strength of Pak Tak International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal