Further Upside For IHI Corporation (TSE:7013) Shares Could Introduce Price Risks After 26% Bounce

IHI Corporation (TSE:7013) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 200% in the last year.

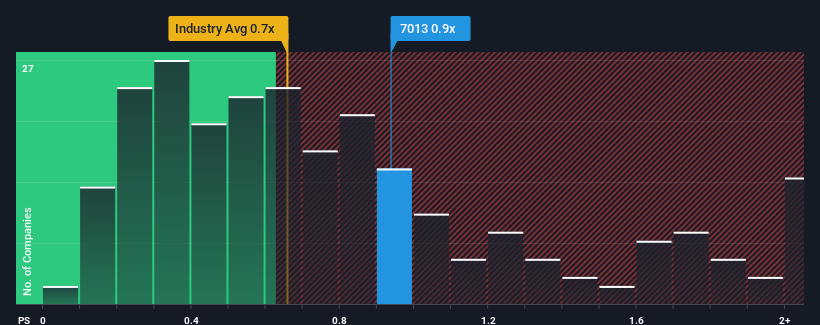

Although its price has surged higher, there still wouldn't be many who think IHI's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in Japan's Machinery industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for IHI

What Does IHI's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, IHI's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think IHI's future stacks up against the industry? In that case, our free report is a great place to start.How Is IHI's Revenue Growth Trending?

IHI's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.4% per year during the coming three years according to the nine analysts following the company. With the industry only predicted to deliver 5.5% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that IHI is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From IHI's P/S?

IHI appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at IHI's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 2 warning signs for IHI you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal